Table of Contents

ToggleKey Takeaways:

- Decentraland marked a magnificent surge of nearly 80% in the past week, while the collective jump since the beginning of the year is more than 150%.

- Despite an intensified bearish action, the price is constantly trying to reclaim the lost positions and mark new highs for the year 2023.

- The MANA price closed the previous day’s trade on a bullish note at $0.6995 with a market capitalization of $1.29 billion and a circulating supply of 1.85 billion.

Decentraland’s (MANA) price has returned to pre-FTX levels, thanks to active Github activity and a cutting-edge partnership. The metaverse tokens have been impressive since the beginning of 2023, as MANA’s price records 10 straight bullish candles, gaining more than 150%. The market capitalization regained a value above $1 billion, while the trading volume is approaching the same levels with a jump of over 30%.

However, some of the intraday gains appear to have been erased, yet the MANA price continues to lead the gainer’s list for the week. The reason behind the giant price action is believed to be the partnership with the Australian Open (AO) tournament, which commenced on January 16, 2023.

The Australian Open (AO) is a grand slam tennis tournament held at Melbourne Park. The rounds of collaboration were shared by the official Decentraland account, where-in the matches can be viewed in Decentraland via big screens but in the metaverse. Alongside this, the GitHub activity also made new highs. With more than 337 commits, the blockchain is now the sixth most active blockchain.

Decentraland MANA Price Technical Overview

- After trading under an extremely bearish influence, the MANA price has rebounded and surged high since the beginning of 2023.

- The bulls appear to have been slightly exhausted, preventing the rally from breaking through the $0.7 level.

- In the event of bearish action, the levels at the 200-day MA at around $0.66 may act as a strong base, igniting a firm rebound.

- Because of the significant bullish pressure that has accumulated, the bearish trajectory may remain unchanged, as the price is poised to reach the upper targets at $0.87 soon after a minor correction.

- After breaking through these resistance levels, the price is expected to reclaim the levels above $1 with the next bullish move.

Read more: Decentraland Price Prediction

Rising Development Activity

The development activity refers to the contribution of the development team to enhance the platform and load it with new features. The activity levels have been within a rising parallel channel, which indicates the activity may continue to move north regardless of the bearish interference in between. The development activity marking new highs may induce significant bullish sentiments within the market participants which enhance the trade and in turn impact the crypto price.

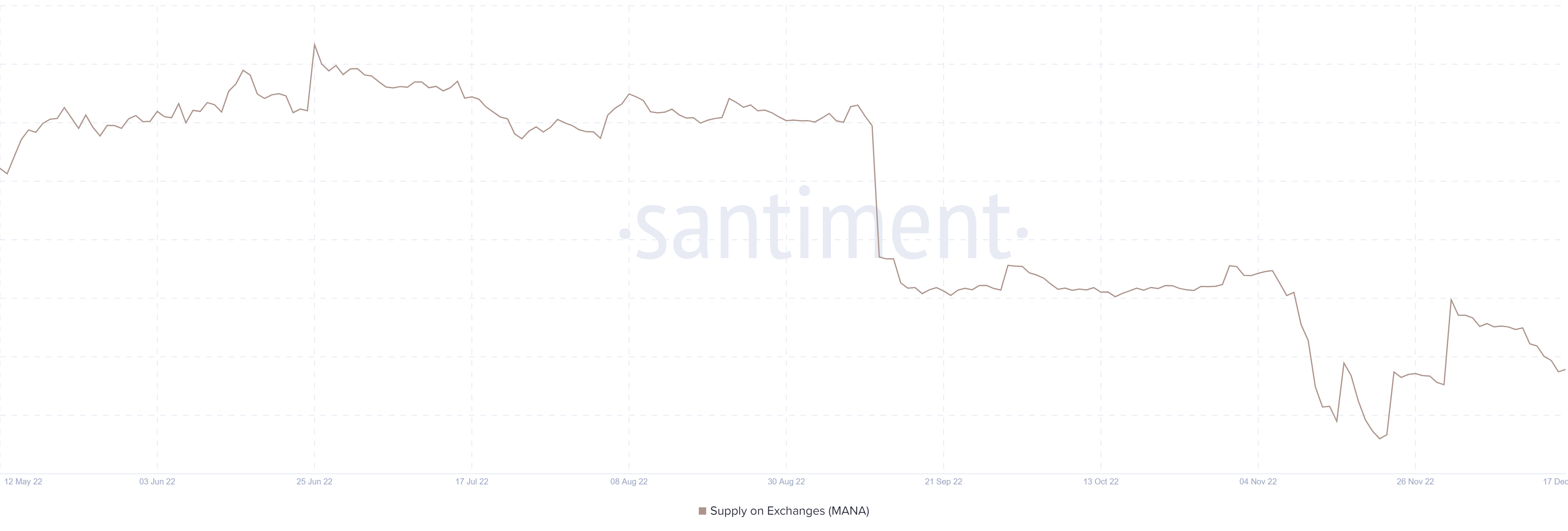

Supply on Exchanges on a downtrend

The supply on exchanges denotes the amount of the tokens present in the wallets belonging to the exchanges. With a rise in the reserve balance of the exchanges, the possibility of market participants looking out for a good liquidating time and extracting their profits. However, It also indicates the availability of liquidity over the platform to carry out the trade. Presently, the activity is dropping towards the lows that indicate the supply is getting dried up. However, this can be considered as a bullish signals as the traders wish to hold the asset on there wallets for long term.

Supply Held by Top Addresses

The supply held on the top addresses suggested the growing or depleting interest of the top holders or whales over the asset. These addresses usually hold a significant amount of the tokens and a slight change in the holding may create a notable FUD within the space. The supply on top addresses had plunged heavily during the FTX fiasco. However, the levels have slightly risen but still continue to face a significant bearish action.

Concluding Thought!

The Decentraland (MANA) prices are believed to maintain a notable upswing, quashing the ongoing price squeeze which had halted the progress of the rally. Besides, multiple indicators like supply on exchanges, development activity ad supply held by top address flash bullish signals, while the possibility of a bearish action cannot be completely eliminated.

Read more: Decentraland vs Sandbox

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more