Table of Contents

ToggleKey Takeaways:

- Chainlink price has slide down in the past few days, marking a double-digit loss after facing an interim rejection a couple of weeks ago

- The price is however trying to withstand the bearish pressure and is believed to revamp a fine upswing to reach the desired target beyond a double-digit figure very soon

- The user activity drops while the whale activity spikes, flashing bullish signals for the token in the longer term

Chainlink, which is the oracle of a decentralized network within the crypto space and has managed to rise by more than 55%, appears to have lost its grip over the market and plunged heavily. The price rise was fuelled by bullish market sentiments. However, it was greatly impacted when the Coinbase-backed Ethereum L2 base integrated with Chainlink price feed on its testnet.

Read More: Ethereum Price Prediction

Notably, the bearish sentiments out-powered the bulls and dragged the price lower by more than 20% from the yearly highs. The price has dropped by more than 13% since the beginning of the month and is believed to prevail for a long time. However, a minor possibility of a rebound may come as the Chainlink whales have awakened again.

According to some reports, three big LINK transactions worth more than $80 million were carried out in minutes, making them the largest in the past 90 days. Moreover, a major share of these transfers was accounted for from the non-circulating supply of LINK, which was set aside by the platform in a whale wallet.

The latest move indicates that the price is preparing to go higher in the coming days and that the current consolidation may be just a short-lived one.

Chainlink Token Technical Overview

Source: Tradingview

- The LINK price is on the way to shedding maximum gains as the price is following a steep descending trend for almost a month

- The RSI is bearish while the MACD displays the piled selling pressure, which may collectively compel the price to reach the lower support zone between $6.33 to $6.41

- However, the volume is pretty low and hence the bulls are believed to enter once the price reaches these levels and uplifts back above $7

- Else a notable plunge may drag the price below $6 to test the bottom at around $5.4 which appears unlikely at the moment.

Chainlink Token On-Chain Analysis

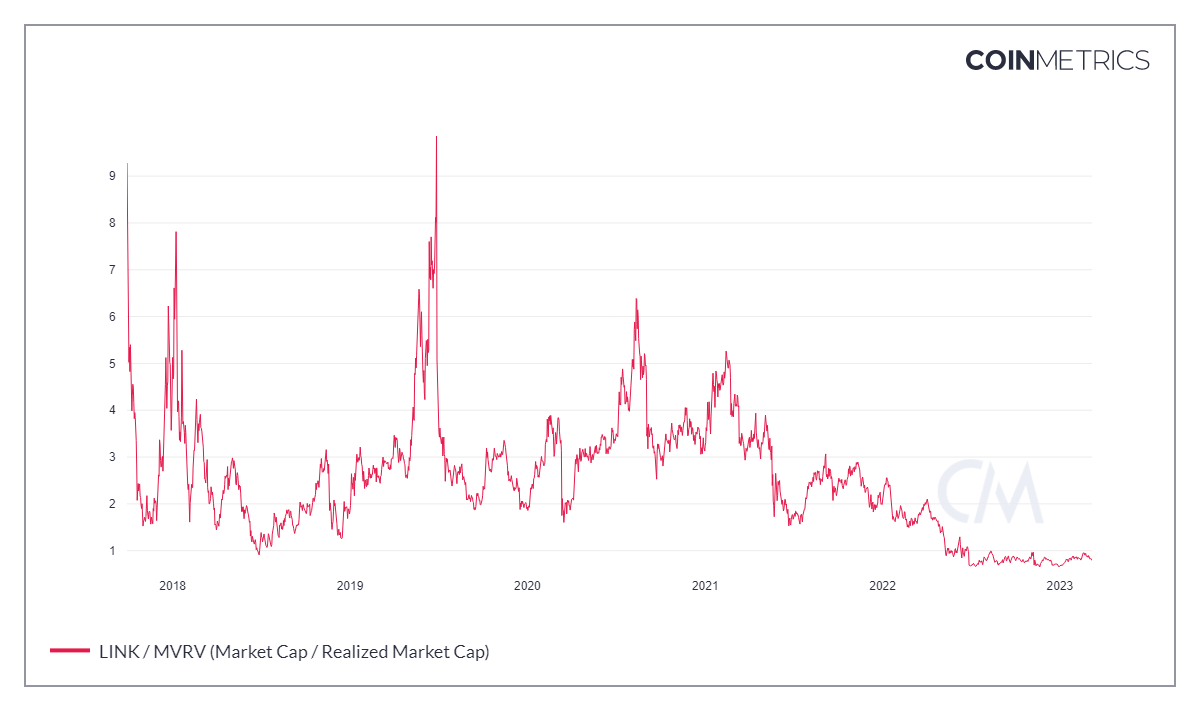

Chainlink MVRV Ratio

Source: Coinmetrics.io

The MVRV ratio is the comparison between the market capitalization and the realized capitalization to get the fair value of the token. Presently, the MVRV ratio for Chainlink has dropped below 1 since the market collapsed in May 2022. However, the levels have again approached 1 during the first few weeks of 2023 which woefully flipped towards the lower ranges. This indicates the bearish sentiments prevailing within the crypto space concerning the token.

Did You Know? Depending on the fair value, it can be determined whether the price of the token is undervalued or overvalued. The token trading within the overvalued region tends to drop while the asset within the undervalued region may attract liquidity.

Chainlink Active Address-30 Day Average

Source: Coinmetrics.io

The active address count is the number of addresses that interacted with the platform either to buy the token or to sell it. The addresses that swap the tokens are also considered. The rise in the active addresses count indicates the swelling bullish sentiment about the token. Meanwhile, if the address count drops then it indicates the traders may have shifted their focus to other platforms.

The above chart shows the 30-day average of the active address count. The levels had spiked heavily during the DeFi boom in early 2021 which fell drastically until the end of the year 2022. However, the count began to rise and surged beyond 7000 in the first few weeks of 2023 and quickly dropped below 2500 at the moment indicating a drop in user activity.

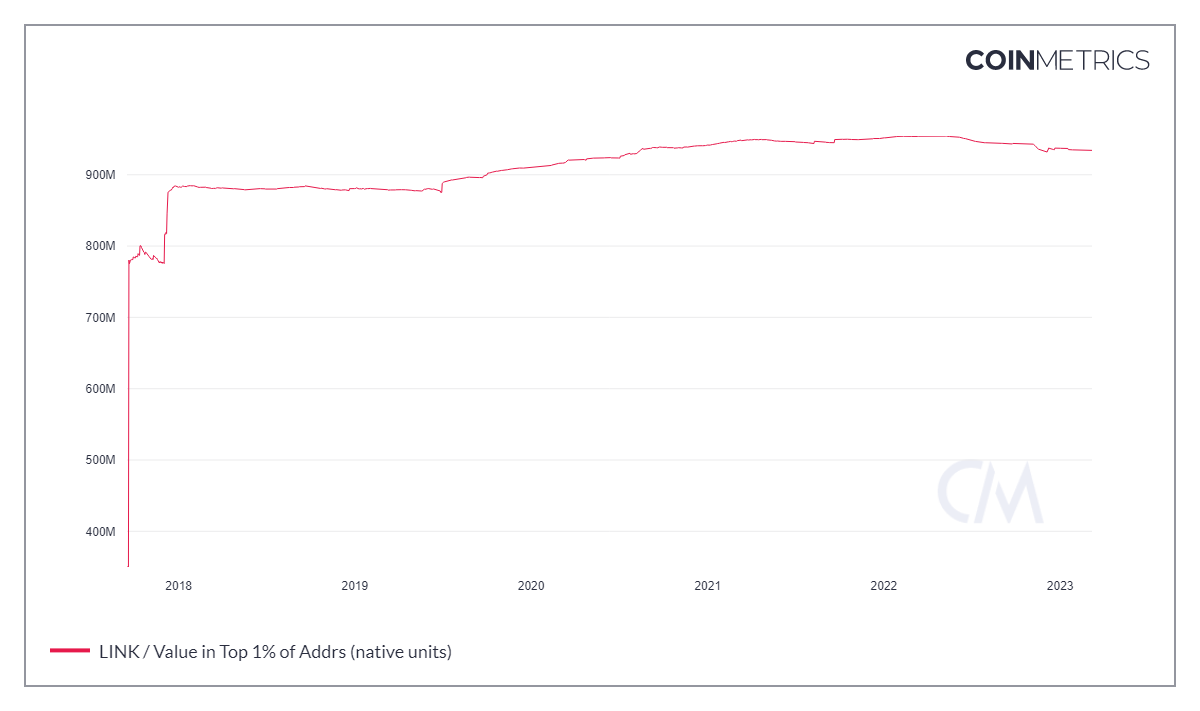

Chainlink Supply in Top 1% Address

Source: Coinmetrics.io

The Supply in the top 1% addresses can also be referred to as the supply held by the whales. The increase in this supply indicates that the whales are confident about the upcoming bullish move and are accumulating at lower rates. This also induces confidence among the market participants who tend to follow the whales.

As seen in the above chart, the whale accumulation of the supply held by the top addresses has been on the rise since 2018. It appears the top addresses are holding a huge amount of tokens indicating bullish sentiments prevailing for the token in the long term.

Read On: Polkadot Price Prediction

Concluding Thought!

Chainlink price has dropped presently but displays the possibility of resuming a fine uptrend in the coming days. Although the user activity has dropped, the whale accumulation is piling up. Therefore, one can expect a fine upswing for the LINK price in the coming days which may even regain a double-digit figure very soon.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more