Table of Contents

ToggleKey Takeaways:

- Bitcoin price soared by more than 20% to mark monthly highs beyond $24,500 and appears to be at crossroads at the moment

- The bulls appear to be well in position to uplift the price beyond the major resistance at $25,000 which may enable the token to head toward $30,000 in the coming days

- The supply of exchanges maintains average levels that indicate the mourning confidence of the upcoming price surge amount the investors

Bitcoin price has been bullish since the beginning of the year 2023 as it soared more than 40% during the first fortnight. However, the bears managed to restrict the growth of the rally beyond $25,000 a couple of times, but it appears they may now face bull’s rage. The US financial markets have been hard hit by the collapse of banks.

Start-up-focused Silicon Valley Bank (SVB) recently became the largest bank to fail since the 2008 crisis. The regulators closed the banks and appointed FDIC as the receiver for the disposition of assets, which created massive fear within the markets. However, the regulators on Sunday cleared the speculations in withdrawals and said the bank would be open from Monday and the payouts would be made available.

Besides, the US President, Joe Biden also assured the people of the state that the country’s banking system is safe and the depositors will be having access to their funds whenever required. Moreover, Circle confirmed its exposure to SVB which resulted in the depeg of USDC to as low as $0.89. However, the assurance by the regulators made Circle’s fund available on SVB which helped the stablecoin to regain its peg.

Additionally, the BTC bull run was also impacted by the announcement of the launch of Bitcoin (BTC) futures event contracts by the American derivatives marketplace CME. The fully regulated exchange may now facilitate daily expiring contracts tied to Bitcoin futures with a lower cost which is cash settled.

Read More: USDC Stablecoin Depeg

Bitcoin Token Technical Overview

Source: Tradingview

- Bitcoin price had raised beyond the pivotal resistance at 200-day MA levels during the beginning of 2023

- The recent plunge compelled the price to drop back toward the same levels, but the recent price action triggered a rebound that surpassed the 0.23 FIB levels

- The buying pressure soared high, which indicates the bullish momentum to prevail for more time until the price reaches the 0.38 FIB level at $27,940.

- However, the price is maintaining a stagnant trend since the early trading hours which indicates the bulls may have drained a bit.

- Presently, it is facing difficulty in clearing the major resistance at $25,234, which may drag the price slightly lower below $24,000 in the coming hours

Additional Read: Bitcoin Price Prediction

Bitcoin Token On-Chain Analysis

Bitcoin Supply on Exchanges

Source: Coinglass

The supply on the exchanges is the reserve balance of Bitcoin in all the aggregated exchanges. The rise in supply indicates the traders are preparing to liquidate their tokens or swap them for others. As more tokens enter the exchanges, the demand for the token depletes which may further have a negative impact on its price.

The balance on the exchanges reached the highest around $1.94 billion in the first week of March which was consolidated at around $1.93 since the beginning of 2023. However, the supply dropped heavily, flashing bullish signals as the traders became confident of the upcoming BTC rally. The drop in the reserves indicates that the traders are holding on to their wallets expecting the price to surge in the long term.

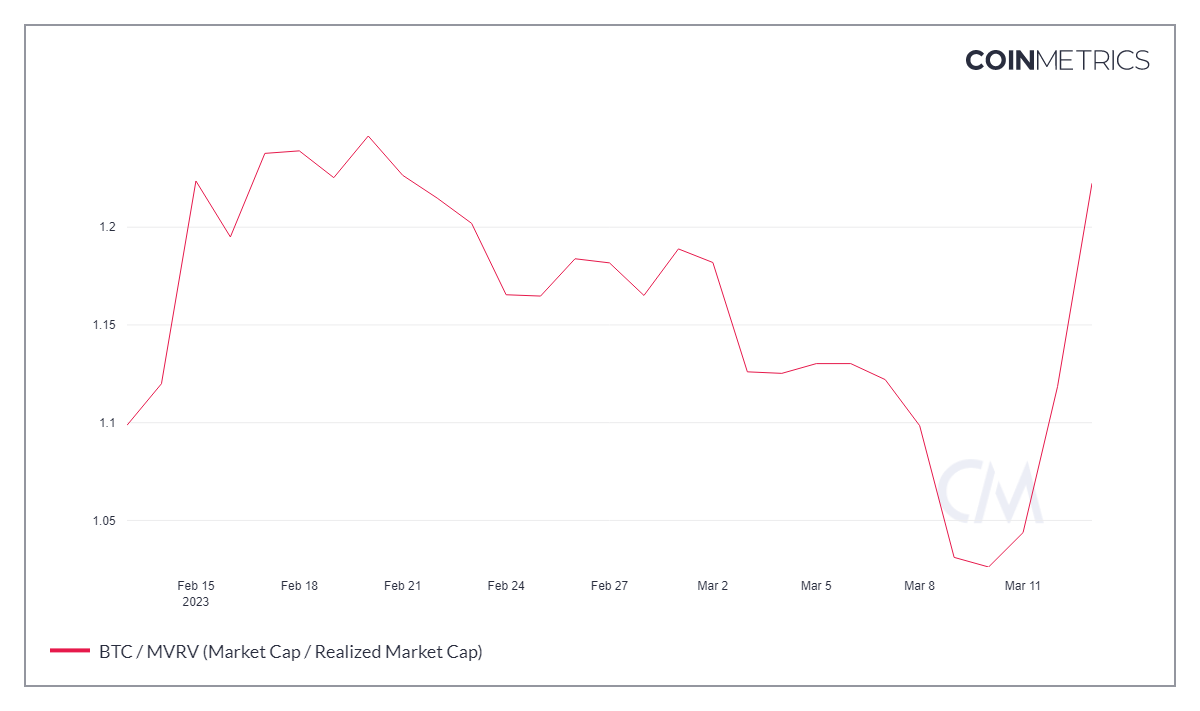

Bitcoin MVRV Ratio

Source: Coinmetrics

The MVRV ratio compares the market capitalization with the realized market cap to get the fair value of the token. This helps to determine whether the price of the token is undervalued or overvalued. If the MVRV ratio was plunging from over a month and marked the bottoms close to 1 and rebounded high to soar beyond 1.2 at the moment.

The rise in the MVRV ratio indicates that the price is gaining value. The price may soon become overvalued and this rises the chances of a trend reversal. The traders may prepare to extract the profits and hinder the progress of the rally. However, these could be just a short time reversal as the sentiments are largely bullish.

Concluding Thought!

The Bitcoin price is rising as the turmoil created in the traditional financial markets has enabled it to soar high. Despite the price rise, the supply on the exchanges continues to remain stable while the MVRV ratio spikes high. This indicates the traders have been holding the token in their wallets and are extremely bullish on Bitcoin.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more