Table of Contents

ToggleKey Takeaways:

- BAT price has displayed a magnificent upswing since the start of 2023 which appear to shed soon as the bulls remain slightly passive

- The momentum continues to remain bullish which may keep up a notable upswing in the coming days

- The investors and whales appear to have diverted away and hence compelling the price to maintain a descending consolidation for some time

Basic Attention Token price fell from a great cliff in 2022 which of course was fueled by multiple events. The rally flipped further and began to test the upper resistance since the beginning of 2023 and marked the yearly highs above $0.33. The short-lived rally changed its course and began to shed massive gains. Presently, the price has regained some of its lost levels and appears to maintain a firm upswing ahead.

With huge variations, will the BAT price sustain the bullish trajectory or drop back to the same consolidation zone?

BAT price has been struggling hard to maintain above $0.22 for nearly a fortnight which signals the bulls may have held a notable hold over the rally. Therefore, the price is believed to manifest a consolidated upswing where-in it may lower the pace and rise high and reach the major resistance at around $0.5.

Basic Attention Token (BAT) Technical Overview

Source: Tradingview

- The BAT price after a decent rebound from the recent lows has been trading along the rising trend line

- The price also rebounded from the 0.38 FIB level and surged notably but is failing to lay down a path towards 0.618 FIB levels

- Therefore, the price may continue to surge along the trend line and eventually achieve the 0.6 GIB level at $0.28

- Meanwhile, some bearish action may be expected at $0.26 where-in the price has faced multiple rejections in the current month.

- Therefore, a breakout above these may offer the required strength to uplift the price close to $0.3 in the coming days

Basic Attention Token (BAT) On-Chain Overview

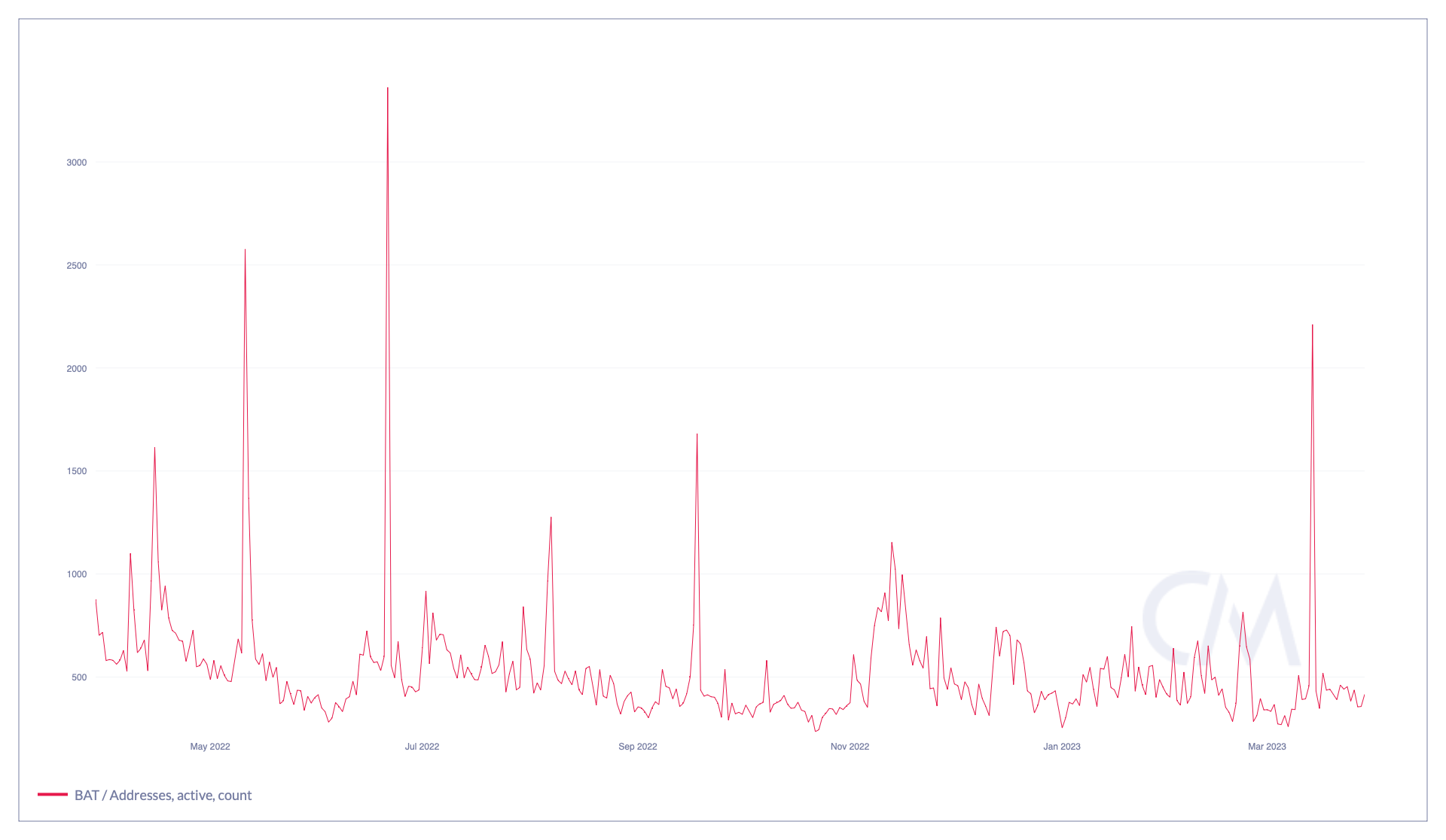

BAT Active Address Count

Source: Coinmetrics.io

The popularity of a token depends on how regularly traders are dealing with the token or performing trades using the token. The active address count considers these addresses which actively interact with the platform to buy/sell or swap their tokens. An increase in the address count indicates a rise in the user’s attention which may further positively impact the price ahead.

Meanwhile, the active address count of BAT presently has dropped heavily which indicates a lowered user adoption. However, the address count has spiked a couple of times, but it remained restricted for a short while.

Read More: Bitcoin Price Prediction 2023

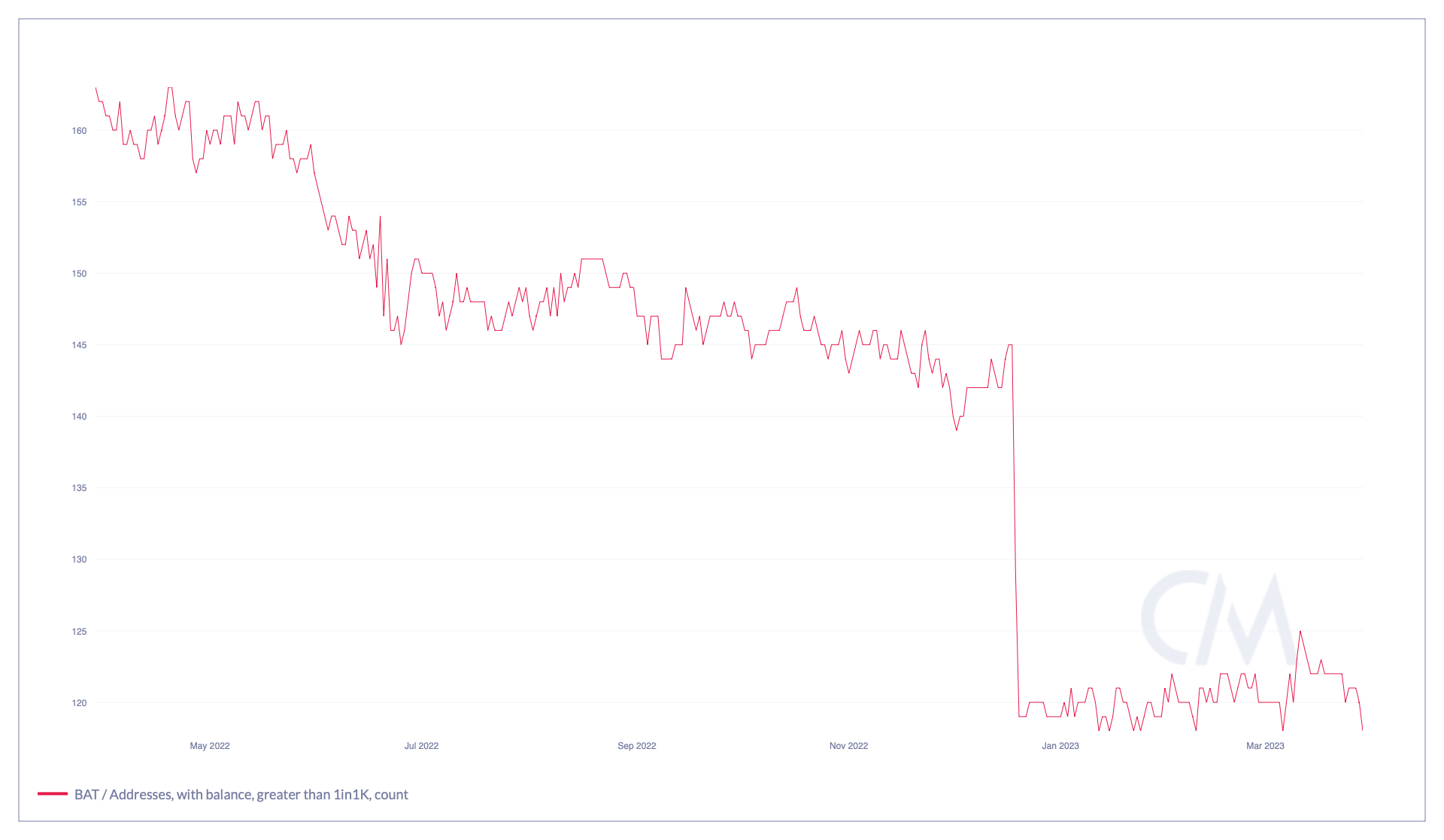

BAT Address Count with more than 1% Supply

Source: Coinmetrics.io

The address count having more than 1% supply can be considered as whale accounts as they also hold 1% of the circulation. The traders tend to follow the trend of the whales as it is considered bullish if the whales begin to accumulate and a start of a bearish phase is assumed if they begin to shed off their gains.

The BAT addresses have been witnessing a massive drop indicating the whales are liquidating their holdings and are not accumulating more. This may harm the token’s value in the coming days.

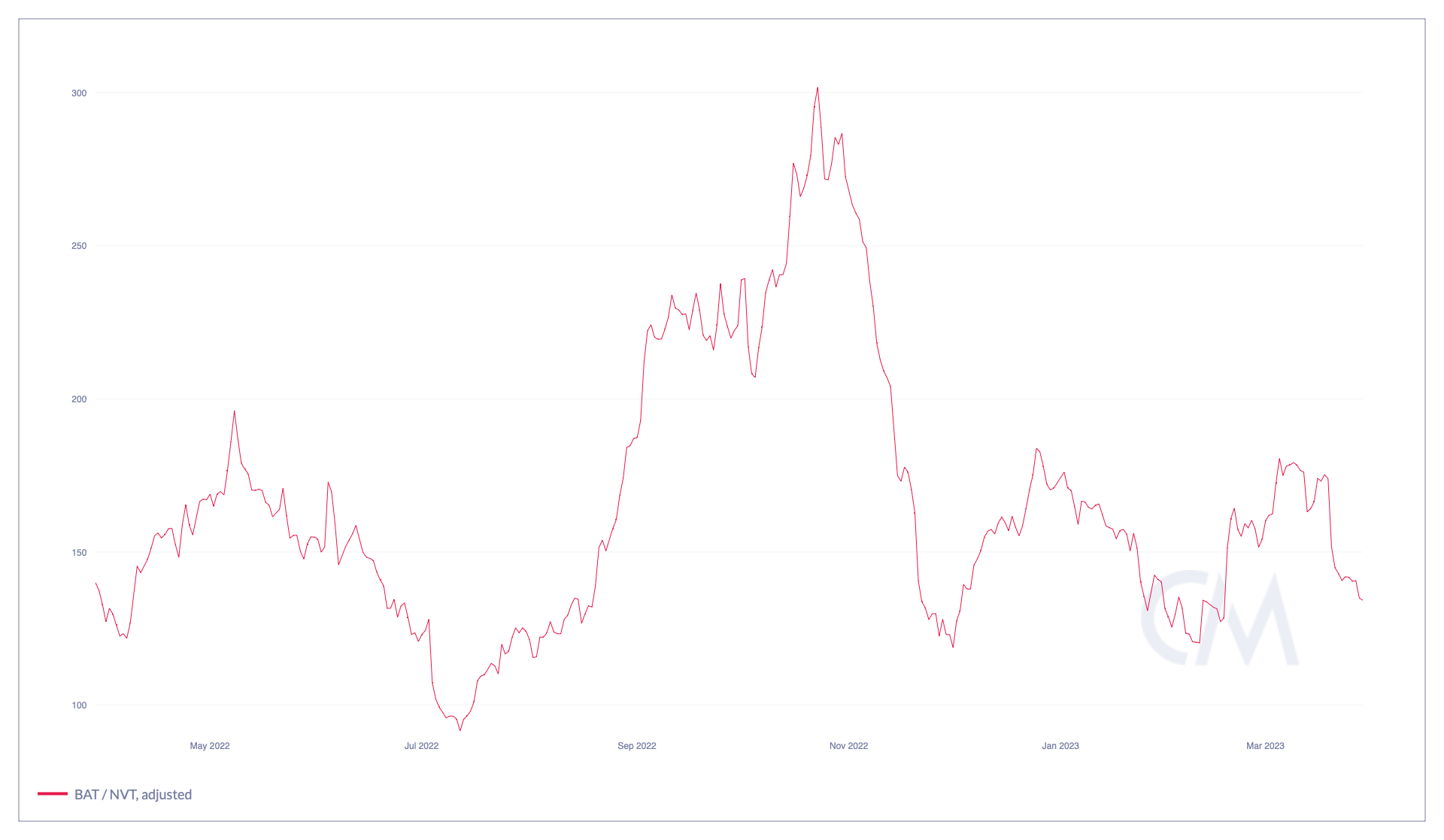

BAT 30-Day NVT Ratio

Source: Coinmetrics.io

The NVT is the ratio which compares the transaction volume of the token to its market capitalization. A high NVT ratio indicates that the investors are pricing the token at a premium as the market cap is growing high compared to the volume. It usually occurs during the market tops, during the period of overvaluation.

Presently, the NVT ratio has dropped which indicates the traders may be selling BAT at discount as the volume of the token surges much ahead of the market capitalization and often coincide with the market bottoms.

Additional Read: Ethereum Price Prediction 2023

Concluding Thought

The BAT price has been largely trading under the bullish influence but the bears seem to intervene in the coming days. With a huge drop in the active address and the addresses with more than 1% of the supply, it appears the bulls and the investors have drifted apart from the token. However, with a slight change in the market behavior, a notable recovery may kick in.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more