Key Takeaways:

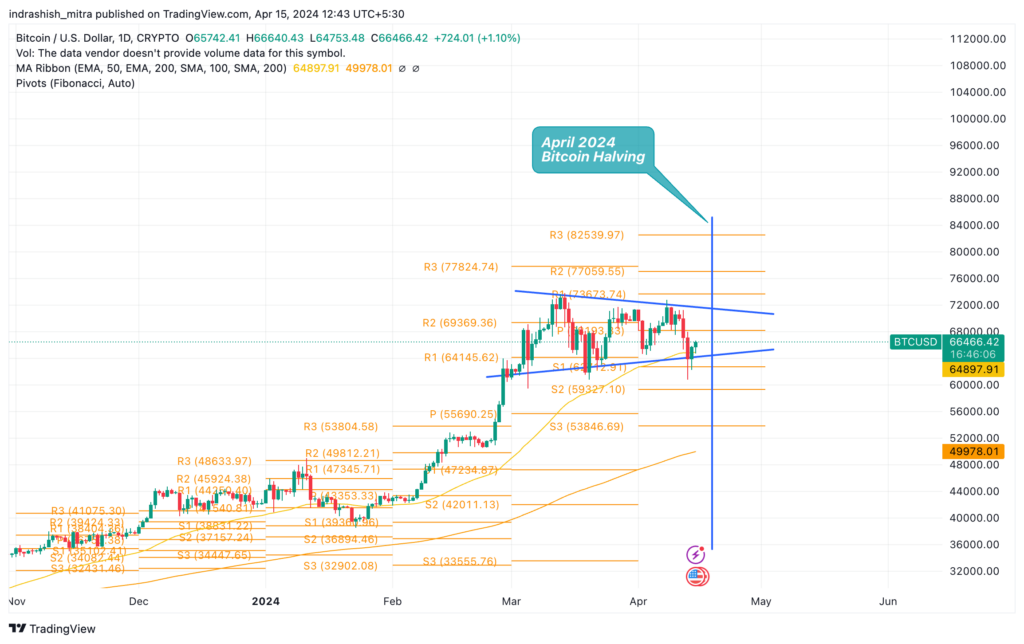

- Bitcoin and major cryptos experienced a sharp decline, with Bitcoin price briefly dropping below $62,000 before rebounding to well over $66,000.

- Other top digital assets like Ethereum, BNB, and Solana also saw significant drops, signaling widespread market turbulence.

- The DeFi sector, particularly projects like Ethena, faced challenges amid falling prices, raising concerns about protocol stability and liquidations.

- Speculation arose regarding the market downturn’s causes, including the potential impacts of decreased dollar liquidity ahead of the US tax deadline on April 15.

- Geopolitical tensions escalated as Iran launched strikes against Israel, contributing to market jitters, although a statement indicating potential de-escalation later surfaced.

Bitcoin, along with the broader crypto market, experienced a significant downturn on Saturday, with the price of the leading digital asset dropping nearly 10%. At one point, Bitcoin briefly plummeted below the $62,000 mark before rebounding to over $66,000 at the time of writing.

Read More: Bitcoin Price Prediction

This downward trend was not exclusive to Bitcoin; other major digital currencies also witnessed similar declines over the past 24 hours. Ethereum (ETH) saw a 7% decrease, trading just below $3,000, while BNB and Solana (SOL) experienced drops of 9% and 12%, respectively. Concurrently, trading volume surged during this period, indicating heightened market activity.

The decentralized finance (DeFi) sector bore the brunt of the market turmoil, with falling prices triggering liquidations and posing risks for certain protocols. Notably, Ethena, an Ethereum-based project known for its synthetic dollar USDe, faced scrutiny due to its untested method for maintaining USDe’s one-dollar “peg” under such volatile market conditions. Despite amassing over $2 billion in deposits, Ethena’s approach raised concerns amid the ongoing market chaos.

While the exact cause of Saturday’s market downturn remains unclear, speculation has emerged regarding potential factors. Former BitMEX CEO Arthur Hayes suggested in a recent blog post that a drop in dollar liquidity preceding the upcoming U.S. tax deadline on April 15 might have contributed to the decline in prices. According to Hayes, decreased liquidity typically leads to lower asset prices.

Additionally, geopolitical tensions added to market jitters as Iran launched drone and missile strikes against Israel, citing retaliation for an alleged airstrike on its consulate in Damascus, Syria, attributed to Israel. However, crypto market prices began to recover following a statement from Iran’s Permanent Mission to the United Nations, indicating a potential de-escalation of the situation.

In conclusion, while Bitcoin and the broader crypto market faced significant volatility over the weekend, ongoing geopolitical tensions and uncertainties surrounding market fundamentals continue to influence investor sentiment and trading activity.

Learn More: Bitcoin Halving 2024

Source: CoinDesk

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more