Table of Contents

ToggleKey Takeaways:

- Bitcoin price displayed a magnificent rise in the past few days and soared above $30,000, marking an intraday high of $30,800.

- After a 25% jump, the bulls appear to have reduced their pace, so the rally is stuck at $30,000, failing to either rise or drop from these levels.

What is happening to the Bitcoin price?

Just a week ago, the Bitcoin price was stuck below $27,000 and was expected to maintain a descending trend and find lows close to or below $25,000. The downfall and the bearish trend were mainly due to the fresh crackdown of the SEC over the crypto space. However, industry giants like BlackRock, Invesco, etc., and a few others jumped in and filed for a Bitcoin Spot ETF. Moreover, the players like Fidelity, Citadel, and Schwab announced to launch of a crypto exchange that induced immense bullish momentum that propelled the price beyond $30,000.

| BTC Price | $30,121.40 |

| 24-Hour Price Change | +0.05% |

| 7D Price Change | +17.95% |

| Market Capitalization | $584.81 billion |

| Circulating Supply | 19.4 million |

| Trading Volume | $17.53 billion |

| All-Time High (ATH) | $68,789.63 |

| All-Time Low (ATL) | $0.04865 |

| Fear-Greed Index | 65 (Greed) |

| Sentiment | Bullish |

| Volatility | 3.62% |

| Green Days | 15/30(50%) |

Bitcoin Technical Analysis

The dominance of Bitcoin continues to soar and has currently reached an impressive resistance point. It is testing the pivotal 200-week MA levels, and if it breaks above these levels, the altcoins are believed to plunge notably. Therefore, it may be a good time to accumulate altcoins.

The #Bitcoin dominance is getting to an interesting resistance point.

We’ve previously had a case that, 10 months prior to the #Bitcoin halving, is the moment to invest in altcoins.

That’s now.

Similarly, that period the 200-Week MA was touched on Dominance.

Just like now. pic.twitter.com/dgal7Qjllb— Michaël van de Poppe (@CryptoMichNL) June 23, 2023

Source: Tradingview

- The Bitcoin price has maintained a significant rise along a lower trend line since the start of 2023

- The price faced a steep rejection after testing levels above $30,000 in April. However, the current price trend suggests the price is about to undergo a bullish breakout from the narrow consolidation along $30,089.

- Once the price clears the pivotal resistance at $30,859, it may further rise above $31,097 and soon trigger an upswing beyond $32,000.

- The RSI rose pretty high and presently consolidating along the upper resistance, and as the buying volume is rising, the possibility of a bullish breakout may be imminent.

Read More On: Bitcoin Technical Analysis

Will Bitcoin price continue to rise?

The star crypto, Bitcoin, has been trading under an acute bearish trend throughout 2022 that has carried on to date. The extended bearish trend has drained the bullish power, which has slashed the volatility. Moreover, the volume also remained below average levels. Although the price remained under the bearish influence this year, it also manifested some strength. Hence, it maintained a significant upswing by undergoing consecutive higher highs and lows. Further, during the second half of 2023, the trend may flip from bearish to bullish, leaving very little room for the bears to act.

Read More: Can Bitcoin Price Reach $100,000 in 2024?

Bitcoin On Chain Metric Overview

BTC Hash Rate Maintains a Steep Upswing

Source: Coinmetrics.io

The Bitcoin hash rate is simply an indicator of the computational power needed to validate a transaction and add a block to the chain. The metric’s rise or fall indicates the miner’s level of involvement in solving the puzzle and validating the transaction. The increase in levels indicates increased participation by miners. This makes the network more decentralized and less vulnerable to a 51% attack, which occurs due to a monopoly over the network.

Presently, the hash rate is hovering around 356.52 TH/s which is very close to the high around 440.71 TH/s which has risen from the levels around 314.88 TH/s.

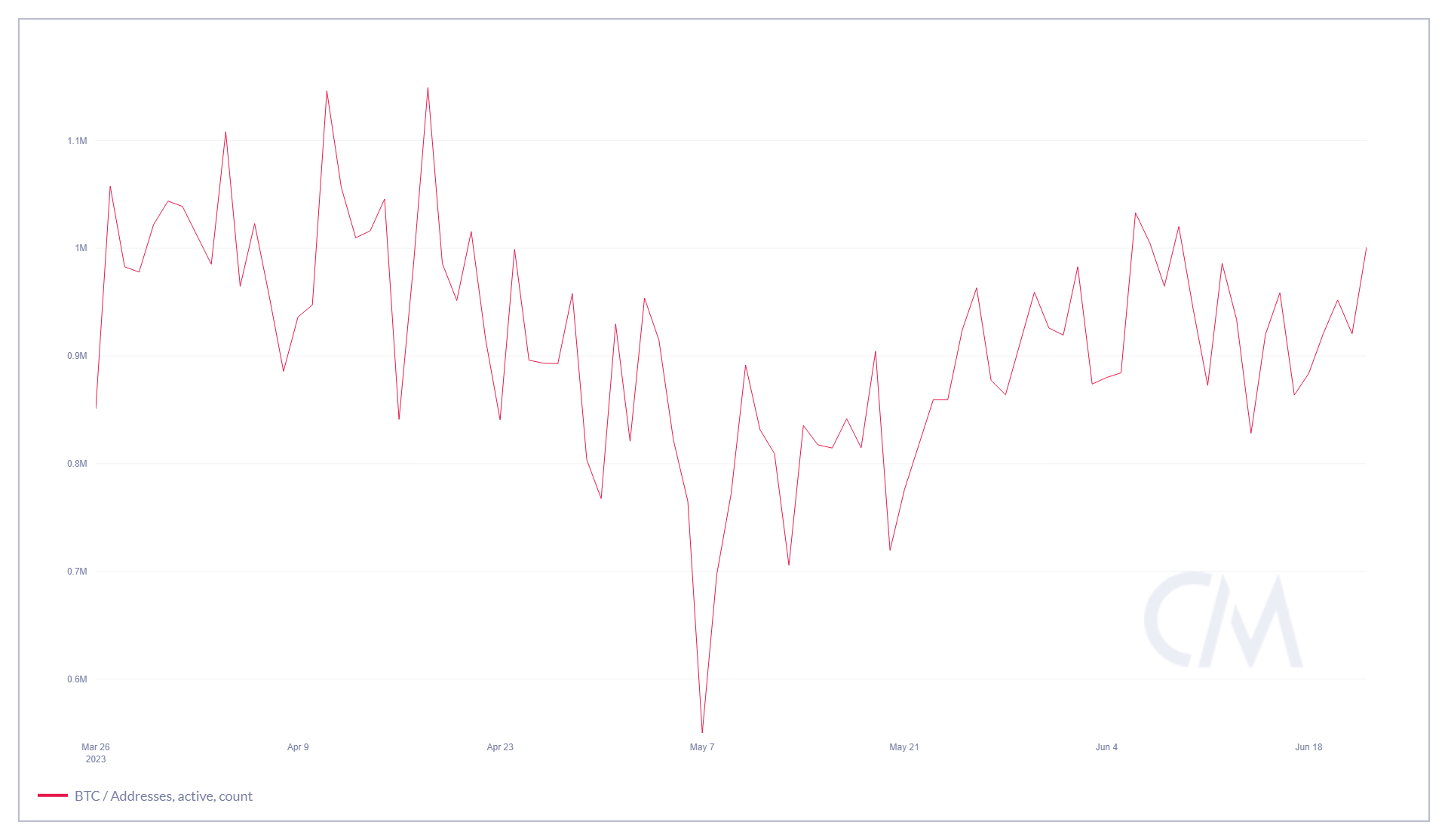

Bitcoin Active Address Count Surges

Source: Coinmetrics.io

The popularity and demand of the platform depend on user activity on the platform. The user’s activity is measured in terms of active address count. The active address includes all the addresses that have interacted with the platform in the past 24 hours, regardless of whether they are buy, sell, or swap addresses. The rise or drop in the active address directly impacts the value of the token as it varies with the user’s activity

The active address had dropped to 549.93k in May, rebounded and soared high to reach 1.03M, and is currently hovering slightly below these levels at $1.0009M at the moment.

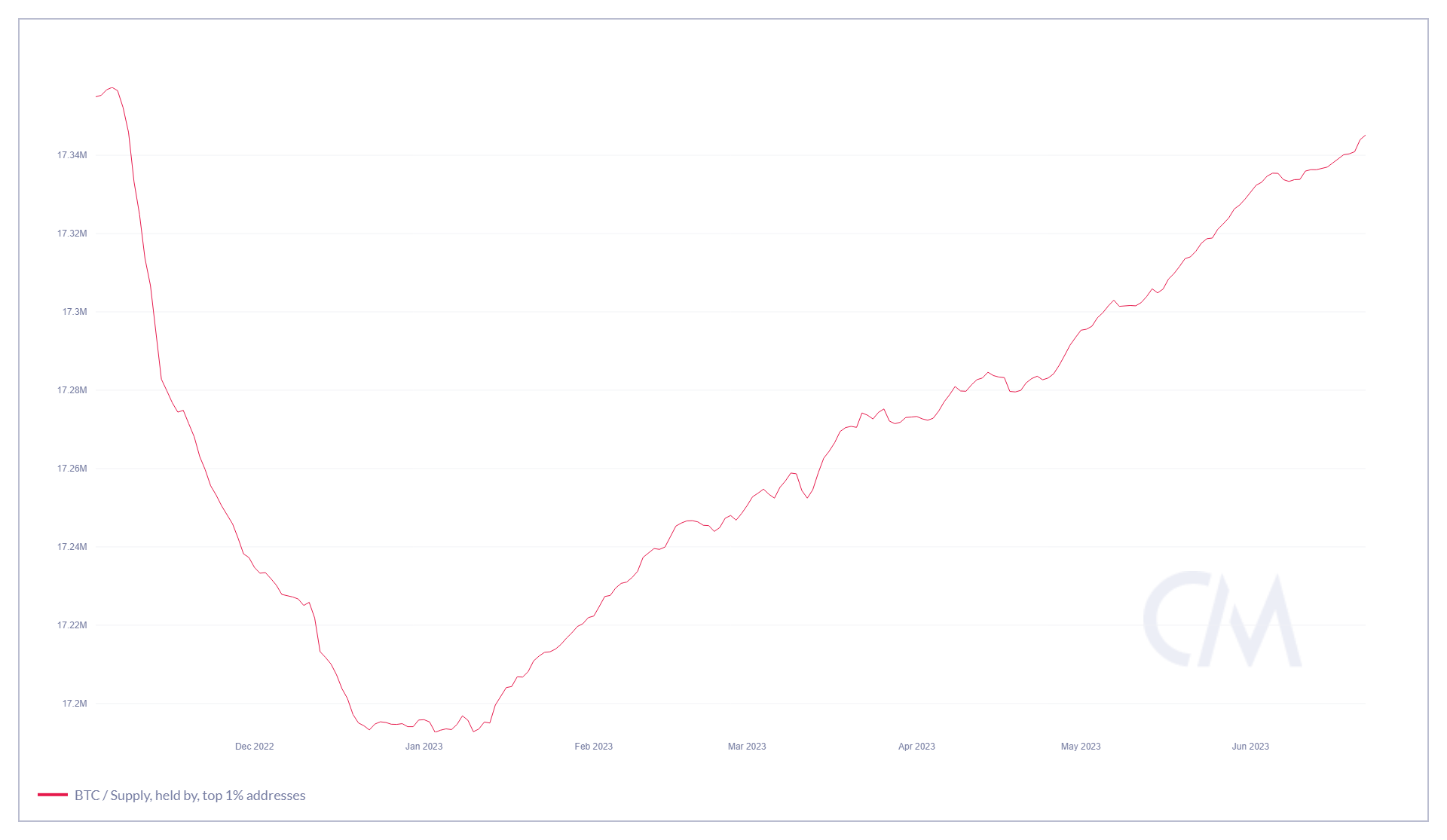

Bitcoin Whales Begin to Accumulate

Source: Coinmetrics.io

The supply in the top 1% of addresses can also be considered a whale address as they hold nearly 1% of the circulation. These addresses usually accumulate at the end of the bearish cycle, speculating a rise in bullish momentum very soon. The rise or drop in the levels does not impact the value of the token in the short term, but it does impact the sentiments of the investors in the long term and keep them bullish over the token’s future.

The supply in the top 1% of addresses dropped in the first few days of 2023 and hovered around 17.13 million. However, the address count flipped and began to rise steadily, marking a high every new day. Presently, the supply at these top addresses is around 17.35 million.

Read More: Bitcoin Price Prediction

Should you invest in Bitcoin today?

Bitcoin is the very first token in the crypto space, and most of the tokens tend to follow the BTC price trend. The token holds nearly 50% of the market share and is considered the most trusted crypto in the market. As it has faced multiple bullish and bearish markets, the token has become more consistent than ever. However, the price has triggered a notable upswing and is expected to remain elevated for the rest of 2023. Hence, with deep research and close analysis of the price movements, Bitcoin can be considered a safe investment.

Crypto Future Trading with CoinDCX

Crypto futures trading with CoinDCX is very simple and safe. We offer multiple tools and benefits that make the future trade a simple trade rather than a tedious job. Along with a wide variety of USDT pairs, low barriers to entry, and easy crypto-fiat on-ramp services, we also offer low transaction fees and attractive trading tools for a smooth trading experience. Therefore, download the CoinDCX App and register now!

Conclusion

Bitcoin has been trading in a consistent uptrend since the beginning of the year and is believed to remain elevated for the rest of the year. Although the price has faced a couple of bearish pullbacks, the bulls have displayed enough strength and triggered a notable rebound each time. Hence the Bitcoin (BTC) price is believed to maintain a healthy upswing in the days coming ahead.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more