Table of Contents

ToggleKey Takeaways:

- Lido DAO token faced a huge slump in the past 24 hours and closed the previous day’s trade at $0.926 with a market capitalisation of $326.23 million and a circulating supply of 312.95 million.

- The popular layer-2 scaling platform for Ethereum underwent a massive price slash which drained more than 50% of its value in less than 48 hours.

The Lido DAO token price had risen significantly to levels above $3 a few days before the Ethereum Merge. The token was regarded as the most extensive staking service for Ethereum, with over a million ETH deposited into the ETH 2.0 smart contract. However, shortly after the Merge, the LDO price fell precipitously and continued to fall amid shaky market conditions. The token has currently reached new lows below $1; however, the token’s recovery is still visible.

Recent Updates:

- Lido DAO recently released its L-2 solution to support Ethereum expansion. It also provides other advantages such as bridging wstETH to Arbitrum One and Optimism while preserving the unique properties of stETH.

Lido is now on L2 🏝️

Bridge your staked ETH to Layer 2 protocols at the click of a button to benefit from lower gas fees and exciting DeFi opportunities.

— Lido (@LidoFinance) October 6, 2022

LDO TECHNICAL OVERVIEW

- The crypto markets have plummeted due to the ongoing Binance-FTX feud, which has pushed the market cap below $850 billion.

- After failing to rebound at the neckline of the double-top pattern, the Lido DAO token plummeted dramatically.

- The extreme bearish conditions may continue to exert significant pressure, and despite a minor short-term rally, the price may soon find new lows.

- However, the bulls are working hard to keep the price at $1, but they are expected to run out of steam and suffer a massive drop to the last line of defence at $0.5 soon.

Read more: Lido DAO Price Prediction

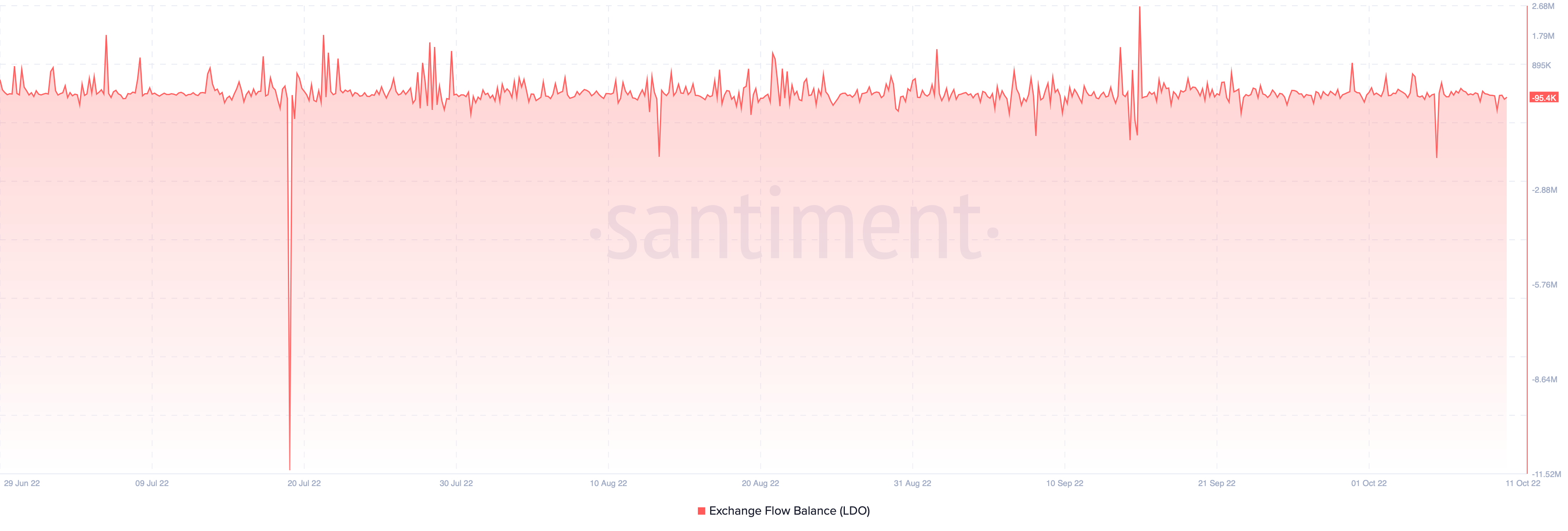

LDO’s exchange netflows indicate bullishness

The difference between the inflows and outflows of the exchange is represented by the Exchange Netflow volume, which is a very important indicator. Netflow typically remains within average levels, but a slight variation on either side may eventually shed light on the crypto markets’ upcoming trend. A positive exchange netflow indicates that inflows are greater than outflows and hence, an intent to sell, while a negative value for the same indicates that outflows are greater than inflows and hence increased HODLer activity.

As of writing, the exchange netflows for the LDO token remains in the negative territory, suggesting that HODLers and long term investors are heavily pulling out LDO tokens from their exchange wallets to their cold wallets. Thus, with the exchange netflows in the negative territory indicates that traders are withdrawing heavily, which could be a bullish indicator and in the current scenario, it could also mean that investors are buying on the cheap, implying that a possible rebound or decent upswing is on the way.

As a result, market participants appear to be stockpiling the token at a discount. However, as prices rise, the possibility of them extracting profits emerges, which may have a negative impact on the LDO price.

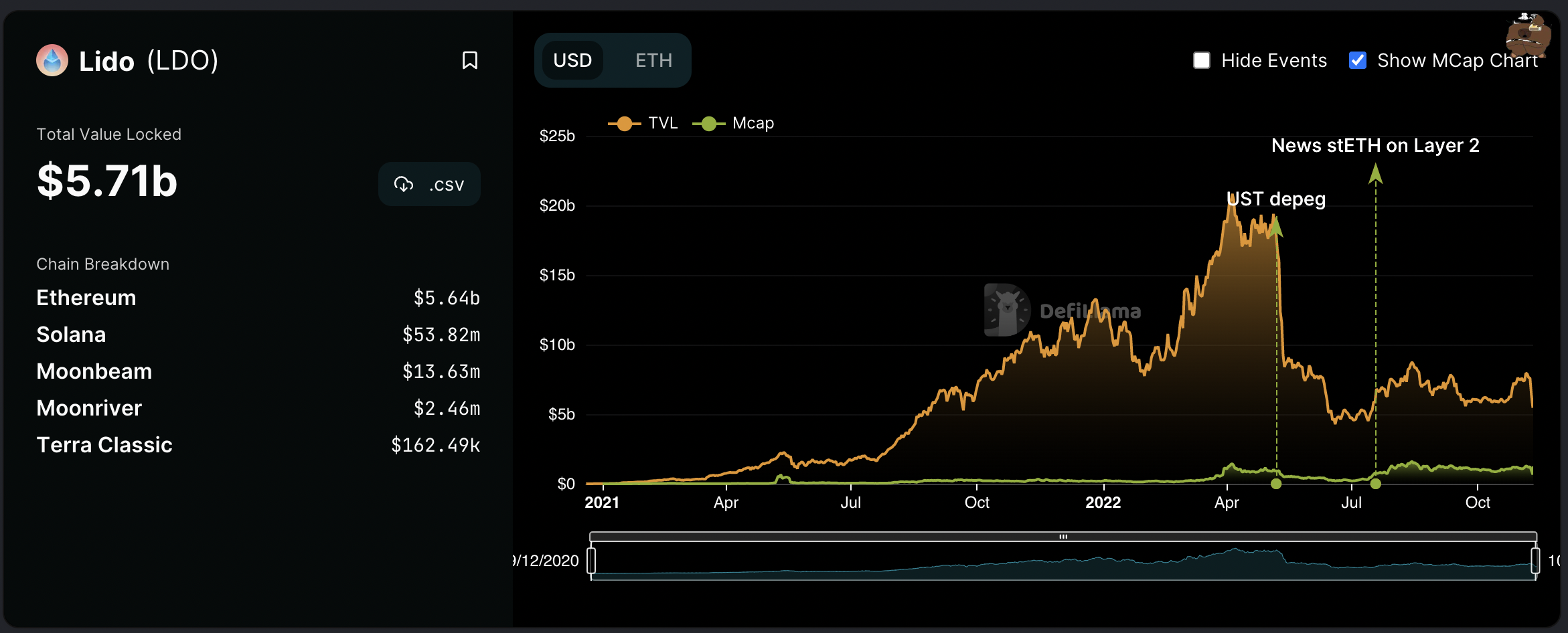

Lido DAO TVL at one of the lowest points in the past year

TVL, or Total Value Staked, includes all coins deposited in all of the DeFi protocol’s functions, such as staking, lending, and liquidity pools. A rapid increase in the TVL indicates that the project is valued by investors and that more money is flowing through the network. This, in turn, assists investors in determining whether the protocol is sound and worth investing in.

Since the start of the yearly trade, the TVL of the Lido Protocol has increased significantly. However, the levels fell precipitously during the May crash, which was exacerbated by the recent market drop. In the last few days, the TVL has dropped from nearly $8 billion to $5.47 billion. Meanwhile, the most valuable token is Ethereum, which is worth $5.57 billion, followed by Solana, which is worth $54.21 million, and Moonbeam, which is worth $13.16 million.

As a result, there is currently less investor interest in its dApps, as well as a broad market-wide correction and a drop in liquidity of the protocol built on the platform.

Conclusion

Right now, the broader market sentiment is extremely bearish, which may force the price to remain within a descending consolidated range. Meanwhile, a drop in TVL indicates a loss of investor interest, whereas a drop in exchange netflow indicates a bullish signal. However, no specific price action is likely until the bearish influence prevails.

Read more: BTC Price Prediction

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more