Table of Contents

ToggleKey Takeaways

- The Decentraland price recorded a huge price rise in the past few days, rising the levels beyond $0.5

- In the meantime, the bears also appear to have intensified their activities in the short term which may hinder the progress of the rally to some exten

- The drop in the active address or the network growth indicates a slash in the user activity while a rise in development activity induces confidence in long term

The crypto space is undergoing a roller coaster ride as the major tokens have been witnessing huge price variations. The altcoins also appear to be accumulating strength to trigger a significant upswing in the coming days. Decentraland, specifically, has been extremely bullish since the last trading day. While the fractals do not appear to favor the bulls, the MANA price is constantly rising, but can it make it to $1 this month?

The price kicked off the yearly trade on a huge bullish note with a jump of more than 190% to mark the high of $0.8427. Since then, the trend has maintained a significant descending trend, while each attempt to trigger a recovery has also failed miserably. However, the MANA price has been printing huge bullish candles in recent times that have kept the hopes of a notable upswing alive.

Decentraland (MANA) Technical Analysis

Source: Tradingview

- The MANA price appears to have triggered a ‘v-shape’ recovery after rebounding from the interim lows below $0.45

- The strength of the rally also soared high and marked the highs and currently is displaying a bearish divergence

- The price required a notable upswing to reach the interim resistance zone between $0.57 and $0.58 which also coincides with the crucial 100-day daily MA levels

- A breakout beyond these levels may trigger a fine upswing towards the next resistance at $0.7 which may further propel the prices beyond the 2023 highs to reach $0.8. This may be when the doors to mark $1 may be released for the MANA price

Read more: Decentraland Price Prediction

Decentraland On-Chain Overview

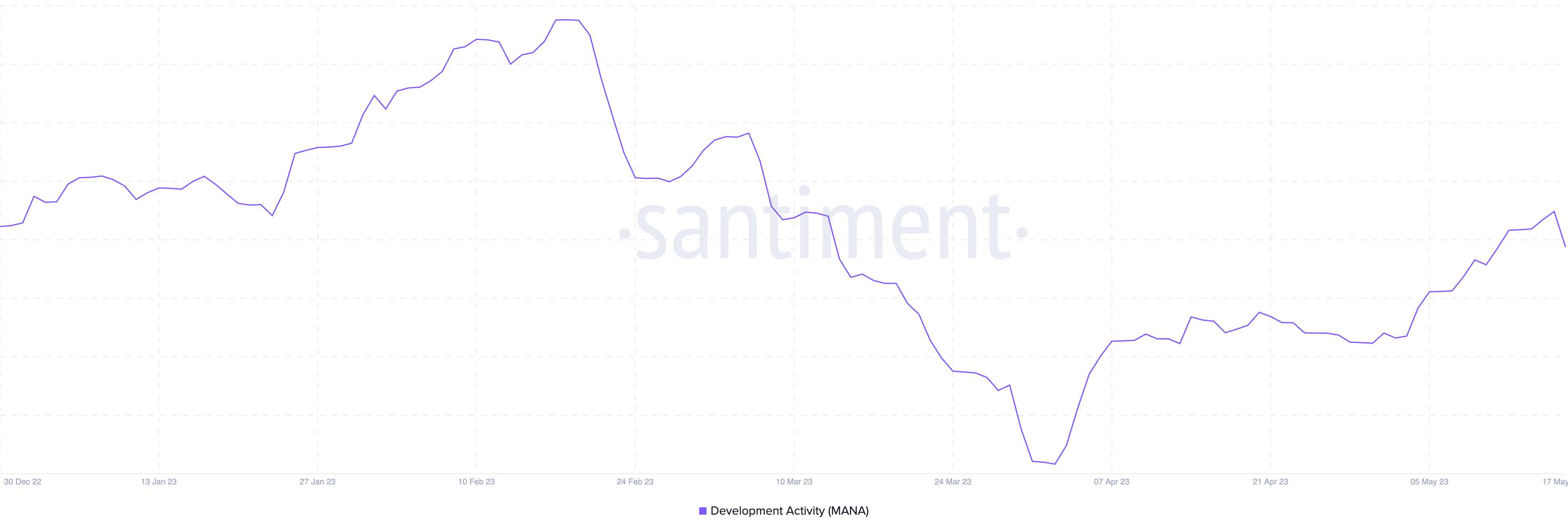

Decentraland Development Activity

Source: Santiment

The development activity is used to gauge the fundamental development of the project and the efforts of the team to deliver new features and upgrades in the coming days. The activity is recorded on the GitHub repositories, which are generally public and accessible to all. The levels are determined by the number of commits made on GitHub, which are simply the query count, new upgrades or suggestions, or any other information about the project.

The activity had maintained a steady rise until the first few days of February, which was followed by a drastic drop to the lows. However, a significant rebound in the levels was recorded, indicating a huge spike in the developer’s activity. Therefore, this may have induced confidence in the project in the long term, leaving a positive impact on the value of the crypto.

Decentraland Supply on Exchange (% of the Total Supply)

Source: Santiment

The supply on the exchanges indicates the balance reserve of all the exchanges. Besides, the above metrics are a comparison of these balances to the total supply of the token. This helps to determine the amount of circulation residing within the exchanges, which further indicates whether the upcoming trend can be bullish or bearish.

Whenever the traders wish to sell the token or swap it for another, they transfer their holdings from their wallets back to the exchanges. In this case, the supply on the exchanges rises significantly, flashing bearish signals for the crypto. However, the levels have been grounded since the start of April, indicating the traders are bullish on MANA and hence are holding for long-term gains.

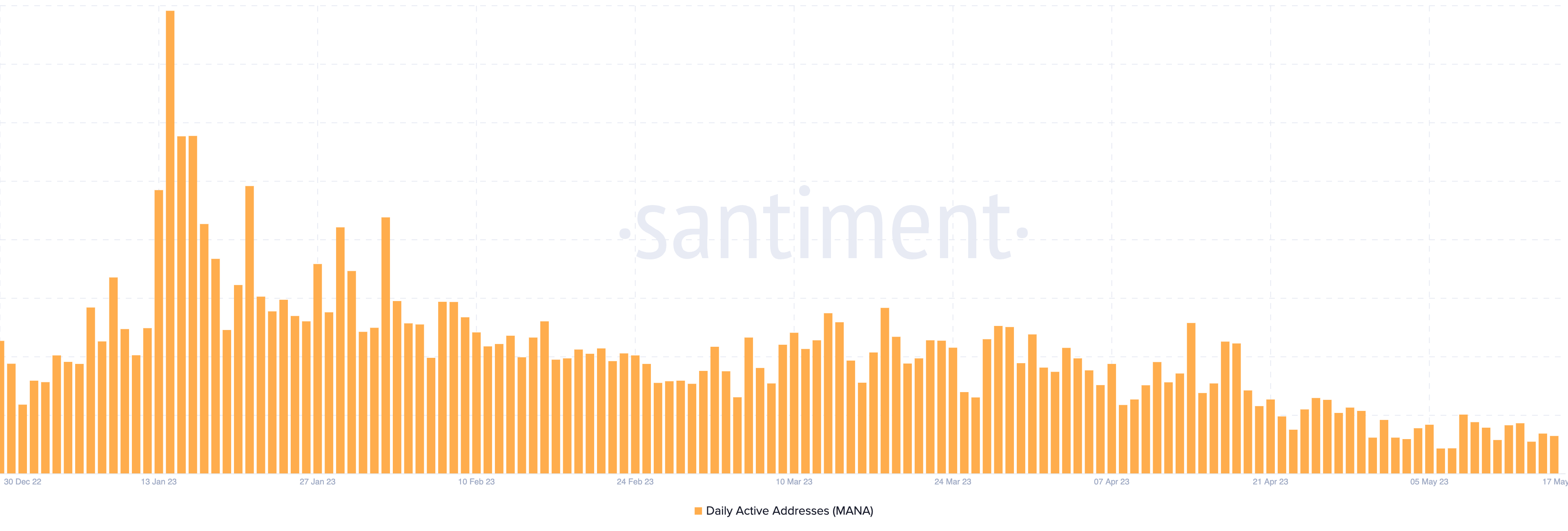

Decentraland Daily Active Address

Source: Santiment

The daily active address is the number of addresses that have interacted with the platform to perform a trade. All the addresses are considered, regardless of whether they are buy, sell, or swap addresses. The rise in the daily active address levels indicates an increase in demand for the token, which may further impact the volatility and value of the token in the long term.

Unfortunately, the active address count has plunged significantly since the start of the month, indicating a drop in user activity. This may reduce the volatility of the token, which may also impact its value. However, the MANA price is maintaining a steady upswing, which indicates a rise in whale activity.

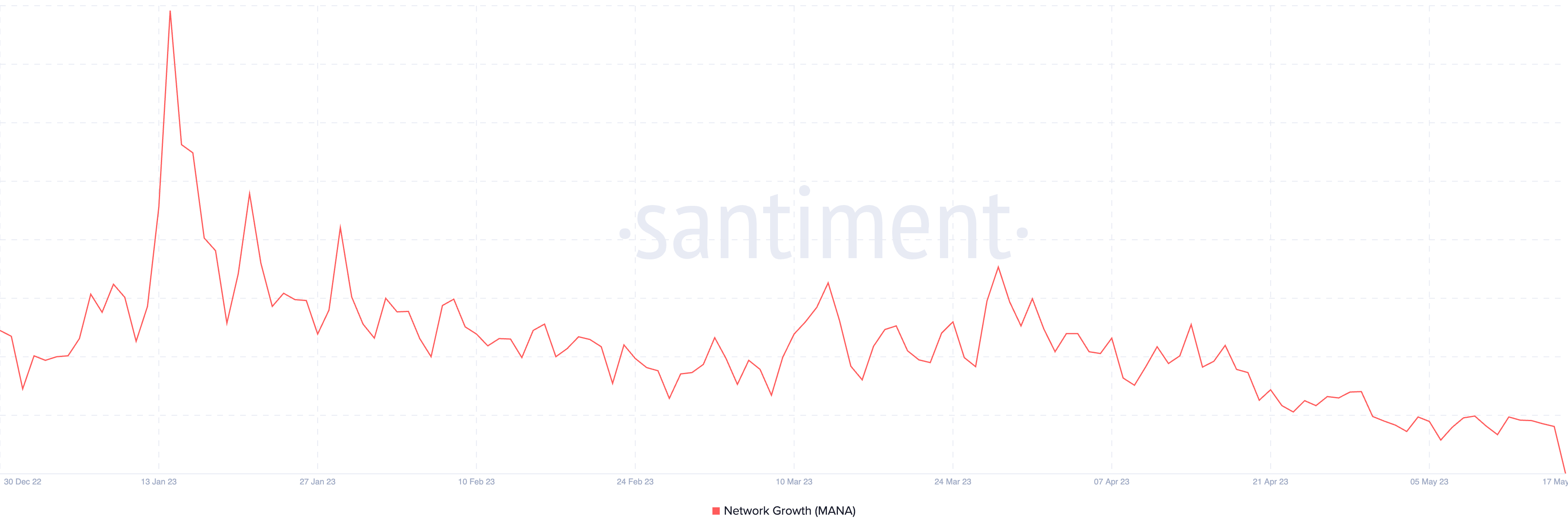

Decentraland Network Growth

Source: Santiment

Network growth is pretty similar to the daily active address count but differs slightly in the type of address. Here, only those addresses are considered that have performed their first trade, or, in simple words, network growth determines the number of new addresses created and traded in a single day.

The metrics gauge the user’s attention over the crypto, which helps to determine the adoption rate that indicates the overall health of the project. Unfortunately, the levels have been dropping ever since they marked their yearly highs in the first few days of 2023. Therefore, it denotes a drop in the formation of new addresses and a drop in the adoption rate.

Read more: Top Metaverse Crypto Projects

Concluding Thought

Decentraland (MANA) prices have witnessed a steep rise in the past few days, but the on-chain fundamentals indicate the bears have maintained their dominance over the crypto. The drop in network growth and the active address indicate drowning user activity. However, the rise in development activity may inspire some confidence in crypto in the long term.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more