Table of Contents

ToggleKey Takeaways:

- Arbitrum price surged to mark new monthly highs beyond $1.8, gaining more than 50% in a week

- Besides the prevailing bearish market conditions, the bulls appear to be poised to maintain a healthy upswing to reclaim the lost positions

- The dropped user activity may raise some concern while the increased developer activity may flash the possibility of a larger price action soon

Arbitrum’s price dropped heavily soon after its launch and plunged from a double-digit figure to as low as $1.1 in no time. However, the price began with a significant recovery during the past week and jumped high to reach levels close to $2. Unfortunately, before reaching these levels, the price began to correct and is trying hard to sustain above the interim support.

Meanwhile, what triggered the massive rally? Will the Bulls manage to reclaim the lost positions?

In a recent update, the popular liquid staking protocol, Lido DAO, is considering accepting ARB tokens and offering rewards to liquidity providers in the form of wrapped staked ether pools. The Lido community has rolled out a new proposal, according to which the claimed ARB tokens during the Arbitrum airdrop will be used as emission rewards. This will be done to provide an incentive for using wrapped-staked ETH (wstETH) across the Arbitrum ecosystem.

Read more: ARB Accounts Surpass 5 Million!

Arbitrum (ARB) Technical Overview

Source: Tradingview

- The ARB price maintained a stagnant trend until it kicked off a massive upswing to mark highs above $1.7.

- Despite the rejection, the token continues to manifest its strength and hence hovers just above the lower trend line and below the crucial 200-day MA levels

- If the bulls lift the price above the 200-day MA levels, it may have a chance to offer a strong base to rebound

- In such a case, the price is then believed to trigger a recovery rally to reclaim the highs and also form new monthly highs above $2

Arbitrum (ARB) On-Chain Overview

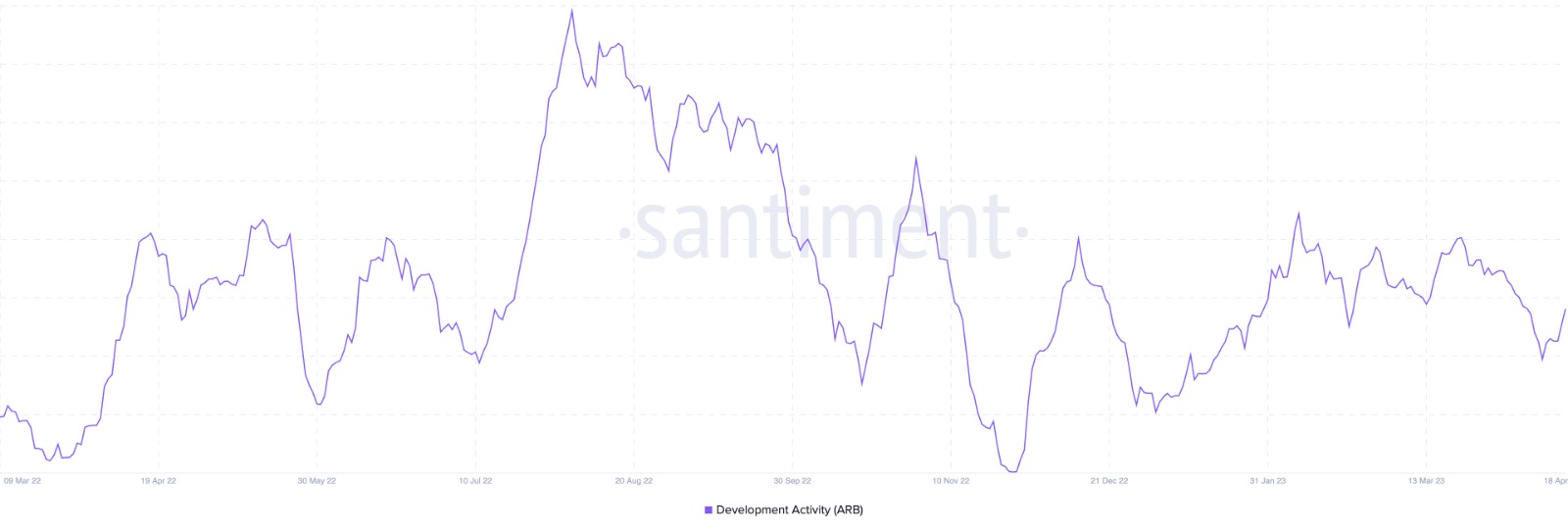

Arbitrum Development Activity

Source: Santiment

The development activity of a project is recorded on the GitHub repositories, which are generally public and accessible to all. The rising levels indicate that the platform is very serious about its business potential, and the development team is working hard to deliver new features and upgrades to build a strong, workable product.

The development activity had dropped heavily in the recent past and is now experiencing a slight recovery. The levels are constantly on the rise, along with the developments, so new features may be shipped soon. This induces confidence among the market participants, who may hold the token for a long time without liquidating.

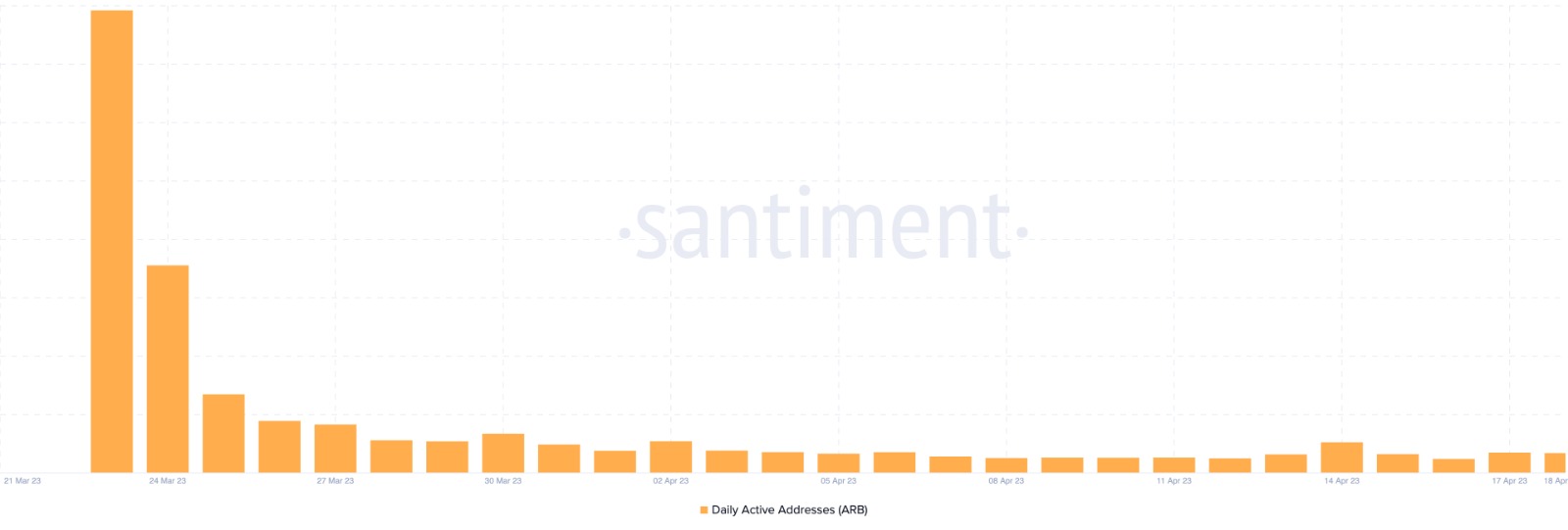

Arbitrum Daily Active Address

Source: Santiment

The daily active address is nothing but the number of addresses that interacted with the platform to carry out a trade. All the addresses are considered regardless of whether it is a buy, a sell, or a swap address. The increasing levels of the metrics indicate rising demand for the token, which helps to keep up the volatility that may further impact the price.

Unfortunately, the DAA of ARB has dropped heavily and is presently hovering along the lower regions. The drop in user activity over the platform is not a good sign of a healthy rally, hence it may impact the price adversely. Therefore, a significant plunge may be expected, which may further attract buyers to the platform and further increase the DAA levels.

Additional Read: Lido DAO Price Prediction

Concluding Thought

Arbitrum is one of the most discussed tokens within the crypto space. The price may have dropped heavily but displays its potential to revoke a fine upswing very soon. Although the user activity has slashed, the developer’s activity has spiked to some extent which may induce significant bullish momentum within the crypto. Once the market sentiments turn bullish, the ARB price is believed to surge beyond the barriers and mark interim highs beyond $2.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more