Table of Contents

ToggleKey Takeaways:

- Record-Breaking Streak: US spot Bitcoin ETFs have achieved an unprecedented 18-day streak of consecutive net inflows.

- Massive Inflows: The 11 spot Bitcoin ETFs recorded a net inflow of $217.78 million on Thursday alone.

- BlackRock Dominance: BlackRock’s IBIT, the largest spot Bitcoin ETF by net assets, attracted the majority of the inflows, bringing in $350 million on Thursday.

- Mixed Performance: While BlackRock, Fidelity, and VanEck saw significant net inflows, Ark Invest’s ARKB and Grayscale’s converted GBTC experienced notable net outflows.

- Steady Recovery: Since their inception in January, the 11 spot Bitcoin ETFs have accumulated a total net inflow of $15.56 billion, showing a strong recovery from a stagnant period in April and May.

Sustained Positive Flows

The US spot Bitcoin exchange-traded funds (ETFs) have achieved a historic milestone, marking 18 consecutive days of net inflows. This streak, the longest since their inception, highlights the growing investor confidence in these financial products.

As of Thursday, the 11 US spot Bitcoin ETFs recorded a daily net inflow of $217.78 million. This continuous influx of capital underscores a sustained interest in Bitcoin as a viable investment option, particularly through these ETFs. The steady inflow streak has brought the total net inflows since the launch of these ETFs to a remarkable $15.56 billion.

Dominance of BlackRock’s IBIT

BlackRock’s IBIT, the largest spot Bitcoin ETF by net assets, is leading the charge in this inflow streak. On Thursday alone, IBIT attracted $350 million in net inflows. This significant contribution reflects investor confidence in BlackRock’s management and the robustness of its ETF offering. Fidelity’s and VanEck’s Bitcoin ETFs also experienced net inflows, albeit on a smaller scale compared to BlackRock’s IBIT.

While most of the ETFs witnessed positive inflows, not all funds followed this trend. Ark Invest’s ARKB stood out with substantial net outflows of $96.6 million, one of the largest fund exits in recent times. Similarly, Grayscale’s converted GBTC reported net outflows of $37.5 million, and Bitwise’s BITB saw outflows amounting to $3 million. The remaining five spot Bitcoin ETFs, including Invesco’s BTCO, reported zero net flows on Thursday.

Learn More: Ethereum Price After ETF Approval

Market Context and Bitcoin’s Performance

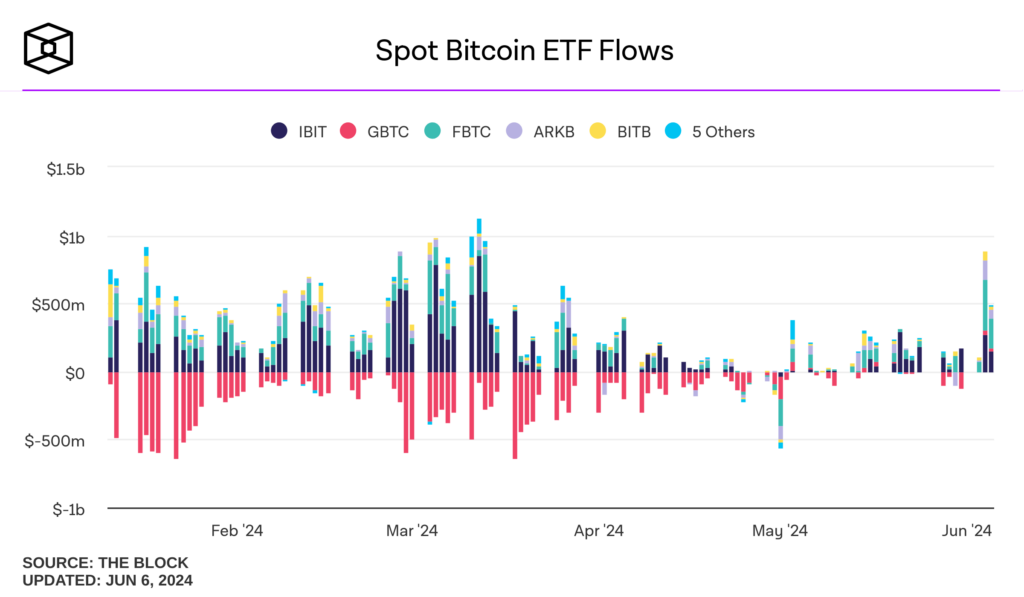

The recent inflow streak follows a period of stagnation in April and May. Despite the slowdown, the current trend indicates a resurgence in investor interest. This resurgence, however, is yet to reach the peak levels observed in March. According to data from The Block’s dashboard, while inflows have rebounded, they remain below the March peak.

At the time of publication, Bitcoin price stands above the $71,000 mark, reflecting a 0.24% increase over the past 24 hours. This price stability and slight growth further bolster the attractiveness of Bitcoin ETFs as investment vehicles.

The sustained inflows into US spot Bitcoin ETFs highlight a growing acceptance and trust in these financial instruments. Investors are increasingly looking towards ETFs as a convenient and regulated means of gaining exposure to Bitcoin. This trend could signal a broader acceptance of Bitcoin in mainstream finance and potentially lead to further innovations in crypto investment products.

Read On: Bitcoin Price Prediction

Conclusion

The record-breaking 18-day streak of net inflows for US spot Bitcoin ETFs signifies a strong vote of confidence from investors. With a total of $15.56 billion in net inflows since their inception, these ETFs are becoming a significant part of the investment landscape. As Bitcoin continues to hold its value above $71,000, the future looks promising for both the crypto and the ETFs that facilitate its trading. The divergence in fund performance, with some ETFs experiencing outflows, also points to a dynamic and competitive market. This historic inflow streak could pave the way for more robust and diversified crypto investment options in the future.

Source: TheBlock

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more