Table of Contents

ToggleKey Takeaways

- TWAMM’s ability to break down large swap orders into smaller, gradual executions can lead to more favorable prices and reduced market disruption.

- Market participants can now access greater price stability and decreased price impact by leveraging TWAMM liquidity pools.

- Uniswap continues to lead the Automated Market Maker (AMM) space with impressive trading volume and liquidity pool fee earnings.

Uniswap recently implemented significant updates to the Time-Weighted Average Market Maker (TWAMM) mechanism, providing valuable benefits for liquidity pool participants.

The upgraded TWAMM

For those actively involved in Uniswap’s protocol, TWAMM, or Time-Weighted Average Market Maker, is a familiar concept. It functions as the on-chain equivalent of maintaining exchanges in alignment with market prices. The primary objective of this update is to reduce the adverse effects of abrupt price swings on significant trades.

Eliminating Surprise Spread

These crucial improvements to the TWAMM protocol are set to help in mitigating the impact of sudden price fluctuations on large trades. Market participants can now achieve price stability by dividing large single swaps into smaller fragments. Although TWAMM has been operational since 2021, its role was initially limited to assisting traders in placing long-term orders over a fixed number of blocks.

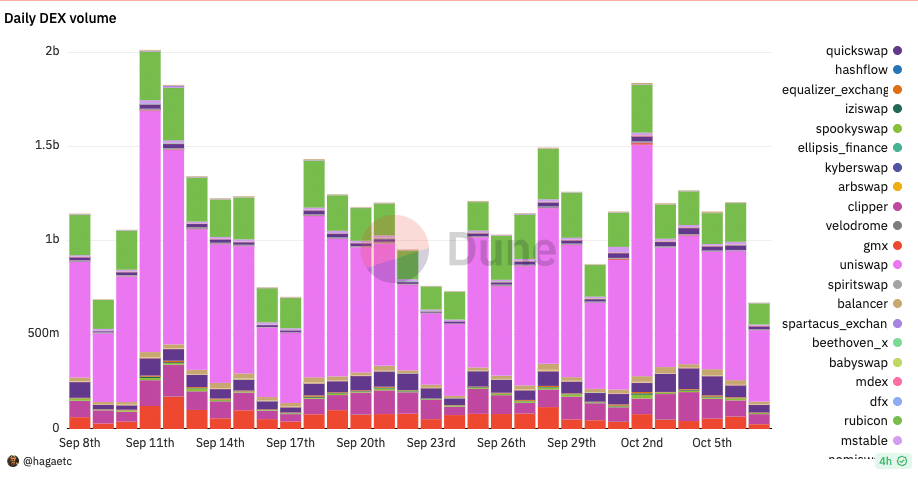

According to Dune Analytics, Uniswap’s trading volume over the last seven days reached an impressive $2.83 billion. This volume translated into $3.53 million in total liquidity pool fees, giving Uniswap a commanding 58% share of the overall DEX market, with PancakeSwap trailing behind.

Source: AMBCrypto I Dune Analytics

With the latest update, Uniswap has altered the order submission process. Nevertheless, Uniswap remains the leader in the AMM segment, boasting the highest decentralized exchange (DEX) trading volume.

The introduction of these updates may enable Uniswap to recover from its recent volume decline. Consequently, there is a potential for Uniswap’s trading volume to once again surpass certain Centralized Exchanges (CEXes), as it did in May.

Read More: Uniswap Price Prediction

Market Sentiment and Outlook

The broader market sentiment appears bullish on Uniswap’s future prospects, as indicated by a notable increase in the weighted sentiment metric, which reached 0.345. This metric evaluates the positive and negative commentary related to a project through social platforms’ conversations.

With this surge in the positive sentiment metric, Uniswap and its native token, UNI, may maintain their relevance in the market for an extended period.

Source: AMBCrypto

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more