Table of Contents

ToggleKey takeaways

- Uniswap begins gaining a lot of traction post the FTX collapse.

- Uniswap’s network growth sees a 1500% jump to its new all-time-high in the past two days.

- Uniswap’s daily active addresses metric also jumps 600% from the overall yearly average too.

Ever since the collapse of the FTX exchange, there has been an increased call in the crypto community to shift to more decentralized services than rely and trust on centralized ones. The memory of the FTX collapse will be hard to forget and it is very much understandable. While that is true, there is a need to understand that there is a wonderful opportunity that is brewing up within the decentralized ecosystem – especially in the decentralized, self-custodial wallets and more importantly – decentralized exchanges.

Uniswap is one of the largest decentralized exchanges there is and rightfully so. It has now become a behemoth offering end to end services ranging from swaps, trading, and a multitude of others. There is a substantial increase in the on-chain user activity on the platform.

This rise has been broadly highlighted in a detailed research report by Bernstein Research, as reported by CoinDesk. According to the report, crypto user activity is moving on-chain following the collapse of crypto exchange FTX and its affiliated trading arm, Alameda Research, last month as self-custody is becoming the talk of the town again.

.@BernsteinBuzz says the wider move to transparent on-chain markets from off-chain markets following the collapse of @FTX_Official is a positive step in crypto's journey to rebuilding customers' and policymakers' trust. @BernsteinGautam. By @willcanny99https://t.co/hY3oW94ko5

— CoinDesk (@CoinDesk) December 1, 2022

According to the writers of the report – analysts Gautam Chhugani and Manas Agrawal mentioned,

‘On-chain data shows higher momentum on user acquisition, and activation post-FTX. In the past 60 days, both revenue and the number of transactions have grown.’

With all that in mind, let’s take a look at some of the most optimistic on-chain metrics that seem to align with the observations made above!

Read more: Uniswap Price Prediction

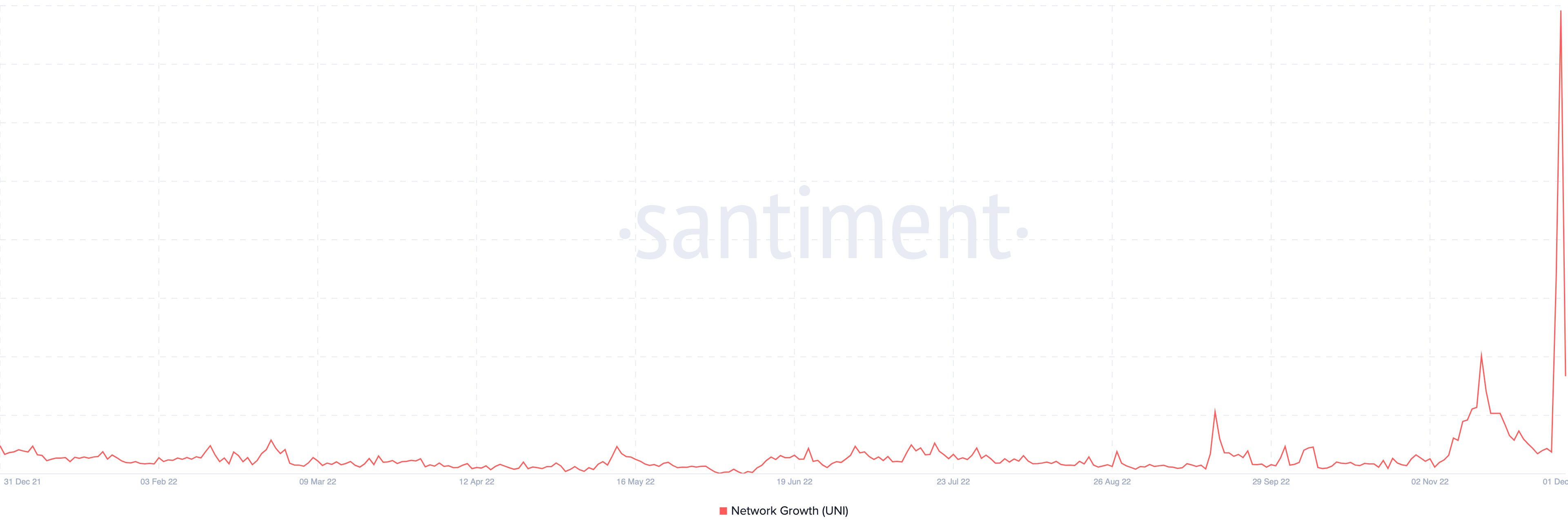

UNISWAP NETWORK GROWTH SEES A MAJOR SPIKE!

Uniswap’s network growth in the last two days has seen a very major jump – a near 1500% spike in the matter of a day between 1st and 2nd December. Also, the network growth showed a spike in the early days of November too, right on the tails of the FTX collapse – between 3rd and 13th November – UNI’s network growth also recorded a near 1000% growth too.

To understand how significant this jump is, let’s understand what this metric indicates. Network growth essentially depicts the amount of new addresses that transferred a given coin or token for the very first time. Very simply, this chart illustrates user adoption over a period of time and is used to identify when the project is gaining (or losing) traction.

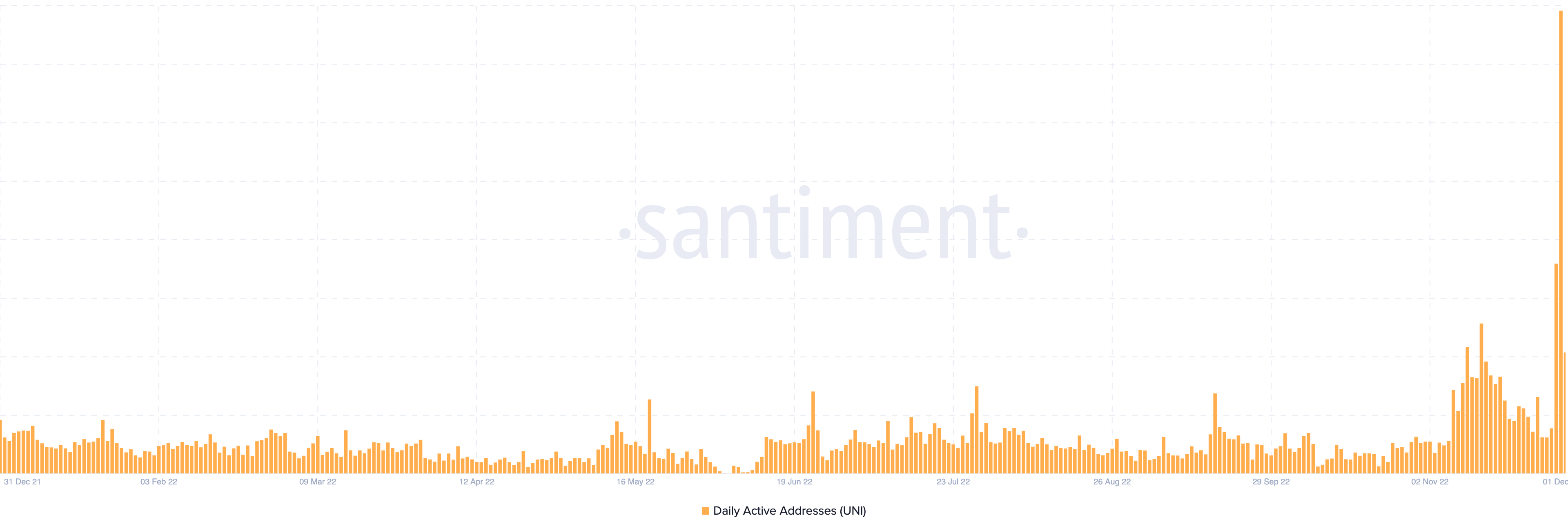

UNISWAP’S DAILY ACTIVE ADDRESSES JUMPS SIGNIFICANTLY

Another metric that ties in with the metric above is the daily active addresses. Daily active addresses metric basically counts the distinct number of addresses on the chain that participated in a transfer for the given asset in any particular day. According to Santiment, each address is counted only once for the day and both senders and the receivers of the asset are counted in the metric.

Thus, this very much ties in well with the daily active addresses on the chart we can see above. Daily active addresses on Uniswap averaged around 1000-1500 for most of the year of 2022, but ever since the beginning of November, right on the tails of the FTX collapse, jumped up to 2500-3000 and in the past two days, jumped all the way till 8500! Thus, we can see a lot of traction coming into Uniswap.

Read more: Top Conversations on Crypto Twitter

CONCLUSION

Thus, from the two metrics above we can clearly see how the metrics tie in well with the report by Bernstein as reported by CoinDesk. With over 1500% jump in the network growth and a 600% spike in the daily active addresses indicates how strongly people are moving from centralized options to decentralized exchanges very quickly. This is growing as we hear more and more crypto firms are succumbing to market pressures due to an overexposed position to the FTX crypto exchange.

Values as on 2 December, 2022.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more