Table of Contents

TogglePositive news around Uniswap

2021 was a very good year for the decentralised exchange project Uniswap. It had rallied nearly 1400% in the matter of a few months, going from around $3 to almost $49 by May 2021 before beginning its slide downwards. 2022 however, hasn’t been that kind to this particular altcoin. Uniswap’s native crypto token, UNI has lost over 66% since the beginning of the year, going from $17 to around $6 as of writing. That is a major erosion of market value and recovering it would take a seriously good piece of news and a lot of bullish momentum in the overall market, neither of which is there as of now.

However, in the last couple of months, despite the overarching bearishness in the crypto market, UNI price has been making some headway on the charts. This can be due to a couple of positive developments coming its way. One of the biggest positives for Uniswap was reported by Whalestats – as it featured on the list of top holdings by Ethereum whales.

🐳 The top 5000 #ETH whales are hodling

$137,542,559 $SHIB

$75,008,082 $BIT

$68,817,920 $MKR

$62,272,276 $UNI

$50,300,341 $LINK

$43,251,468 $LOCUS

$39,600,752 $MANA

$38,303,900 $MOCWhale leaderboard 👇https://t.co/kOhHps9vr9 pic.twitter.com/H8EOANmh6f

— WhaleStats (tracking crypto whales) (@WhaleStats) October 9, 2022

Along with that, according to recent data collected by CryptoDep,Uniswap’s DAO or the decentralised autonomous organisation has the most social activity going for it, indicating that there is a lot of chatter around it in the crypto market.

⚡️TOP #DAO Projects by Social Activity

9 October 2022#Uniswap $UNI $RARE $RARI $MKR $BOND $STRAX $SUSHI $CRV $SNX $COMP pic.twitter.com/44QD2ubRWV— 🇺🇦 CryptoDep #StandWithUkraine 🇺🇦 (@Crypto_Dep) October 9, 2022

Uniswap: A technical overview

From a technical point of view, the last couple of months for Uniswap price has been moderately on the upside. UNI price managed to rally almost 160% from its lows towards the end of May 2022 all the way till August end. It has since then corrected a little bit but it has managed to sustain over its trendline support level (marked in black). Along with that, UNI is currently in a symmetrical triangle pattern on the charts (marked in yellow trendlines). This is a neutral pattern as of now, and a breach in either direction would decide what happens with the crypto. A breakout of the upper line could result in a strong rally, led by a bullish golden crossover of the 50 and 200 day moving averages while at the same time a breakdown would result in a near 50% crash down to $3 levels. Thus the next couple of weeks will be very crucial for this crypto token.

Additional read: Uniswap Price Prediction

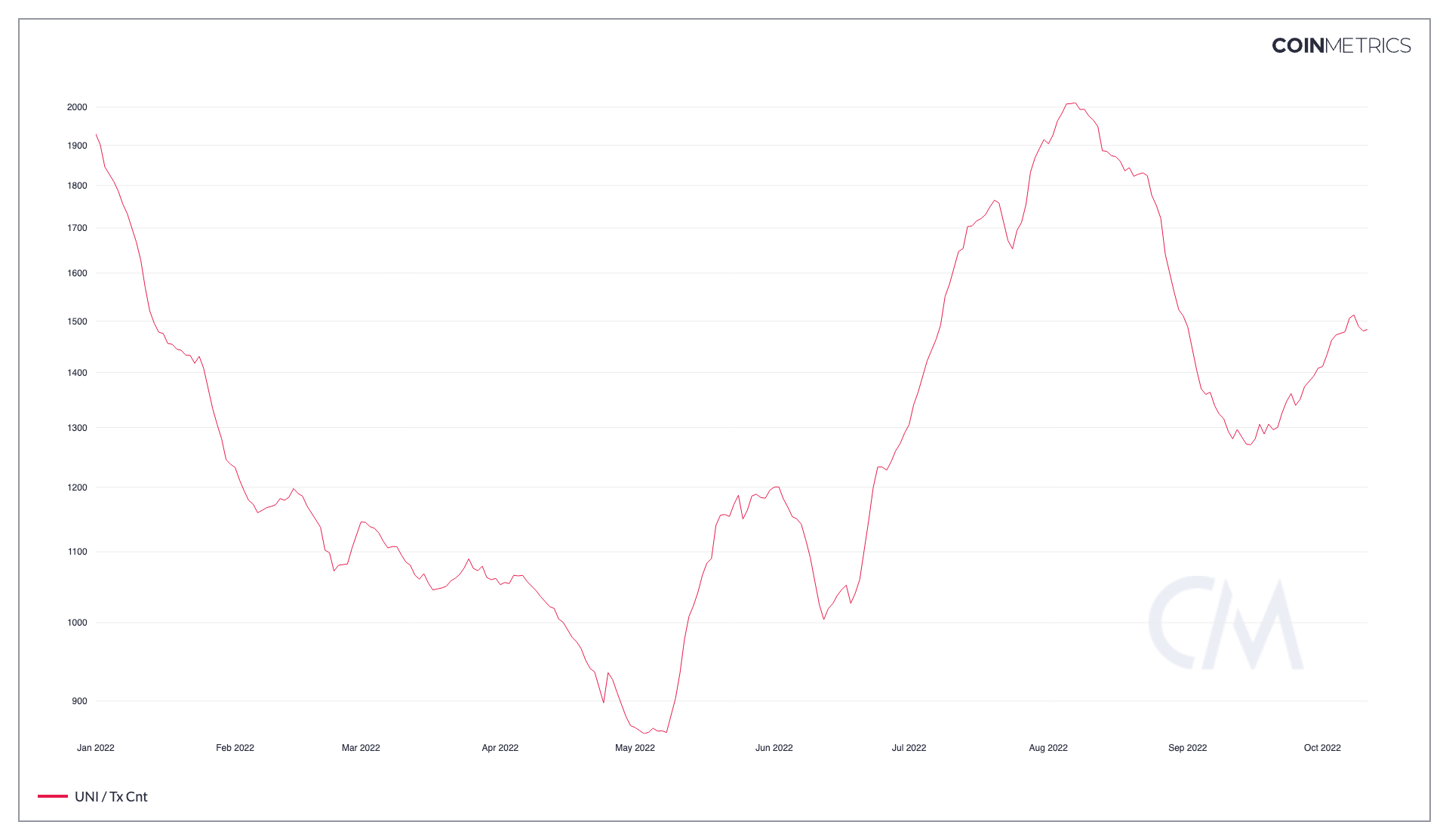

Uniswap’s Transaction Count sees a spike!

Along with the moderately positive Uniswap price action on the charts, on the on-chain metrics front, we can see a spike in the transactions count on the blockchain for Uniswap too. Transactions count, as the name suggests, measures the number of transactions that are happening on the chain. Thus, this is an optimistic sign for any crypto’s blockchain network in general because a higher transaction count directly means that there is more activity happening on the chain, which indicates higher adoption amongst folks.

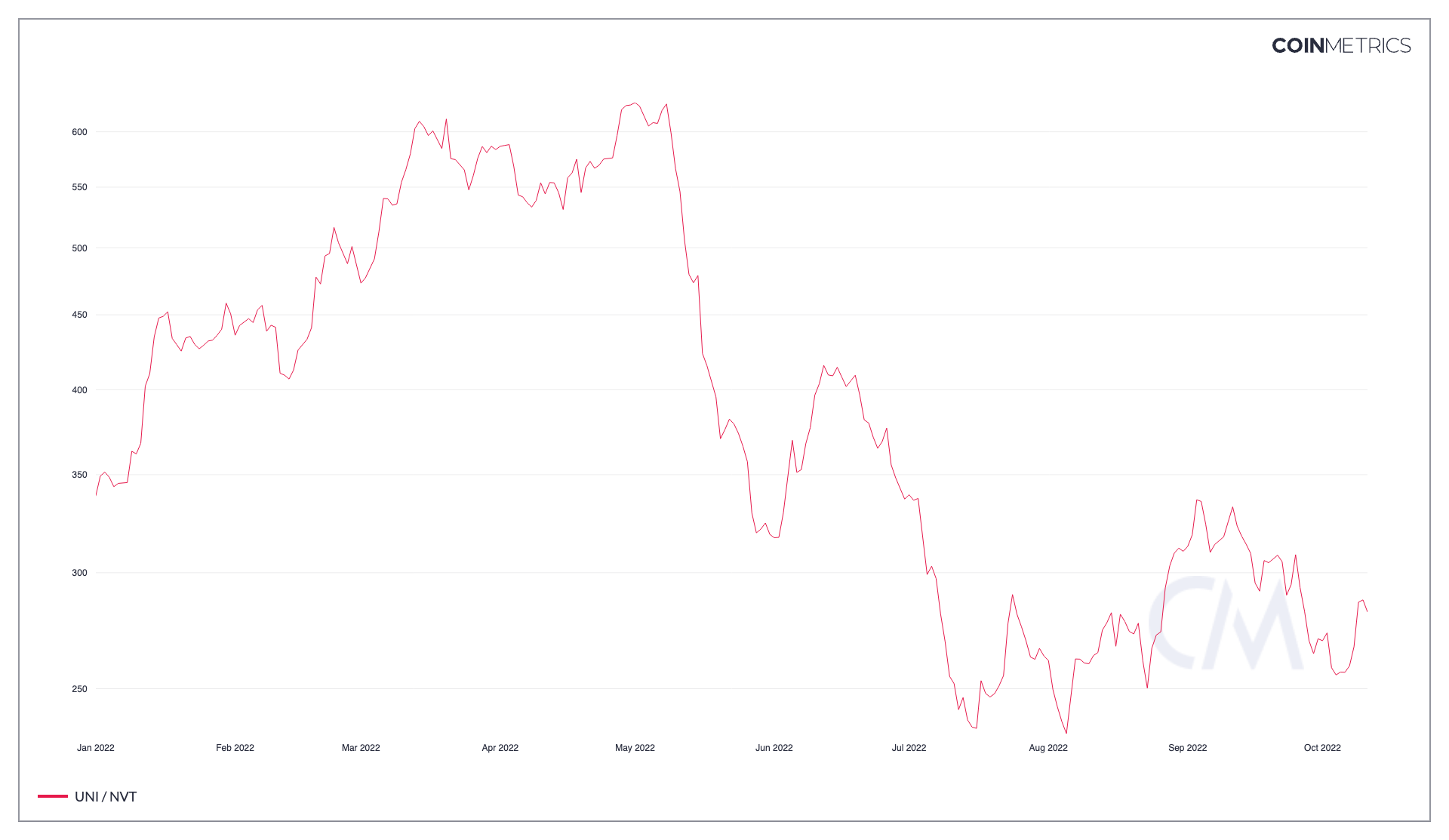

Uniswap’s NVT Ratio indicates attractive valuations too!

Transposing both the Uniswap price chart and its NVT Ratio chart, we can see in the YTD timeframe, UNI’s NVT ratio reached its highest point in the beginning of May 2022, when prices had reached rock bottom thanks to the Terra LUNA implosion. Now however, the picture is vastly different. UNI price has recovered significantly since the lows of May, however, the NVT ratio has remained within a reasonable range and not unsustainably high.

To understand its significance, let us first quickly understand NVT Ratio. Drawing parallel to the popular stock market metric – price to earnings ratio (PE Ratio), Network Value to Transaction ratio is simple a ratio that described a relationship between market capitalisation of the crypto and its network volumes. Or in other words, market cap divided by network transaction volume.

So in our current scenario, despite a rise in the market cap of Uniswap’s native crypto token UNI – we have a NVT ratio that is not very high. While this means that investors aren’t valuing UNI at too high a premium, which is but natural in a bear market. However, on the flip side, it also indicates that network transaction volumes are increasing with increasing market cap of UNI – which is a very positive sign.

Conclusion

To conclude, things seem to be reasonably positive for the largest decentralised crypto exchange by market cap, Uniswap. Technical structures hint at moderately bullish sentiments, and are awaiting simply a good breakout to trigger a rally. On the fundamental side, multiple on-chain metrics point to optimism building up under the ground, just waiting for a good trigger. However, investors must take note that these are subject to change at a moment’s notice and the abovementioned analysis is simply based on current live data only. One must do thorough research before putting money into volatile cryptos such as UNI.

Prices as on 12 October, 2022.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more