Table of Contents

ToggleKey Takeaways:

- The Compound price soared high in the past few days accumulating gains of over 50% and marking new highs beyond $50

- The fresh surge has induced immense bullish momentum due to which the price could remain inflated for the rest of the year and reach a 3-digit figure soon

- The Social volume and sentiments have turned extremely positive due to which the price is believed to remain elevated for an extended period

The compound price displayed a magnificent bull run in 2021 and surged beyond $900 from levels below $100. Ever since then, the COMP price remained largely bearish and formed constant lower highs and lower lows to mark the bottoms close to $30. This is when the COMP price ignited a firm upswing which coincided with the beginning of the year 2023. After maintaining a minor upswing for the first few days of the year, the COMP price surged by 50% during the past weekend, manifesting a resurgence of the bullish trend.

While the reason behind the surge is clearly unknown but referring to their official Twitter account of Compound Labs, indicates an ongoing voting process. The voting process is for Proposal 143 which seeks to upgrade the Uniswap V2 data to Uniswap V3 for an effective price implementation feed of Compound V2. However, the price spike is also influenced by the bullish market sentiments as Bitcoin price soared above $21,000.

Read More: Top DeFi Tokens In 2023

Compound Token Technical Overview

Source: Tradingview

- The COMP price remained largely consolidated within very narrow regions until the bulls jumped in to uplift the price beyond the bearish influence

- The Bollinger band after experiencing an extreme squeeze triggered a massive upswing and yet again began to squeeze indicating the resumption of consolidation

- Besides, the Average Directional Index(ADX) and Average True Range (ATR) both have bottomed signifying a drop in the strength of the rally and being less volatile. However, both are attempting a bullish divergence

- In the first attempt, the COMP price faced a minor rejection that may drag the price close to the middle bands at 20-SMA.

- However, this plunge may trigger a massive bullish action that may lay down a notable upswing to reach $60 in the next few days

Compound Token On-Chain Overview

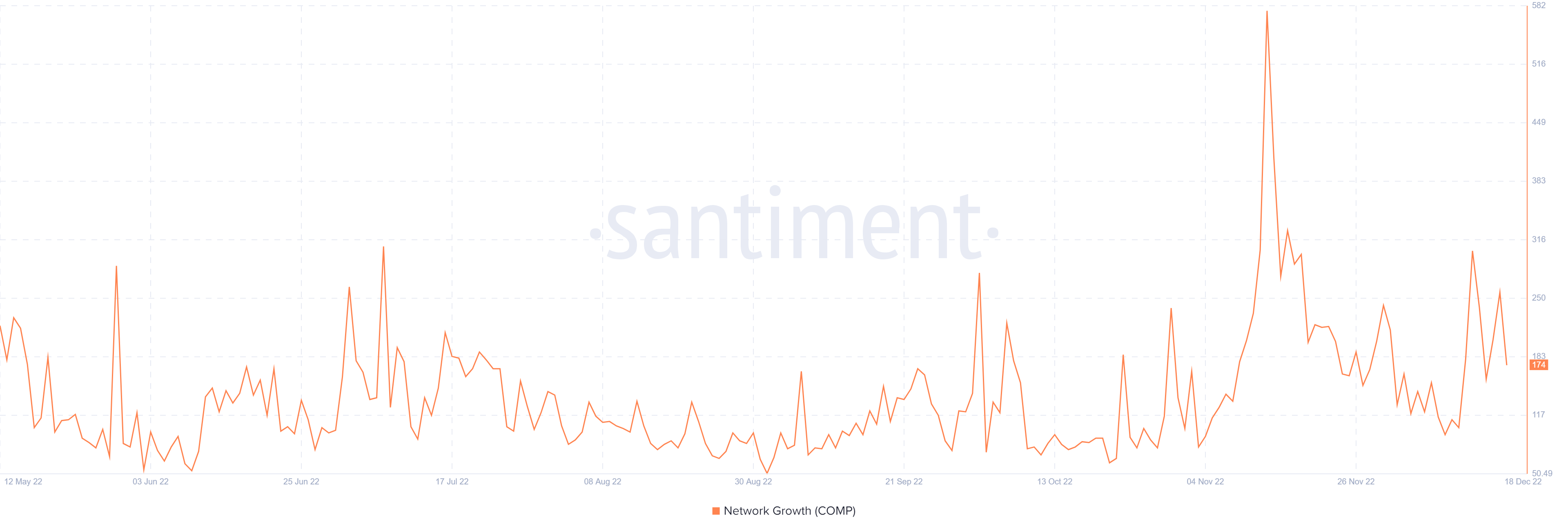

Network Growth

Source: Santiment

The network growth illustrates the user adoption over time, which is usually considered to indicate whether the project is gaining or losing traction. It is a number of new addresses that performed a transaction for the very first time. A rise in the levels indicates a deep involvement of the new traders, who are constantly interacting with the platform.

The levels represented yearly highs at a time when markets were under extreme bearish pressure due to the collapse of the FTX exchange. It represents the fear of the newbies who succumbed to the FUD and sold the tokens in a panic. Besides, the levels are trying to rise, which may get a strong base hereafter as the market sentiments have largely flipped.

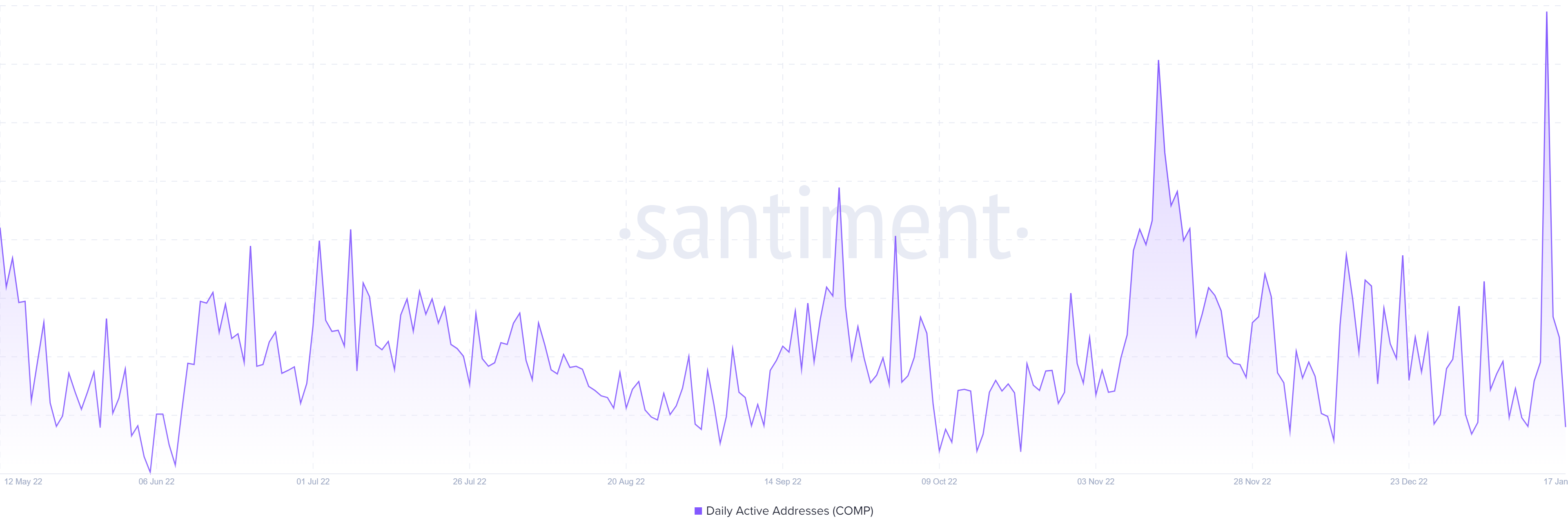

Daily Active Addresses

Source: Santiment

The Daily Active Address (DAA) is a measure of the number of addresses, wallets, or traders interacting with the platform in the last 24 hours. The traders may either perform a buy or sell trade or just swap the tokens, it is considered an active address. A spike in the DAA indicates rising sentiments toward the token, keeping the network active.

In the case of Compound, the DAA experienced a couple of spikes only in the case of any events but remained largely consolidated below 300. The levels spiked during the times when FTX collapsed and during the past weekend when BTC prices surged beyond $21,000. Presently, the levels continue to range at higher levels, signifying intensified user interaction prevailing within the space.

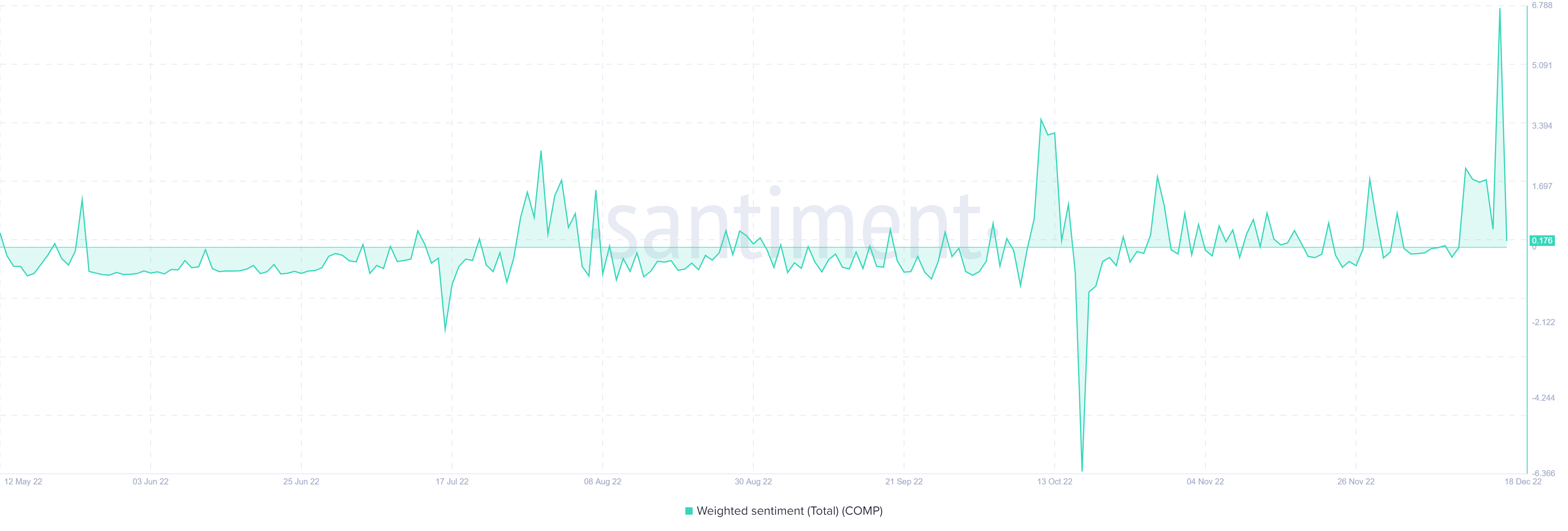

Weighted Sentiments

Source: Santiment

The total weighted sentiments denote the market sentiments for the crypto. Usually, the sentiments are either positive or negative, but the total weighted sentiments combine both and compare with the frequency over time. The levels rise when the social volume is really high and a majority of the mentions and messages are in favor of the token, and they dip in the case of intensified negative mentions.

The total weighted sentiments in the case of the Compound have surged and are hovering within the positive ranges. This indicates an increase in positive messages and mentions as the social volume has increased significantly. This could have a long-term positive impact on the price of COMP.

Additional Read: Bitcoin Price Prediction

Concluding Thought!

The Compound price has been displaying immense strength nowadays, due to which the price is displaying the possibility of achieving a 3-digit figure very soon. However, with the price rise, the sentiment and the social volume have also turned extremely positive. Therefore, the ongoing bullish momentum is expected to sustain for a longer time until the price reaches the required resistance levels.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more