Table of Contents

ToggleThe FTX meltdown has brought the decentralized exchanges into limelight. Popular dex Uniswap recorded a high number of user traffic for Ethereum (ETH) trading. The exchange now ranks second for Ethereum trades with Binance in the first spot.

Hayden Adams, the founder of Uniswap posted Nansen’s CEO – Alex Svanevik tweet on Uniswap became the second largest exchange for Ethereum trades.

DEX starting to replace CEX?

Total ETH/USD (or stables) volume:

Binance: ~$1.9b

Uniswap: ~$1.1b

Coinbase: ~$0.6b https://t.co/FQR2PcIQzX— hayden.eth 🦄 (@haydenzadams) November 14, 2022

DEXs allow investors to trade in crypto assets while retaining full control over their funds. These trades are automated with smart contracts – a solution that self-executes the rules laid by the parties.

Uniswap registered Ethereum trades amounting to $ 1 billion in the last 24 hours which is double of what Coinbase has clocked in the recent times. Coinbase is the second largest centralized exchange by world trading market cap.

Coinbase has reported $564,937,971 worth of Ethereum trades, while Uniswap recorded $966.17 million ETH trades in the last 24 hours. Binance, the top exchange is leading the race with $1.7 billion across all Ethereum trading pairs.

Read more: Ethereum Shanghai Upgrade

DEXs witness more traction post the FTX collapse

DEXs’ have taken the center stage not just for Ethereum trades but for overall crypto trading. According to Dune Analytics, DEXs have recorded a trade of $ 31 billion in the last week. Out of this the total trade volume recorded by Uniswap was $20.3 billion.

The DEX spike was recorded last Tuesday. Decentralized exchanges alone doubled since the FTX fall. This includes Curve Finance jumping from $ 700 million to $ 1.3 billion overnight. Uniswap’s trades have tripled in this period.

Uniswap’s wallet activity has also spiked over the last few days. The DEX also recorded new unique 55,550 wallets.

According to a leading analyst WuBlockchain, Uniswap V2 and V3 burned more than 2300 Ethereum. The analyst also added that the traders have flocked to DEXs’ as many have lost trust in centralized exchanges.

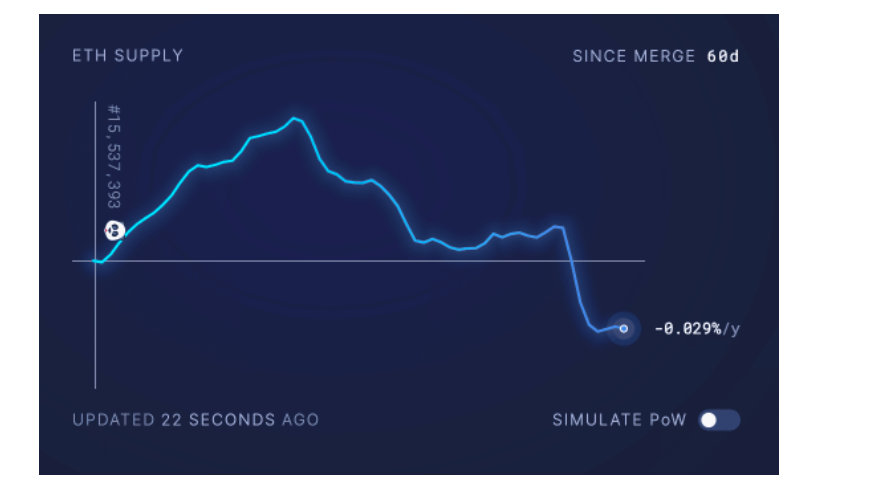

The increased burning of ETH tokens post the FTX feud has made the token to become deflationary for the first time. At the time of writing ETH’s issuance rate or At press time, Ether’s net issuance or annualized inflation rate was around 0.029%, according to data from Ultrasound rate.

The Moves of DEX

There is more to the DEX’s surge in user activity. According to Dune Analytics, Uniswap V3’s MEV robotics activity has seen a surge in the last seven days. The average daily total volume of the MEV bot activity was at $1,256,263,553.

The TVL on Uniswap was $3.81 billion and it has declined by 13.4%, to $2.85 billion since the FTX crypto exchange filed for bankruptcy.

Impact on UNI after FTX’s collapse

The FTX meltdown was another major blow to the crypto market. None of the crypto assets were spared from the heat. Uniswap’s native token UNI also recorded a decline of 17% according to Coinmarketcap. According to Santiment, an on-chain crypto metric tracker, Uniswap holders were at a loss at the time of the FTX fiasco. Its MVRV ratio was negative 55.67% and the investor sentiment was down by -0.53%.

Additional Read:Will crypto survive the market crash?

Source: Ambcrypto

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more