Since the overturning of the banking ban by RBI back in 2018 and following the massive adoption of the crypto asset by the Indian mass, the Indian government has made sure to mention the ongoing backend work on understanding crypto assets and the technology behind them. It is during the Union Budget session of 2022 that the government saved the dreams of millions of crypto believers and investors. It was then that the concept of a soon possible CBDC or Central Bank Digital Currency was introduced to the Indian mass.

Following the update back in February RBI has issued a concept note on CBDC, where they have mentioned that the RBI is aiming to create awareness in general while also mentioning the planned features of the e-Rupee. The concept note stated,

“While most central banks across the globe are exploring the issuance of CBDC, the key motivations for its issuance are specific to each country’s unique requirements.”

The concept note on Central Bank Digital Currency by the RBI stated that the CBDC is aimed to complement the current forms of money, rather than replace them. The CBDC is being envisioned to provide an additional payment avenue or options to the users rather than replacing the existing payment systems available.

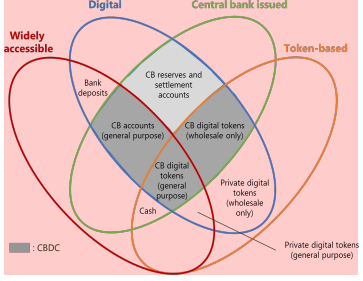

According to the RBI CBDC docs, the Central Bank Digital Currency is defined as the digital form of currency notes issued by a central bank. It is a sovereign or entirely independent currency issued by the central bank (in this case, RBI), in accordance with the country’s monetary policy. Since it is issued by the central bank, it will appear as a ‘liability’ (or debt owed) on the bank’s balance sheet.

Additional Read: What are Virtual Digital Assets?

One important thing to understand is that the CBDC is government-recognized. That means they can be freely converted into any commercial bank’s money, notes, etc. Another interesting fact about the e-rupee is the convenience it is bringing on the table for the users! CBDC is an exchangeable currency that does not require a bank account. This means that individuals can own CBDCs without opening a separate account!

Two Types of CBDCs?

Yes! There are two forms or types of CBDCs that are being worked upon. According to the CBDC concept note, these digital currencies can either be token-based or account-based. To explain it further, the token-based digital currency will be similar to banknotes, which means that any individual holding tokens at any given point would presumably be owing the digital currency. On the other hand, account-based digital currencies will be working similarly to that of owning a bank account. In other words, the RBI is expected to hold an account of all transactions and balances of all CBDC holders. The central bank would also have to maintain a record of ownership of monetary balances.

Motivations For Introducing CBDCs in India

Every country that has issued CBDCs has had its own set of motivations working towards the inclusion of the digital currency, while the concept for India remains similar to them the motivation however has been set in accordance with the nation’s interest. Some of them are as stated below:

- Reduction of the cost that is associated with the management of physical cash

- Furthering the cause of digitization in order to achieve a less cash economy

- To support competition, efficiency, and innovation in payments

- Safeguarding the trust of the common man in the national currency along with the addition of the crypto assets

Source: Economic Times

Additional Read: Guide to Crypto Tax in India

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more