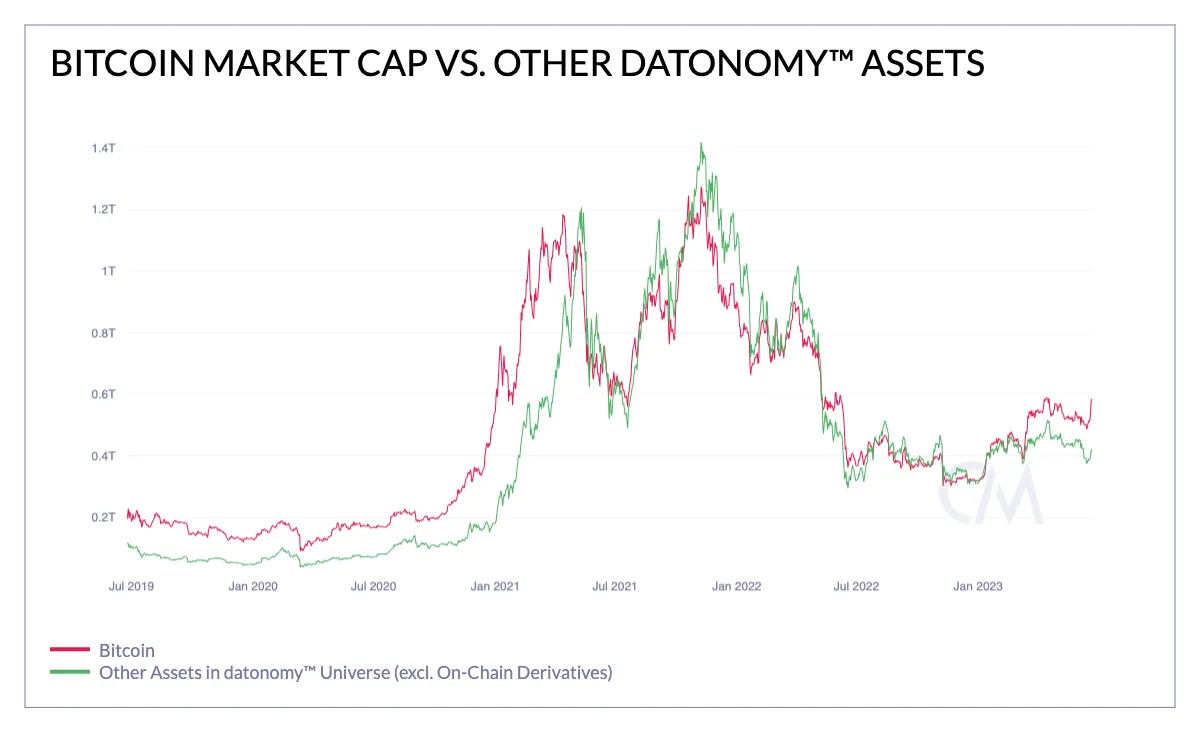

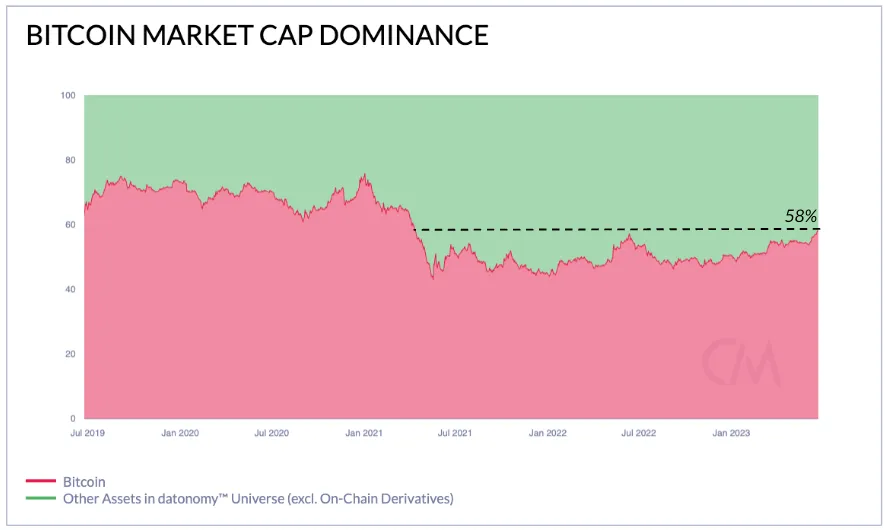

Bitcoin, the world’s leading crypto, has surged in dominance, reaching a relative percentage of 58% of the total crypto market capitalization, according to a recent report by Coin Metrics. This marks its highest level since April 2021 and underscores Bitcoin’s continued pushback against Ethereum and smaller altcoins.

Source: Coin Metrics datonomy

With an astounding market capitalization of $590 billion, Bitcoin has solidified its position as the dominant force in the crypto market, overshadowing its competitors. The overall market cap for the entire industry stands at $1.2 trillion, as reported by Coingecko.

These developments come amidst news of intensified regulatory scrutiny by U.S. regulators, who have recently labeled a few cryptos as unregulated securities. Consequently, several of these crypto have experienced substantial declines in their market capitalizations, resulting in billions of dollars being shed.

Bitcoin’s recent bullish rally has been fueled by BlackRock’s filing for a spot Bitcoin exchange-traded fund (ETF), a move that sparked increased confidence in the asset. This surge in demand has not only bolstered Bitcoin’s dominance but has also influenced investors to purchase the crypto, despite previous rejections of ETF applications.

Read more: BTC Price Prediction

Source: Coin Metrics datonomy

The positive momentum has extended to other assets, including Grayscale’s Bitcoin Trust (GBTC). The “GBTC discount,” which measures the difference between the share price and the net asset value (NAV) of the underlying Bitcoin holdings, has reached a monthly low of -30%, according to data from YCharts.

Coin Metrics, a renowned open-source data analytics platform for public blockchains, highlighted that Bitcoin’s dominance experienced a steady decline during the crypto spring of 2021, hitting its lowest point in January 2022 when it accounted for only 37% of the global crypto market cap.

The report also revealed that Bitcoin’s presence in the CBMI 10, Coin Metrics’ index for the top 10 cryptos, has reached its highest level in two years, standing at 65%. It is important to note that this metric excludes stablecoins such as Tether (USDT) or USDC.

Bitcoin has exhibited a remarkable performance year-to-date, with an 85% increase in value, currently trading at $30,395, according to Coingecko data. The crypto has outperformed most other digital assets in 2023, except for Bitcoin Cash (BCH) and Lido Finance (LDO), which have also seen notable gains.

Source: Decrypt

Read more: Bitcoin Cash Price doubles in June 2023

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more