Top Crypto News Today: Bitcoin Hash Rate Continues at an All-Time High, Here’s Why

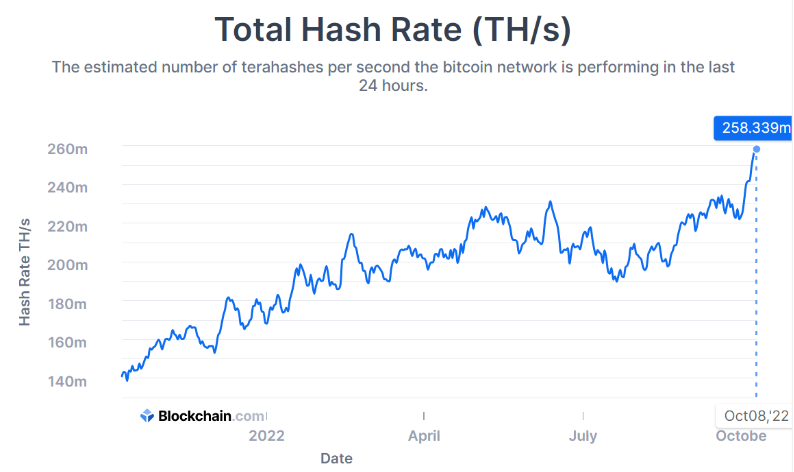

Bitcoin’s hash rate has surged by a whopping 10.8%! This recorded a new all-time high for Bitcoin’s hash rate on a daily basis. While this increase in the hash rate confirms greater security for the Bitcoin network, there are a lot of other factors that contribute to the metric.

Table of Contents

ToggleEver since the inception of the crypto assets and the numerous altcoin projects over the years, a lot of different sentiments from investors have been regarding the “death of bitcoin,” However, the digital asset has continued to prove its doubters wrong. In recent times, BTC has seen a significant rebound in its hash rate which suggests that more miners have been coming back online. The continued increase in Bitcoin’s hash rate also carries with it the implications for the increase in the number of miners showing more interest in the network. Along with the increase in hash rate, this is also a big cause for the on-chain metrics to light up green.

Back in June of 2022, the hash rate of Bitcoin had previously reached its all-time high. However, the increase in the hash rate soon plummeted following the heat wave in the US that caused the miners to shut off their rigs in a bid in order to preserve energy. Following the event, the miners are now coming back online as temperatures have stabilized. This is a major cause that has led to a surge in the hash rate over time. Apart from that, Bitcoin miners have also continued to take advantage of the falling GPU prices in order to upgrade their mining equipment. This is a step towards their aim to remain competitive in the fierce competition.

All through October 2022, Bitcoin’s hash rate has surged by a whopping 10.8%! This recorded a new all-time high for Bitcoin’s hash rate on a daily basis. While this increase in the hash rate confirms greater security for the Bitcoin network, there are a lot of other factors that contribute to the metric.

Additional Read: Bitcoin Price Prediction

Source: Blockchain.com

Top Reasons Affecting the Bitcoin Hash Rate

Decrease in The Minning Rig Prices

The hash rate of BTC is related to the computing power that is required by Bitcoin miners in order to mine a block. This is the sole reason why a higher hash rate ends up demanding a stronger mining rig so that it could help miners mine a block and earn mining rewards.

Following the global markets recovering from chip shortages in 2022, the prices of the graphics processing units, commonly referred to as GPU; which is a key component of mining rigs; came down to a reasonable value. The decrease in GPU prices also aided the miners in initially helping offset their operational costs amid an ongoing bear market in crypto.

Source: Techspot

Crypto-Friendly Jurisdiction Amid China Ban

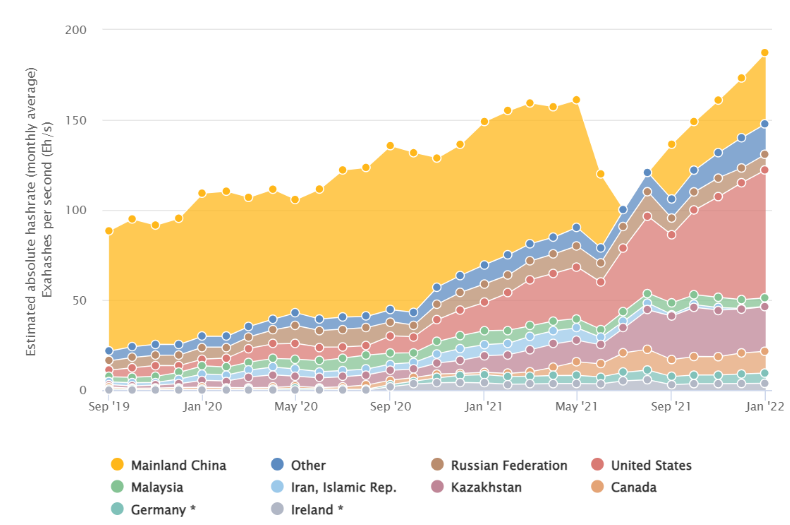

Soon after China put a blanket ban on crypto mining, many other countries decided to provide a solution to the Bitcoin miners by giving them assess to no less than a safe haven! Countries such as Kazakhstan, Canada, and Germany, among few others, became the first of many choices for Bitcoin miners when it came to relocating their mining operations. Following this Bitcoin mining became more decentralized and as a result, it grew less reliant on China.

Source: CoinDesk

According to the data from Cambridge Centre for Alternative Finance, China resumed its mining operations three months after the ban was imposed, which further contributed to the rise in Bitcoin’s hash rate. According to CoinDesk, the United States is currently the biggest contributor to the Bitcoin hash rate, with Georgia on the top at 30.8%, which is followed by Texas at 11.2%, then Kentucky at 10.9%, and New York at 9.8%.

Source: CoinDesk

The Ethereum Merge

Following the biggest event in the crypto space, where the most famous altcoin, Ethereum transitioned to Proof of Stake consensus from Proof of Work consensus, the ETH network does not have any use of GPUs for its mining operations. As a result, the sudden shift in mining mechanism naturally forced the Ethereum miners to either sell off or repurpose their equipment toward mining Bitcoin.

Source: CoinDesk

Read more: Ethereum price struggling despite ETH supply turning deflationary

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more