Table of Contents

ToggleKey Takeaways:

- Crypto traders incurred approximately $1 billion in losses through liquidations in the past 24 hours, thanks to a major drop in top crypto prices.

- Bitcoin’s price dropped by about 8% to about $26,500, hitting a two-month low.

- Long positions worth $821 million were wiped out during this sell-off, with Bitcoin and Ethereum being the most affected.

- The current sell-off triggered the highest level of BTC liquidations for a single day since June 2022.

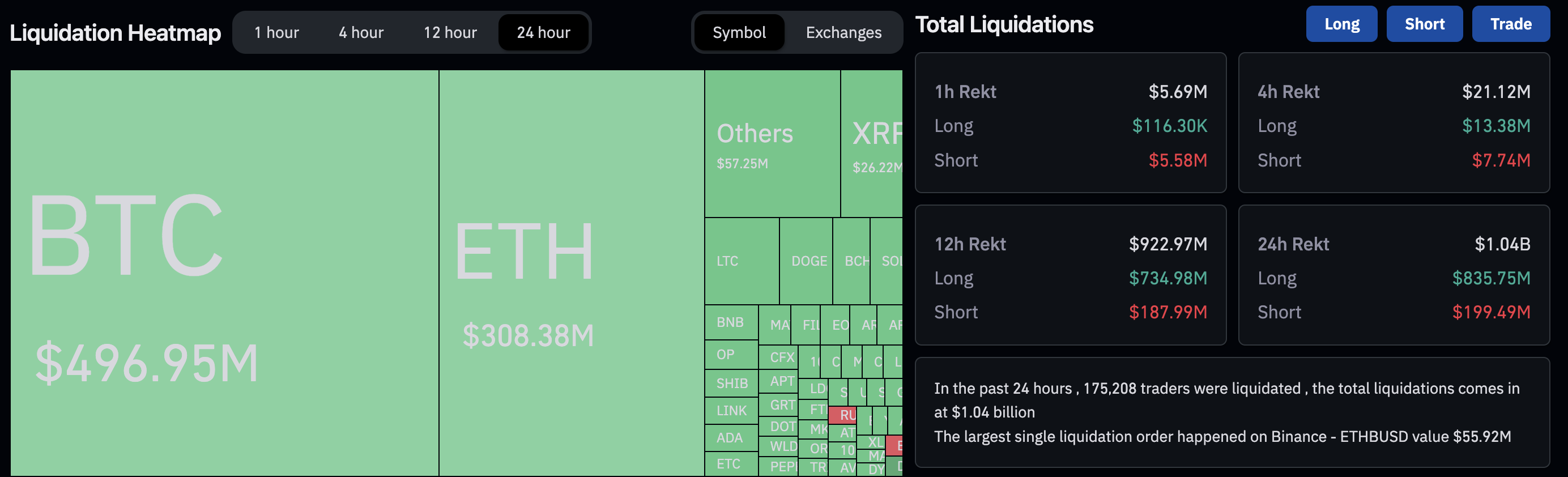

In a sharp downturn for digital assets, crypto traders faced substantial losses of around $1 billion in liquidations within the past 24 hours, based on data from Coinglass. This sell-off marked one of the most severe setbacks in the crypto market this year, as the price of bitcoin plummeted to a two-month low.

Bitcoin, the original and largest crypto by market cap, experienced a significant decline of over 8%, reaching approximately $26,500. It dropped close to $25,000 earlier in the day, marking the lowest point since June.

During the tumultuous exit rush, around $835 million in long positions, which bets on price increases, were eradicated in the past 24 hours. The losses were particularly harsh for Bitcoin (BTC) traders, who faced approximately $496 million in long liquidations, followed by ether (ETH) with $308 million.

Notably, this marks the most significant BTC liquidation in a single day since June 2022, when the primary crypto’s price experienced a steep decline to $17,000.

These liquidations occurred as crypto prices took a nosedive during US afternoon hours on Thursday. This sudden downturn transformed this month’s gradual decline into market turbulence, echoing broader financial concerns, including unstable foreign currencies, apprehensions about China’s economy, and surging bond yields.

Liquidations transpire when leveraged trading positions on exchanges are closed due to a total or partial loss of the trader’s initial margin. This can result from failing to meet margin requirements or having insufficient funds to maintain an open trade. During sharp declines in asset prices, a cascade of liquidations can ensue, exacerbating both losses and price drops.

Read More: Bitcoin Price Prediction

- As is evident from the chart above, BTC has suffered a significant correction over the past 24 hours and in one fell sweep, has broken down below the upward trendline (marked in blue), the 200-day exponential moving average and the bottom of the consolidation range (marked in grey).

- This indicates the incoming of serious selling pressures across the board, with nearly $500 million worth of BTC long positions liquidated over the past 24 hours.

Additional Read: Why is Bitcoin Price Going Down Today?

Conclusion

The recent sharp sell-off in the crypto market has led to substantial liquidations for both Bitcoin and Ether traders, marking a significant downturn in the market. The volatility and interconnectedness of financial markets have contributed to this abrupt decline, impacting traders who relied on leveraged positions.

Source: CoinDesk

FAQs

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more