Table of Contents

ToggleIntroduction

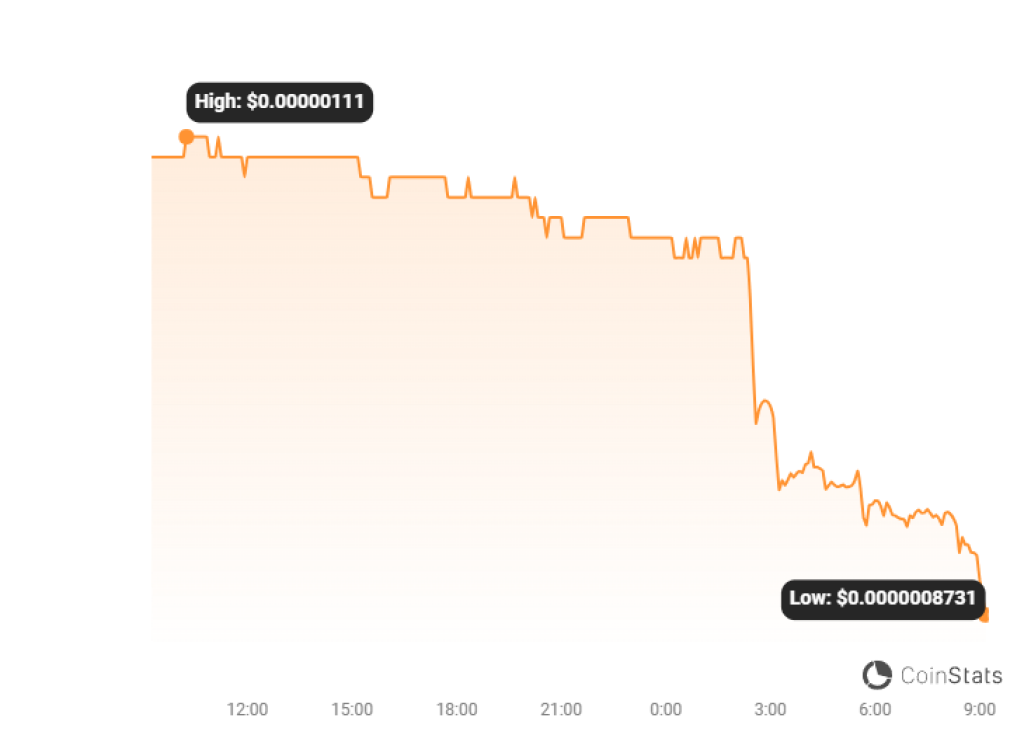

In a surprising and unprecedented turn of events, an astounding 16 trillion PEPE meme coins were recently transferred out of the project’s multisig wallet. This significant maneuver occurred last Thursday and directed the coins to various addresses tied to major crypto exchanges such as Binance, OXK, and Bybit. The repercussions were swift and severe, as the market value of PEPE plummeted by 20%, leaving bewildered investors in search of explanations.

Source: CoinStats

The intrigue didn’t halt at the mere transfer of coins. Detectives combing through the blockchain soon unearthed a puzzling alteration in the multisig wallet’s transaction authorization process. Previously, a robust mechanism demanded approvals from five out of eight associated wallets to greenlight transactions. In a startling twist, this arrangement had been modified to necessitate only two out of the eight signatures, significantly weakening the security threshold.

Read More: Pepe Coin Price Prediction

Key Takeaways

- Massive Outflow: A staggering 16 trillion PEPE meme coins, equivalent to millions of dollars, were transferred from the project’s multisig wallet. This led to a rapid and substantial 20% decline in PEPE’s market value, sparking concerns among investors.

- Security Protocol Shift: The multisig wallet, which safeguards a substantial portion of PEPE’s total supply, underwent a baffling alteration in its transaction approval process. The requirement for signatures was reduced from five out of eight to just two out of eight wallets, raising security concerns.

- Unprecedented Incident: This is the first instance of the PEPE project’s multisig wallet initiating an outgoing transaction of the meme coin. The incident has exposed questions regarding the project’s governance and security measures, causing uncertainty among investors.

Any reason why the PEPE multisig wallet changed the threshold to just 2/8 signatures? Seems weird, this isn’t standard right?

Also, seems that some has been sent to exchanges pic.twitter.com/1DVZIOvef8

— CryptoNoddy (@Crypto_Noddy) August 24, 2023

- Market Impact: The sequence of events triggered a sell-off in the market, resulting in a 20% decrease in PEPE’s price. This decline not only eroded investor confidence but also cast doubts on the future prospects of the project.

In light of these developments, the crypto community is awaiting further clarifications from the project’s team. This situation serves as a stark reminder of the necessity for robust security protocols and transparent governance within decentralized ventures. The PEPE incident underscores the inherent volatility and unpredictability associated with meme coins, prompting valid apprehensions regarding the oversight of analogous projects.

1/4

1 hour ago, the Pepe multisig wallet, changed the amount of signatures required on their multisig from a 5/8 to 2/8. This comes after sending $15.7 million worth of $PEPE to exchanges.

A breakdown of what we know: pic.twitter.com/bxBxp6Nzqz

— ASXN (@asxn_r) August 24, 2023

Conclusion

The sudden and perplexing occurrences revolving around PEPE’s multisig wallet have left the investor community on tenterhooks. Calls for heightened vigilance and openness within the realm of meme coins have grown louder. This incident provides a pertinent lesson on the significance of stringent security measures and clear governance frameworks, which are essential for the sustainability of decentralized projects. As the crypto space evolves, the PEPE incident stands as a milestone underscoring the need for cautious and well-considered approaches.

Source: Cointelegraph, CaptainAltcoin

FAQs

What led to the 20% drop in PEPE's value?

The significant transfer of 16 trillion PEPE meme coins from the multisig wallet to addresses linked with major crypto exchanges triggered panic among investors, resulting in the substantial decline in value.

How did the security protocol change impact PEPE's ecosystem?

The adjustment in the multisig wallet's transaction approval process, requiring only two out of eight signatures, weakened the security threshold. This raised concerns about the project's security and governance.

What does the PEPE incident teach the crypto community?

The PEPE incident emphasizes the importance of robust security measures and transparent governance within decentralized projects. It serves as a reminder of the unpredictable nature of meme coins and highlights the need for prudent oversight.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more