As we march into the new year, the crypto space has been showing the results of the long crypto winter that the ecosystem encountered in 2022. One of the biggest events to take place within the crypto world was Ethereum’s transition to Proof of Stake from its previously energy consuming Proof of Work consensus mechanism; The Merge.

After the successful transition of the Ethereum network, Nansen; which is a blockchain analytics platform that helps with on-chain data with millions of wallet labels, in December noticed an increase in the demand for Ether staking solutions. With the merge giving way for the upcoming updates to one of the largest networks known in the crypto world, many ETH staker solutions have been looking at developing themselves further. One of the liquid staking protocols; Lido Finance; has seen a lot of attention post the Ethereum merge in September. The protocol now has its total value locked, commonly referred to as TVL, sitting at the top position among other the various decentralized finance (DeFi) protocols known today.

Lido now has the highest TVL of any DeFi protocol. pic.twitter.com/2xsM3lVGVl

— Patrick | Dynamo DeFi (@Dynamo_Patrick) January 1, 2023

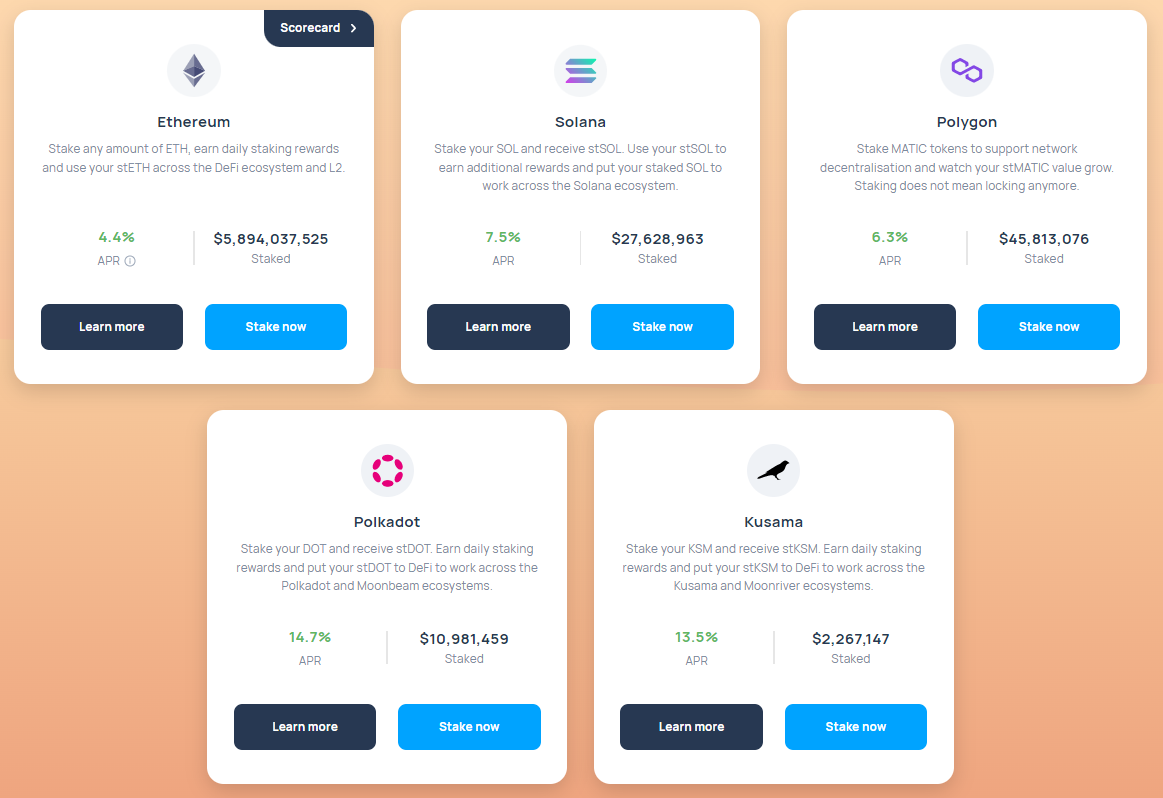

The data from the DeFi TVL aggregator, DefiLlama, Lido’s liquid staking protocol has now piled about $5.9 billion in TVL. The previously leading protocols, namely MakerDAO and AAVE now hold $5.89 billion and $3.7 billion respectively. According to Lido Finance’s website, as of yesterday, January 2, 2023, there has been $5.8 billion Ether staked on the protocol, while there was around $23.2 million staked in Solana, $43.9 million in Polygon, $11 million in Polkadot $4.51 and $2.2 million in Kusama $22.59.

Read more: Lido DAO Price Prediction

Source: lido.fi

Lido Surpasses MakerDAO in Total Value Locked

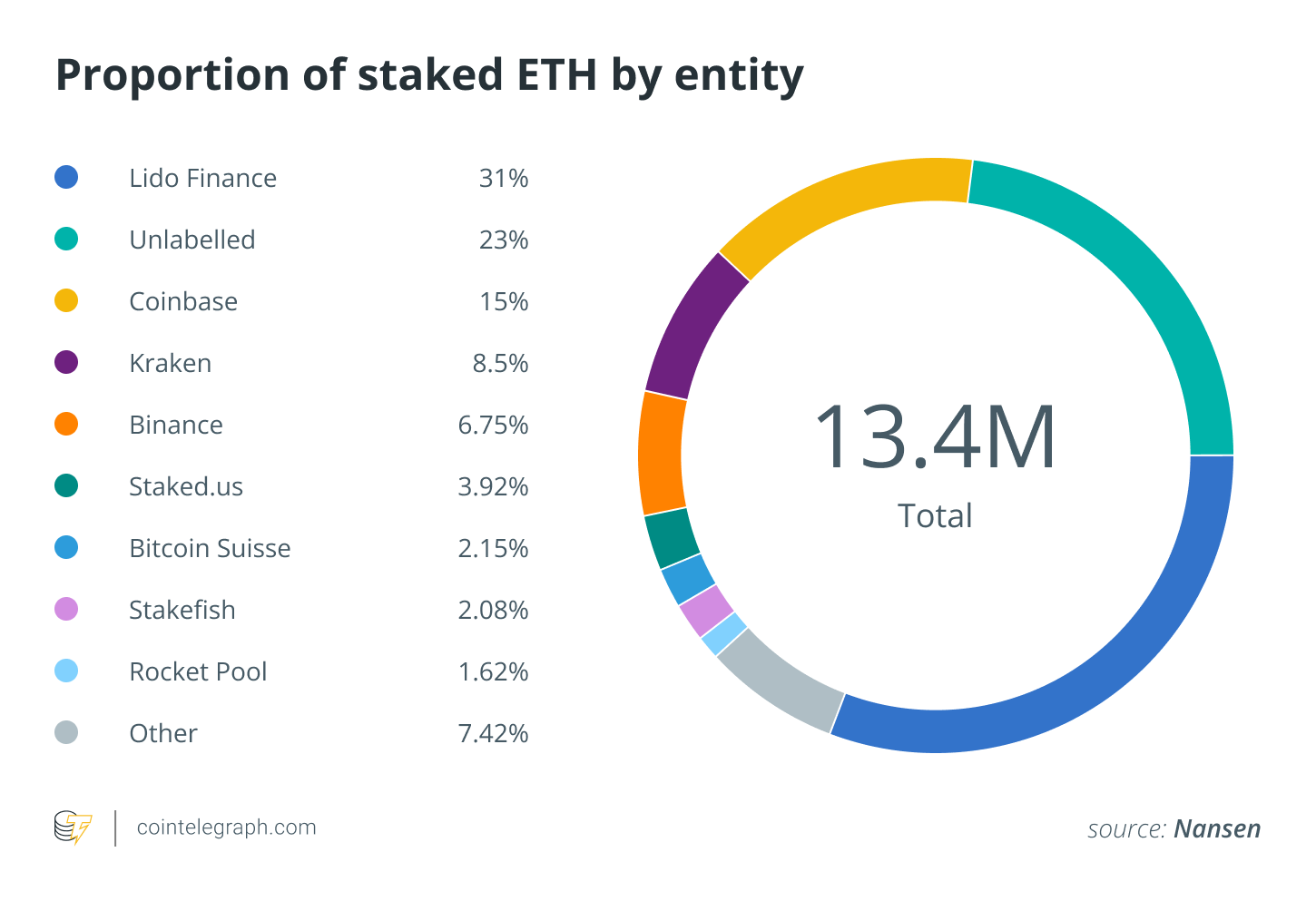

Blockchain analytics platform, Nansen’s metrics show that liquid staking holdings are commonly weighted toward long-term holders, however, these recently launched protocols are alluring or drawing new deposits faster than the established services. As a result of this rise, a whopping 5.7 million of the total 14.5 million ETH is seen to have been staked in staking pools like Lido and Rocket Pool, which is coming to a total of over 40% of the total staked ETH in the ecosystem.

Of this, the Lido protocol’s staked ETH (stETH) pool dominates the space with a strong 79% share of the total market supply of staked ETH. According to the Cointelegraph report, 52% of the stETH tokens are staked in Aave, Curve, and Lido’s wrapped stETH which is a contract displaying interest and utility for investors and DeFi applications. The stETH has furthermore witnessed a 127% increase in average daily trading volume ever since the Ethereum Merge.

Lido fees and revenue over time. Lido has collected over $1M in fees every day since October 26th pic.twitter.com/GHkzSzYIOo

— DefiLlama.com (@DefiLlama) November 18, 2022

Around September, as shown by the data from Nansen, Lido held the most amount of staked ETH among DeFi, about 31%, which is a significant amount while major crypto exchanges like Coinbase and Kraken, held 15% and 8.5%, respectively.

Source: Cointelegraph

Read more: Bitcoin Price Prediction 2023

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more