The FTX feud has shook the entire crypto verse after wiping off $ 150 billion of the market cap leaving investors in a murky situation. Crypto has already been through a rocky road in 2022 and with Sam Bankman Fried bursting the FTX bubble the crypto investors are taking their crypto assets both fungible and non-fungible off the edge to mitigate any further risks.

Crypto market fell to a mere $ 786 billion from $1.02 trillion since the FTX fiasco scooped up all the crypto-linked assets. Nansen’s NFT-500 index reported a 14% sharp drop in Ethereum NFTs. Solana-based NFTs took a massive hit of 68% price drop which brought its valuation from $ 424 million to $ 135 million in a matter of days.

Top performing blue chip NFT project Bored Ape Yacht Club – BAYC fell by 43% bringing its valuation to $ 60,000. Crypto Punks went down by 37% amounting to $ 69,000 and Moon Birds fell by 51% and is now valued at $ 6,800. Solana, also known to be Ethereum Killer, saw a sharp price drop in its NFT ecosystem. DeGods – an NFT project saw a drop in its floor price by 66% bringing its price to $ 2,700. Other NFT projects like Solana Monkey Business and Yoots also recorded a floor price drop by 68% and 70% respectively.

The core reason for Solana’s NFT price dropping like a pack of cards is due to FTX’s advocacy for Solana layer 1 solution. As FTX was dealing with its own showdown the value of SOL crashed to $ 12. While the smoke and fire around FTT was affecting the entire ecosystem including the king crypto ‘BTC’ the insolvency dreadfully affected Solana DEX called Serum (SRM). At the beginning of the meltdown FTT – the native token of FTX exchange was down by 89% while SRM was down by 53% in the last few days.

Read more: FTX collapse explained

The FTX story is becoming clear to the industry as the chips have come down bit by bit. The exchange has lent customer’s funds to its sister firm Alameda Research which made uncalculated and illegitimate bets. The poor mismanagement of funds by Alameda has led to FTX’s insolvency that led to a loss of $ 10 billion. The exchange filed for bankruptcy on Friday, November 11, 2022.

Round up of FTX’s impact by Dune Analytics

Dune Digest #55 is LIVE

Spicy issue this week with stories on:

– FTX/Alameda

– Reddit World Cup

– Web3 social adoption

– MetaMask Bridge& More!

Wizardry by:

– @21Shares

– @Thea_Chenyj

– @_denze

– @marcov_91+ Many more!

🧙♂️🧙♂️🧙♂️

Check it 👇https://t.co/YG1iKofilh

— Dune (@DuneAnalytics) November 11, 2022

FTX had emerged as a strong NFT marketplace in the last quarter. It made strategic partnerships and new issuances across growing NFT projects. FTX’s venture arm named ‘FTX Ventures’ was valued at $ 2 billion. It invested in some noteworthy NFT projects including Yuga Labs – the creator of BAYC. FTX Ventures also funded an A series round for Doodles the maker of pastel-colored profile picture avatars which was later valued at $704 million. FTX also supported some projects and franchises including the Golden State Warriors, the Washington Wizards and Capitals, Dolphin Entertainment and Mercedes F1 to support their collections.

Interestingly as FTX’s NFT did not do well in the NFT space but it recorded a spike during the time of its insolvency as many investors thronged to the NFT marketplace to try liquidating their tokens to minimize further losses.

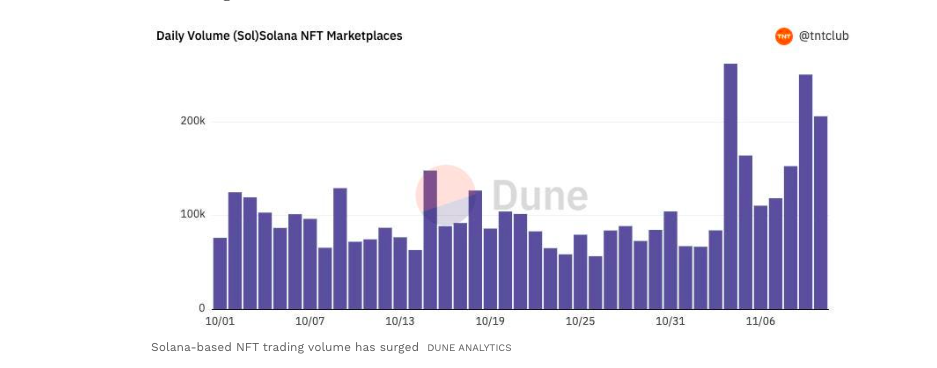

According to Dune Analytics, the Solana-based NFTs saw a rush in sell-offs just after the FTX insolvency news spread like wildfire.

Additional Read: Sam Bankman Fried net worth evaporated from $16 Billion to Zero

Source: Forbes

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more