Institutional interest in the crypto market has taken its course of influencing the investors into exploring the new asset class. Even more so after the US Inflation rate has seen a spike in recent times. This week saw two of the biggest crypto tokens, Bitcoin and Ethereum, extend their winning values reach an intraday high of around $18,224 and a nearly 5% rise to $1,401 respectively.

To summarise the behaviour, two of the most popular crypto tokens, Bitcoin (BTC) and Ethereum (ETH), have seen a continued rise in value this month. The rise has resulted in adding more than 10% and 17%, respectively to the assets’ values that helped the coins reach around the $18,000 and $1,400 levels!

Additional Read: Bitcoin Price Prediction

Bitcoin has been on the rise for the past two weeks. Current price for 1 bitcoin = 18250 usdt. Im can’t wait for #Core (Solution Trilema Blockchain) pic.twitter.com/zeIFW8BPH1

— SHATOSHIANS #CORE 💎🚀 (@sabtajichan) January 12, 2023

One of the reason for the rise in interest in the crypto tokens has been the US inflation rate reaching its highest levels in a decade. However, the rise of Bitcoin can also be credited to the increasing demand from the institutional investors. According to various reports, many are of the belief that these crypto assets are a better store of value compared to traditional fiat currencies. Propelling the sentiment that is going around are the adoption rate of the asset. The crypto bulls are now driving the market higher as they have their optimistic outlook on the future of digital assets.

📢US CPI release today

Expectations leaning on a drop 6.5%

🟢 Bullish if we go below it

🟡 Neutral if it falls within expectations

🔴 Bearish if we go above it pic.twitter.com/OA8jirwZdF— CryptoWhale™ (@SCryptowhale) January 12, 2023

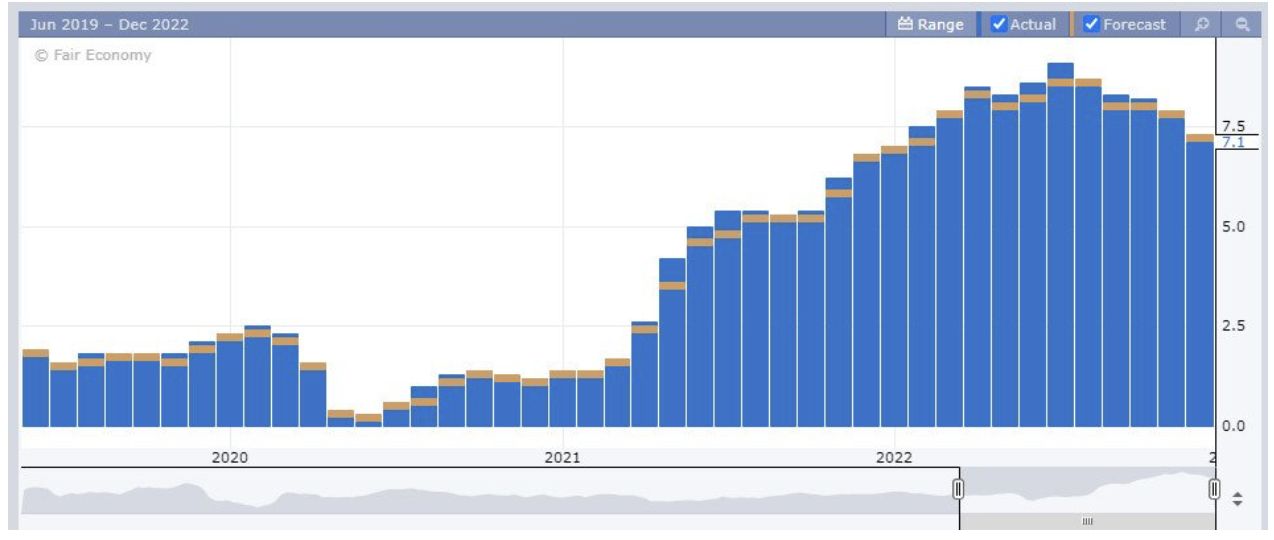

Following this, the financial markets are also anticipating the Bureau of Labor Statistics’ US CPI figures today. The CPI figures has the ability to impact the crypto prices massively.

What is US Consumer Price Index (CPI) and How Does It Work?

The US Consumer Price Index (CPI) is an economic indicator which helps in measuring the average change in prices over time for a set of goods and services. This indicator is also used to measure the inflation rate in the United States, along with the measurement of assessing changes in the purchasing power.

The CPI calculations take into consideration the purchasing pattern of consumers, which includes the difference in behavior which changes along with the prices for food, housing, transportation, medical care, and other items. In totality, CPI calculations helps in making predictions about future inflation rates.

Read More: Top Ways To Beat Inflation In India

How will CPI Numbers Affect The Crypto Market?

The calculations that would showcase the difference in the numbers in CPI can have either a positive or a negative impacts on the price of crypto assets. Inflationary possibilities from higher CPI figures can lead to increased demand for crypto assets as investors look for hedges against inflation. On the other hand, deflationary forces from lower CPI figures can lead to a decreased demand and volatility in crypto prices.

GM🫡

Today is a big day – US CPI (inflation) numbers will be published😳

The forecast is: 6.5% (down from 7.1%)

Remember that:

below 6.5% = likely bullish

over 6.5% = likely bearishHere’s JPMorgan’s Game Plan👇 pic.twitter.com/iuIFxFv8Jt

— Crypto Hub💡 (@CryptoHub210) January 12, 2023

According to cryptonews, the core inflation is predicted to drop to 5.7% annually, which is the lowest level in a year. However, the monthly core inflation is predicted to increase at a slightly quicker rate of 0.3% as compared to 0.2% in November 2022.

Source: forexfactory

Source:Crypto News

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more