Table of Contents

ToggleIntroduction:

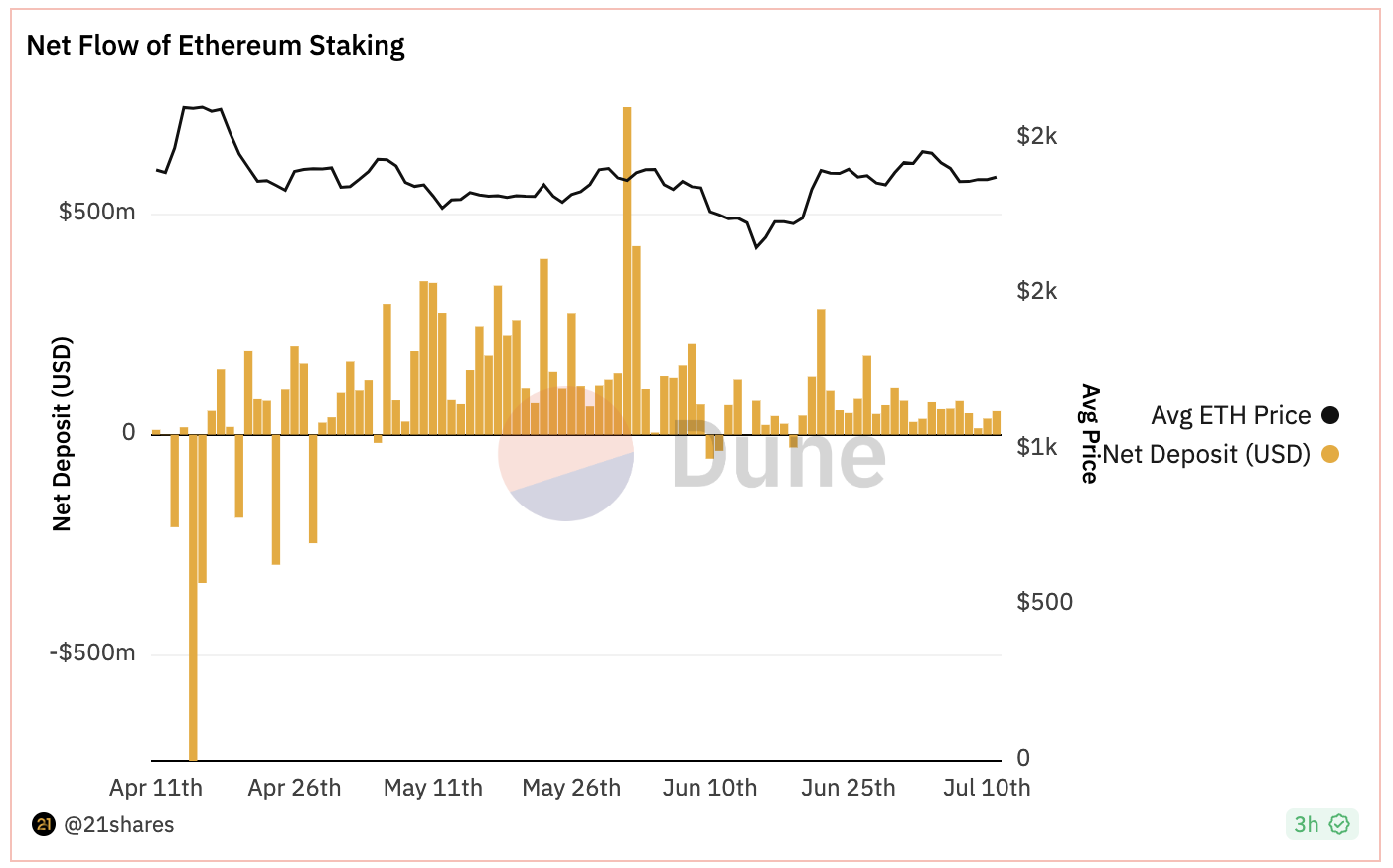

Ethereum (ETH) staking is steadily approaching a significant milestone, with approximately 20% of all tokens locked in staking contracts. However, inflows have experienced a slowdown as investors grow cautious about regulatory risks. Despite this, Ethereum’s Shanghai upgrade, which enabled withdrawals from its proof-of-stake network, ignited fresh demand for staking the second-largest crypto. Staking allows crypto owners to lock up tokens and participate in securing the network as validators in exchange for rewards, making it an attractive long-term investment option, particularly among institutional investors.

Source: Dune Analytics

Key Takeaways:

Here are the key takeaways from the current state of Ethereum staking:

- Approximately 23.9 million ETH tokens have been deposited into Ethereum’s staking network, accounting for around one-fifth of the token’s total supply.

- Since the implementation of the Shanghai upgrade, deposits have significantly exceeded withdrawals, resulting in a waiting time of around one-and-a-half months to establish new validators.

- Regulatory scrutiny on centralized exchanges, particularly following lawsuits against major staking services like Binance and Coinbase, has contributed to a slowdown in inflows.

- The waiting time for deploying new validators has decreased to 36 days from its peak of nearly 46 days in early June, aided by an increased threshold of new validators entering the network daily.

Read More: Ethereum Price Prediction

Conclusion:

While Ethereum staking has witnessed substantial growth, regulatory concerns have impacted the pace of inflows in recent times. The lawsuits against prominent staking services have triggered caution among investors, leading to a temporary decline in net flows. However, the waiting time to activate new validators has improved, and the decentralized nature of staking services has become more appealing to investors seeking alternative solutions. Despite the challenges, Ethereum staking continues to be an attractive investment option for those interested in long-term returns.

FAQs

The waiting time to activate new validators can impact investors as tokens transferred to staking do not earn rewards until they are stuck in the queue. This can lower the effective annualized yield. Investors are more concerned about the unstaking queue, which refers to the time it takes to remove funds from ETH staking. Yes, risks associated with centralized staking services have led investors to explore decentralized alternatives, contributing to their rising popularity.How does the waiting time to activate new validators affect investors?

What are investors more concerned about regarding Ethereum staking?

Are decentralized staking solutions gaining popularity?

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more