Table of Contents

ToggleIntroduction

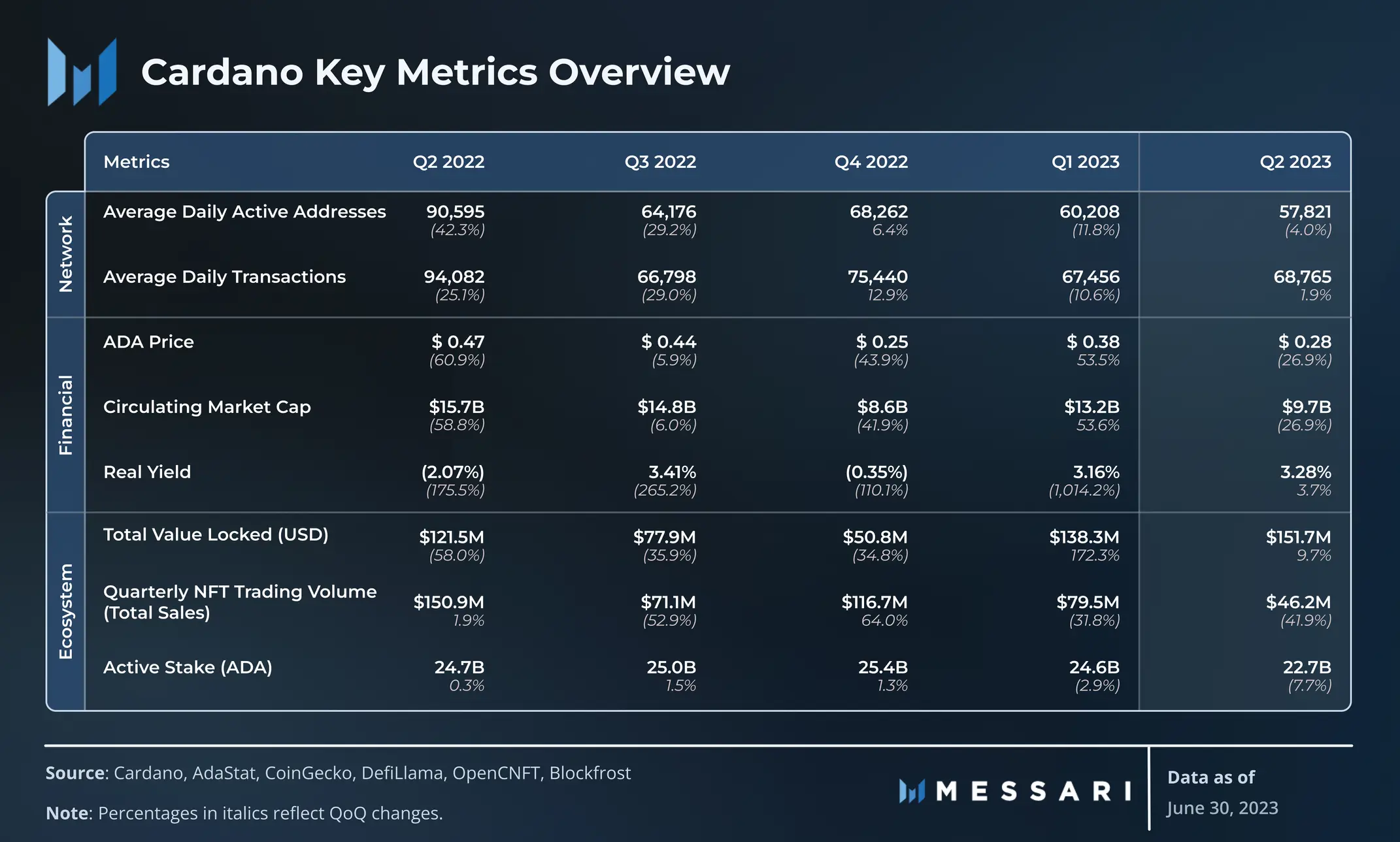

The Cardano ecosystem has exhibited substantial growth throughout the second quarter of 2023, despite a relatively subdued crypto market environment. Key indicators of this growth include the development of novel infrastructure elements such as stablecoins, programming languages, and wallets. These advancements have empowered Cardano developers to construct sophisticated applications enriched with elevated user experiences, as per the latest findings by Messari, a renowned blockchain intelligence platform.

Key Takeaways

Resilient Growth Amid Market Fluctuations: Despite a downturn in ADA’s price and market capitalization, the Cardano ecosystem demonstrated diversification and resilience, largely attributed to the incorporation of novel protocols.

Transaction Activity Expansion: Notwithstanding a consistent rise in average transaction costs, the Cardano network observed an 8.5% surge in average transaction values, reaching $0.126 in Q2. The USD transaction fee exhibited a notable year-over-year decline of 50.8%, primarily due to ADA’s diminished value.

Steady Transaction Surge: The second quarter witnessed a 2% quarter-over-quarter increase in average daily transactions, surging from 67,500 to 68,800. This trend is noteworthy as the connection between transaction movements and active addresses slightly deviated during recent quarters.

Growing Engagement: Over the past five quarters, the transaction-to-active address ratio consistently grew, signifying heightened user engagement. Q2 saw this ratio escalate to 1.19, marking a sequential uptick of 6.1% and a remarkable year-over-year spike of 13.2%.

Cardano Ecosystem Growth: Q2

In the Q2 edition of Messari’s “State of Cardano” report, it is highlighted that the Cardano ecosystem flourished despite ADA’s price pressures. The average transaction value soared by 8.5% in comparison to the prior quarter, reaching $0.126. Notably, the average transaction fee in USD displayed a considerable 50.8% decline year over year, mainly due to ADA’s comparative decrease in value.

Read More: Cardano Price Prediction

Surge in Transaction Activity

The second quarter marked a notable surge in transaction activity. With an approximate 2% quarter-over-quarter rise, the daily average transactions increased from 67,500 to 68,800. This surge is crucial as transaction movement and active addresses were historically closely correlated, but recent quarters have witnessed slight deviations from this pattern.

Elevated User Engagement

Over the past five quarters, the transaction-to-active address ratio has displayed consistent growth, pointing to enhanced user engagement compared to earlier periods. Q2 recorded this ratio at 1.19, indicating a sequential growth of 6.1% and a remarkable year-over-year expansion of 13.2%.

Steady Dapp Usage Growth

Cardano experienced an upsurge in its average daily decentralized application (dapp) transactions for the third consecutive quarter. Dapp usage witnessed a substantial 49.0% surge from the previous quarter, maintaining an average of 57,900 daily transactions.

Surging Blockchain Activity

Despite ADA’s price decline, Cardano’s total value locked (TVL) expanded by 9.7% quarter over quarter, reaching $151.7 million. The platform’s year-to-date TVL surged by 198.6% in USD, propelling it from the 34th to the 21st position among all networks in 2023.

Minswap’s Dominance

Minswap, an automated market maker (AMM), continued to assert its position as the dominant liquidity provider in Cardano’s decentralized finance (DeFi) landscape. Concluding Q2 with a TVL of nearly $50 million and over 32% dominance, Minswap’s influence remains pronounced.

Stablecoin Influence

The report also emphasizes the role of stablecoin infrastructure in fueling the blockchain’s TVL growth. Cardano’s stablecoin market cap climbed from the 54th to the 37th position in 2023, indicating its increasing significance.

Additional Read: PayPal Introduces PYUSD Stablecoin

Conclusion

Cardano’s Q2 2023 growth, showcased through increased transaction activity, heightened user engagement, and expanding TVL, underscores the platform’s resilience and adaptability within the crypto market. The emergence of stablecoins and innovative protocols has provided the ecosystem with essential tools to flourish.

Source: CryptoPotato

FAQs

What fueled Cardano's growth in Q2 2023?

Despite ADA's price decline, the integration of novel protocols and stablecoin infrastructure contributed significantly to Cardano's growth.

How did transaction activity evolve in Q2?

Average daily transactions witnessed a 2% increase from the previous quarter, demonstrating consistent growth and enhanced user engagement.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more