Earlier last week, the BTC price surged to the highest value that the token has seen in a while, to a whopping $28,000. The surge was seen soon after the collapse of the SVB bank, due to its liquidation issue. The global banking sector was put under additional pressure soon after Sunday’s announcement which stated that the Swiss banking giant UBS agreed to buy the crisis-hit rival of them, that is, Credit Suisse, in an emergency deal. The deal was worth over a whopping $3 billion!

Crypto experts and analysts are saying that this banking network collapse that has been taking place since the beginning of March, poses a significant risk to the health of the crypto market. One example of that is the drop in Bitcoin liquidation due to the same reason.

Read More: Bitcoin Price Prediction

The liquidity of an asset in the market is important because that very feature describes the ability of the market to facilitate the conversion between an asset and the fiat currency. There is an adage that quite literally sums up the importance of liquidity of the assets in the trading world; ‘Liquidity is King.’

Reasons why poor liquidity is worrisome:

- Poor liquidity in an asset leads to market inefficiencies.

- It can also become the cause of serious volatility.

- The liquidation issue has an influence on sophisticated investors with them placing their trades.

According to the research note from the Head of Research at the Digital Asset data provider, Kaiko, Clara Medalie, “A drop in liquidity certainly helps traders to the upside, but there is always eventually a downside. The moment buy pressure subsides, anything can happen to price.”

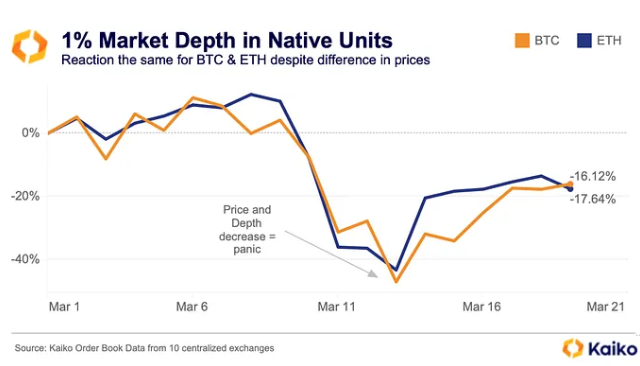

The research on the drop in liquidation was calculated by taking a look at the Market Depth, as it represents the amount of orders that are actually waiting to be filled within a certain price range. Kaiko pointed out that this liquidity crisis was first manifested when there was a $200 million drop in 1% market depth after Silvergate’s SEN network was suspended.

Source: Kaiko

Did You Know? The 1% market depth is calculated by taking all the bids and their asks within 1% of the mid-price for the top 10 crypto assets.

As per the report, the monthly opening levels for Bitcoin and Ethereum are both down by 16.12% and 17.64%, respectively. The liquidity of Bitcoin also suffered after Binance shut down its zero-fee programme for the most commonly liquidated pair in the crypto market; the BTC-USDT pair. As a result, the asset saw a drop in liquidation by 70% and the market makers shifted to other options.

Additional Read: Ethereum Price Prediction 2023

With solutions to the gap present in the market for market makers to look into liquidation is the most probable way out in today’s scenario it seems, as per the experts.

Source:Decrypt

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more