Following the surge in congestion on the Bitcoin network earlier this week, the supply for the oldest crypto asset Bitcoin reaches its lowest in five years on exchanges. The talk among the crypto enthusiasts is that Bitcoin hitting its lowest ratio since December 2017, a five-and-a-half-year low that suggests that the crypto market is witnessing a noticeable shift in the trading patterns of the traders. There is an increased amount of interest in the ‘self-custody’ feature among the traders.

📉 The amount of #Bitcoin on exchanges is now at its lowest ratio since December, 2017. The five and a half year low is a good sign of increased interest in self custody for traders, and less potentially at risk to be sold back to exchange wallets. 👍 https://t.co/U3n9McxcnH pic.twitter.com/8NjZLf0k2D

— Santiment (@santimentfeed) May 8, 2023

One interesting fact for new joiners of the crypto world is that, this lower supply of the flagship crypto token, such as Bitcoin, on trading platforms results in the amount of Bitcoin potentially to be at the risk of being sold back on the market. This almost effectively reduces the availability of the supply while also making it easier for the price of Bitcoin to rise when the demand for it grows.

Read on: BSV Price Rallies Over 40%

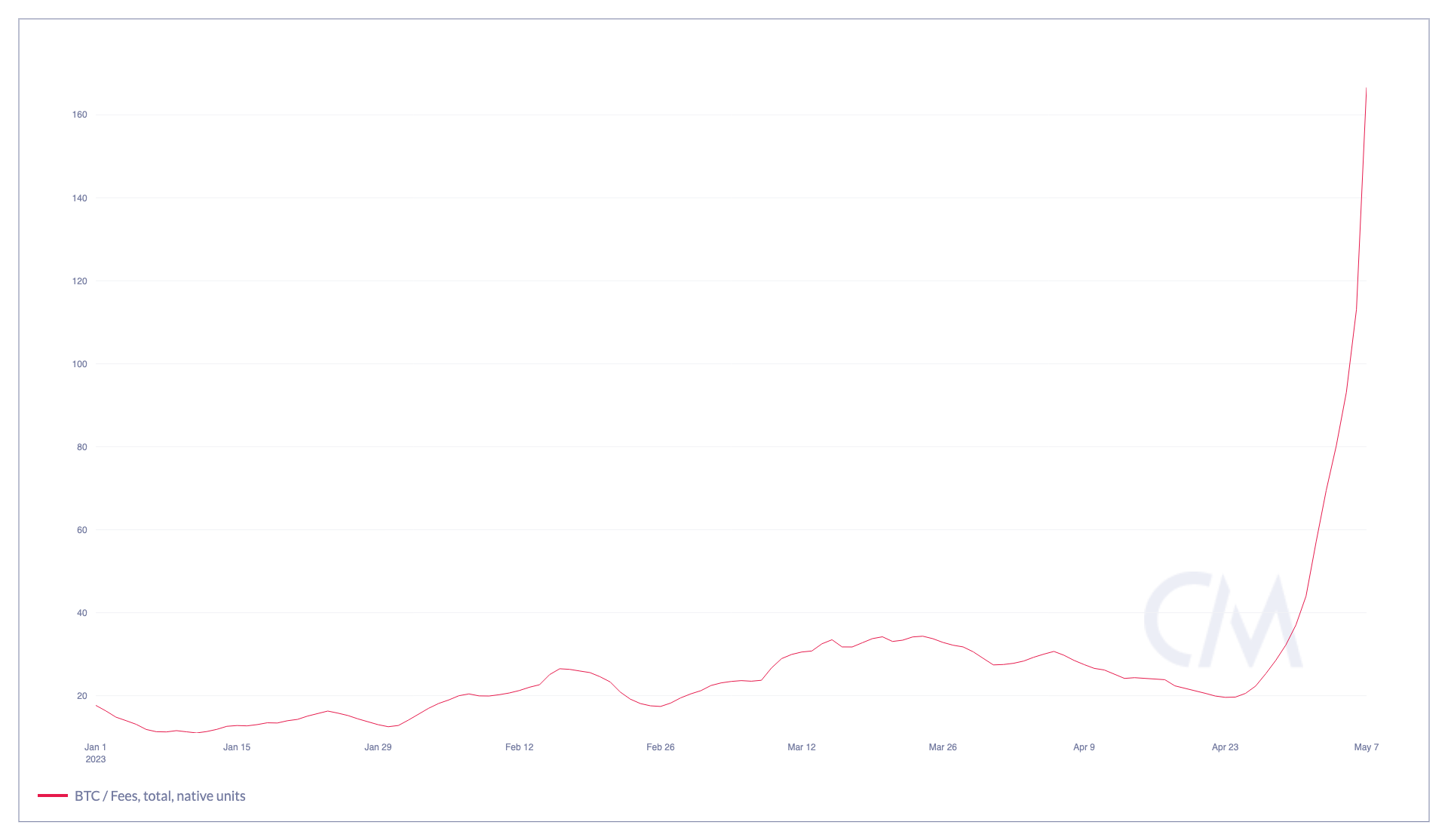

Source: Coinmetrics.io

The previous congestion, as per the data above, has caused a massive rise in unconfirmed transactions, which has resulted in a whopping 8x jump in transaction fees. It is almost close to a near 700% jump in transaction fees between the time period of April 23, 2023 and May 8, 2023!

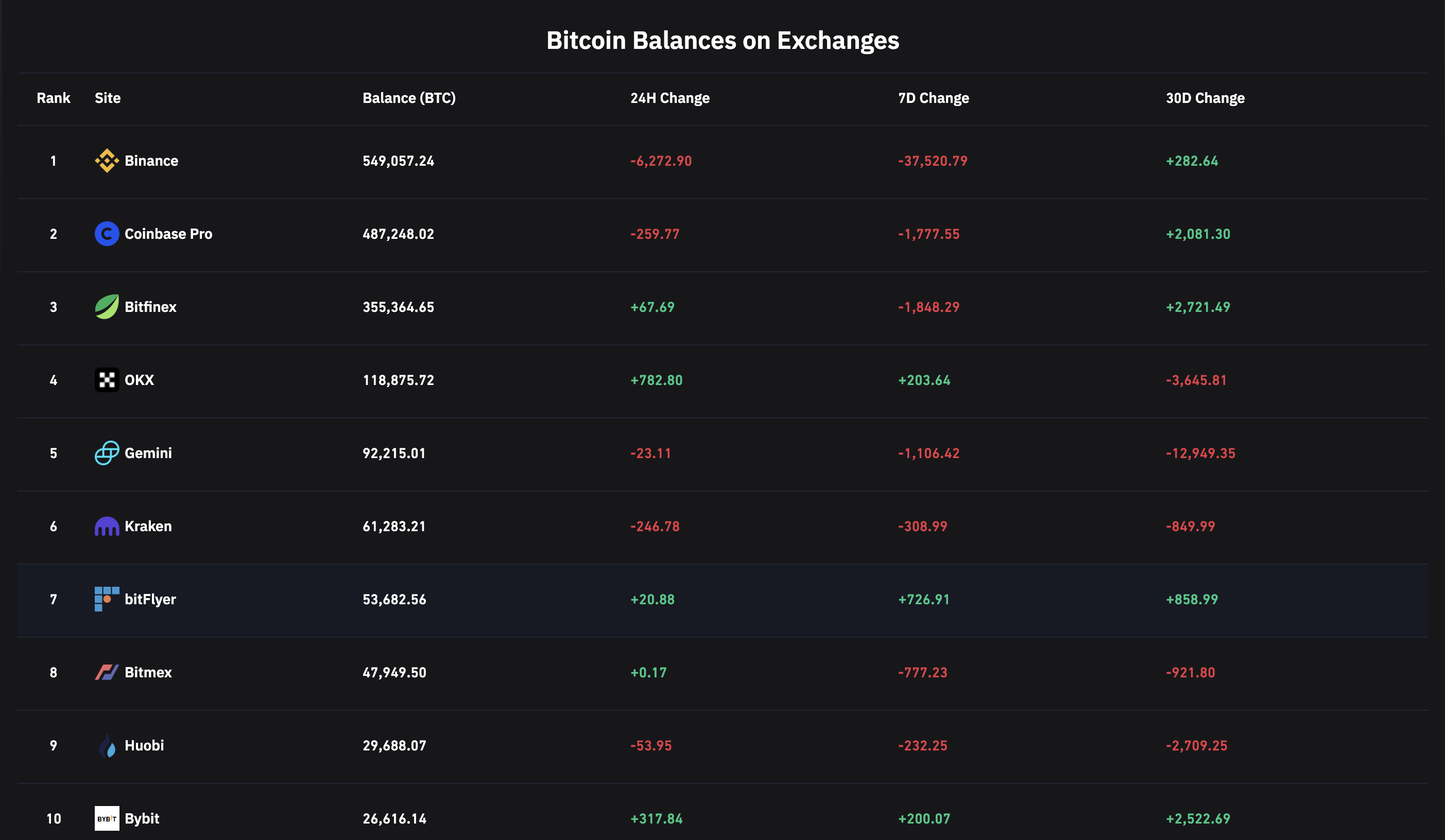

Source: Coinglass

As per the data from Coinglass, the balance of the OG crypto asset; Bitcoin; on all top exchanges stood at 1.13 million BTC as of May 9, 2023. The total was a dip by nearly 15% since earlier in the month, May 7, 2023. The change in the number stands for about 6% of the total supply of Bitcoin, that is at the time of writing, around 18.8 million BTC.

Previously, when the supply and the ratio of BTC was low to the similar rate as of today, was back in December 2017, when the crypto asset had reached a high of nearly $20,000 per BTC.

In short or a recap, this decline in the supply of BTC on exchanges is suggestive of the mere fact that increasing number of users are holding their coins for the long term; rather than selling their BTC tokens back to their exchange wallets. The change in behaviour can be an indicator that the traders have gained an increased amount of confidence and interest in Bitcoin. They may be treating the token as a store of value or a hedge against inflation. The understanding can also be a push of the current market scenario; especially with the ongoing economic uncertainty and monetary stimulus.

Read more: Bitcoin Price Forecast

Source: Cryptoglobe

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more