Key Takeaways:

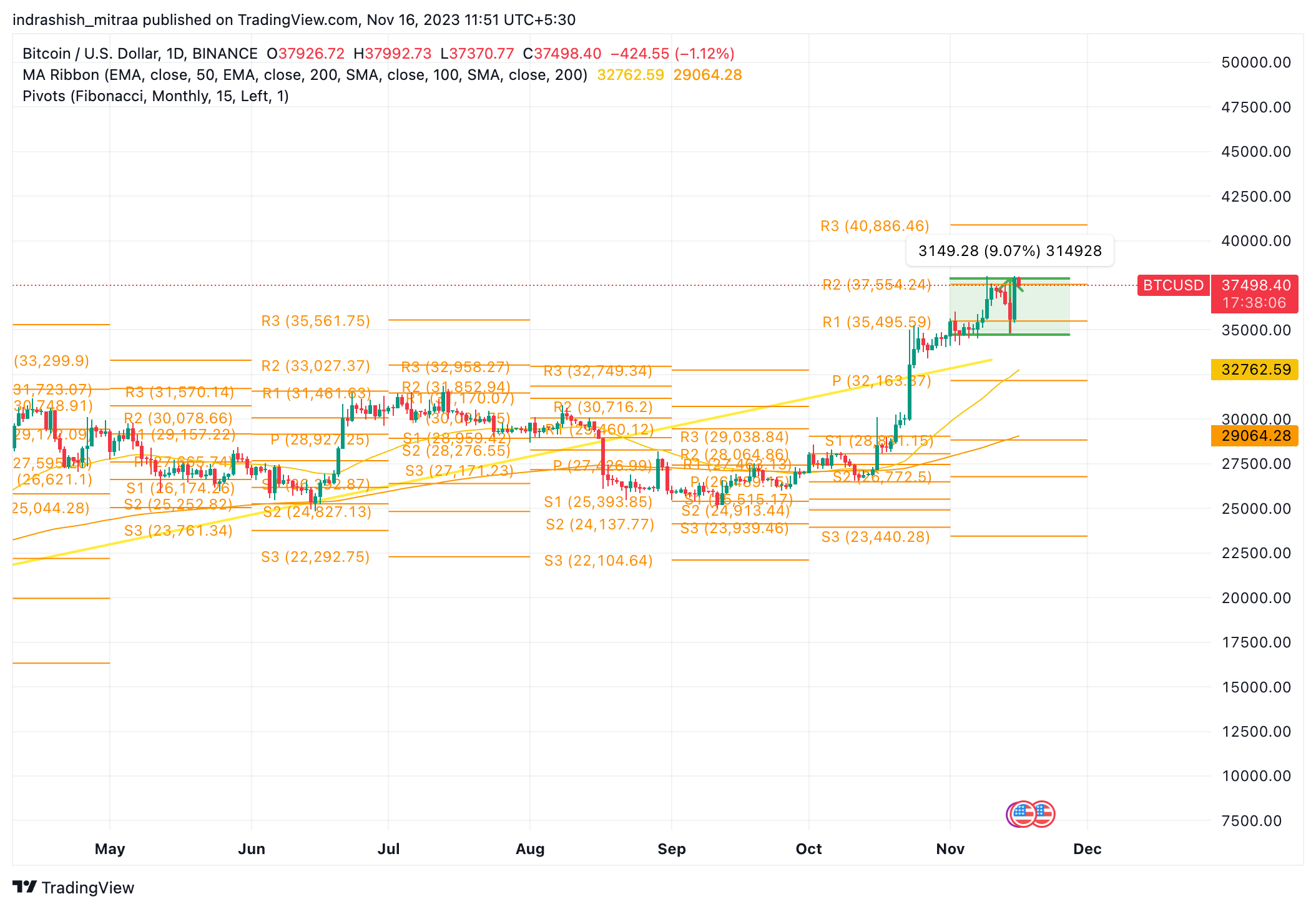

- Bitcoin Price Resurgence: BTC price nearly hit an 18-month high, hovering around $38,000 after a brief dip below $35,000, marking a 9% gain in November and a remarkable 42% surge from October lows.

- Altcoin Prices Surge: Some popular Layer-1 blockchains like Solana and Avalanche surged impressively by 18% and 23%, respectively.

- Market Momentum: The CoinDesk Market Index reflected a 5% upswing, signaling a positive trend across various digital assets.

- Bitcoin vs. Traditional Assets: Bitcoin price resilience surpassing US equities and gold indicates mainstream integration, echoing Charlie Morris’ confidence in Bitcoin’s market position and institutional interest.

- Market Sentiment and Future Outlook: The crypto market resilience suggests a potential shift favoring digital assets, with Bitcoin leading and altcoins regaining momentum. Growing institutional confidence and a positive market breadth paint an optimistic future for crypto.

Amidst the slight downturn on November 15, cryptos across the board surged back, led primarily by the king coin, Bitcoin, where BTC price edged close to an 18-month high, nearly reaching $38,000 after a dip below $35,000 on November 14. Alongside, Ether (ETH) did a 3% jump, hovering near $2,060, regaining ground after a recent drop to almost $1,900. Bitcoin price has gained over 9% in the month of November so far and a staggering 42% from October lows!

Read more: Bitcoin Price Prediction

Among the altcoins, native tokens of Layer-1 (L1) blockchains Solana (SOL) and Avalanche (AVAX) emerged as frontrunners, recording remarkable surges of 18% and 23%, respectively. SOL price has been a consistent performer, nearly tripling in value over the past month, fueled by reduced apprehensions about FTX’s token selling and a heightened appetite among institutional investors. AVAX price saw a recent leap, which might be linked to news about JPMorgan and Apollo utilizing its network to showcase a “proof of concept” for fund tokenization, a trending concept in the crypto sphere.

The broader market sentiment, mirrored by the CoinDesk Market Index (CMI), displayed an impressive 5% upswing, signaling an overall positive trajectory across various digital assets.

Bitcoin price resurgence, surpassing traditional assets like US equities and gold, marks a pivotal moment in its adoption and market performance.

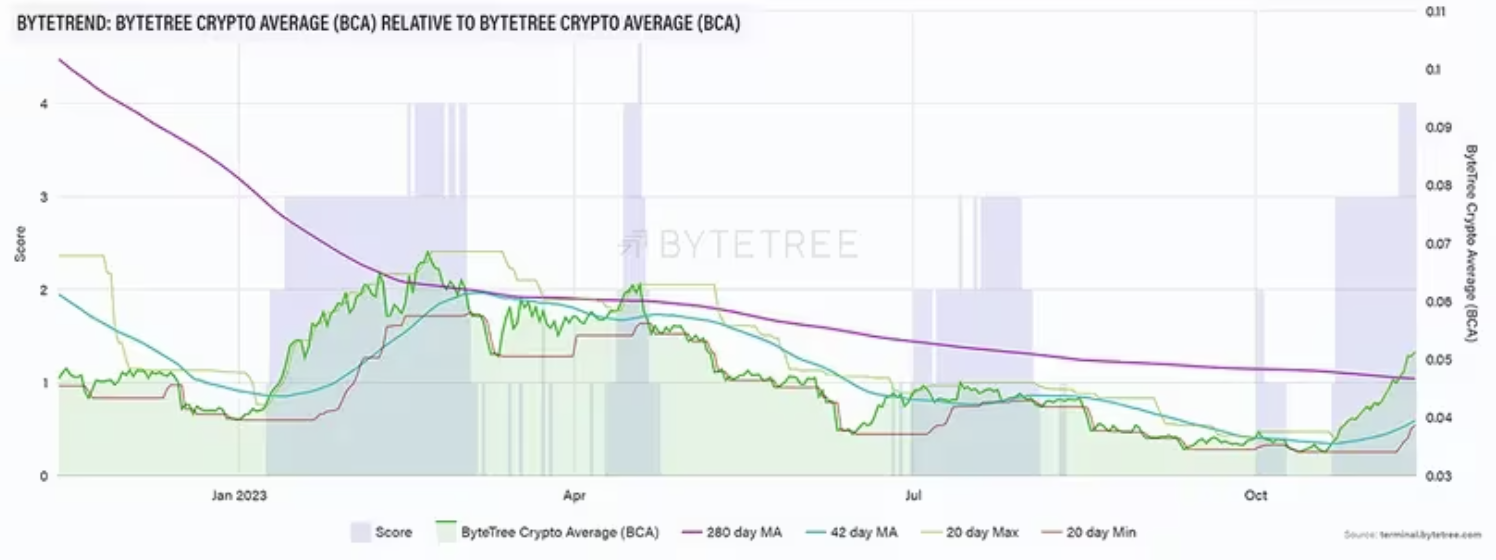

Charlie Morris, founder of investment advisory firm ByteTree, expressed confidence in Bitcoin’s mainstream integration, stating, “Bitcoin is going mainstream, and the bear is behind us. The good times are here.”

Morris emphasized Bitcoin price resilience against key assets, a crucial factor amplifying institutional interest. He also noted the resurgence of altcoins, indicating a positive market breadth after a challenging two-year crypto winter. The ByteTree Crypto Average (BCA) trend score, gauging the daily average price changes for the top 100 tokens, flashed a four-star rating, reflecting a positive trend not observed since April.

As the crypto market exhibits remarkable resilience and Bitcoin’s dominance solidifies, Morris advised higher exposure to crypto during favorable market trends. This buoyant market sentiment suggests a potential shift in favor of digital assets, marking a notable resurgence for the crypto landscape.

The recent surge underscores the evolving nature of the crypto market, with Bitcoin once again leading the charge and altcoins finding renewed momentum. This positive trend is indicative of growing institutional confidence and market maturity, painting an optimistic picture for the crypto community and investors alike. As the crypto market continues its upward trajectory, attention will remain focused on how this resurgence shapes the future of digital assets.

Source: CoinDesk

Read more: Bitcoin vs XRP

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more