Table of Contents

ToggleKEY TAKEAWAYS:

- Bitcoin price, after managing to recovery significantly in the month of October and beginning of November, saw a major crash soon after the collapse of the FTX crypto exchange.

- BTC price crashed nearly 23% ever since the news of the collapse broke on 7 November, 2022, falling all the way from $20,600 down to $15,900 as of writing.

Bitcoin, the king coin, had begun making some decent gains in the month of October, breaking out from the $20,000 psychological resistance level and had even reached $21,400 at the beginning of the month of November, 2022. Bitcoin, which has a market cap dominance of around 40% as of writing and hence, Bitcoin’s crash is pulling the entire crypto market down with it too. The overall crypto market cap has fallen from over $1 trillion at the end of October to now close to $800 billion only.

This crash has made the entire ecosystem and its market participants extremely nervous and understandably so. The crash of the FTX crypto exchange, built by the extremely popular figure in the crypto space, its founder Sam Bankman-Fried has caused a dent in the sentiments of these participants too.

More:

Sam Bankman Fried net worth evaporated from $16 Billion to Zero

BITCOIN TECHNICAL OVERVIEW

As mentioned earlier, ever since the news of the FTX collapse began making the headlines, BTC price took a major hit. Up until then, Bitcoin had been on a slow yet steady upward trend, but from the 7th of November, BTC price began its strong downward trend which is still going strong as of press time. The price crash saw heavy volumes, indicating that many weaker hands in the market decided to sell and exit to safeguard against further pitfalls that could come later on.

From a technical perspective, Bitcoin price is below any and all significant levels of support on the chart. It has broken down below the crucial region of support between $18,500 to $19,000 – which had previously been the lowest points in the YTD timeframe. Hence, a further freefall could be expected going forward too. The Relative Strength Index is at 31, with price levels below the 50 and 200 day moving averages – which indicate further bearishness. So, one can easily conclude that unless there is some major positive news in the market any upward move would be extremely slow and difficult.

Read more: BTC price prediction

MIXED SIGNALS FROM BITCOIN’S EXCHANGE FLOW METRICS

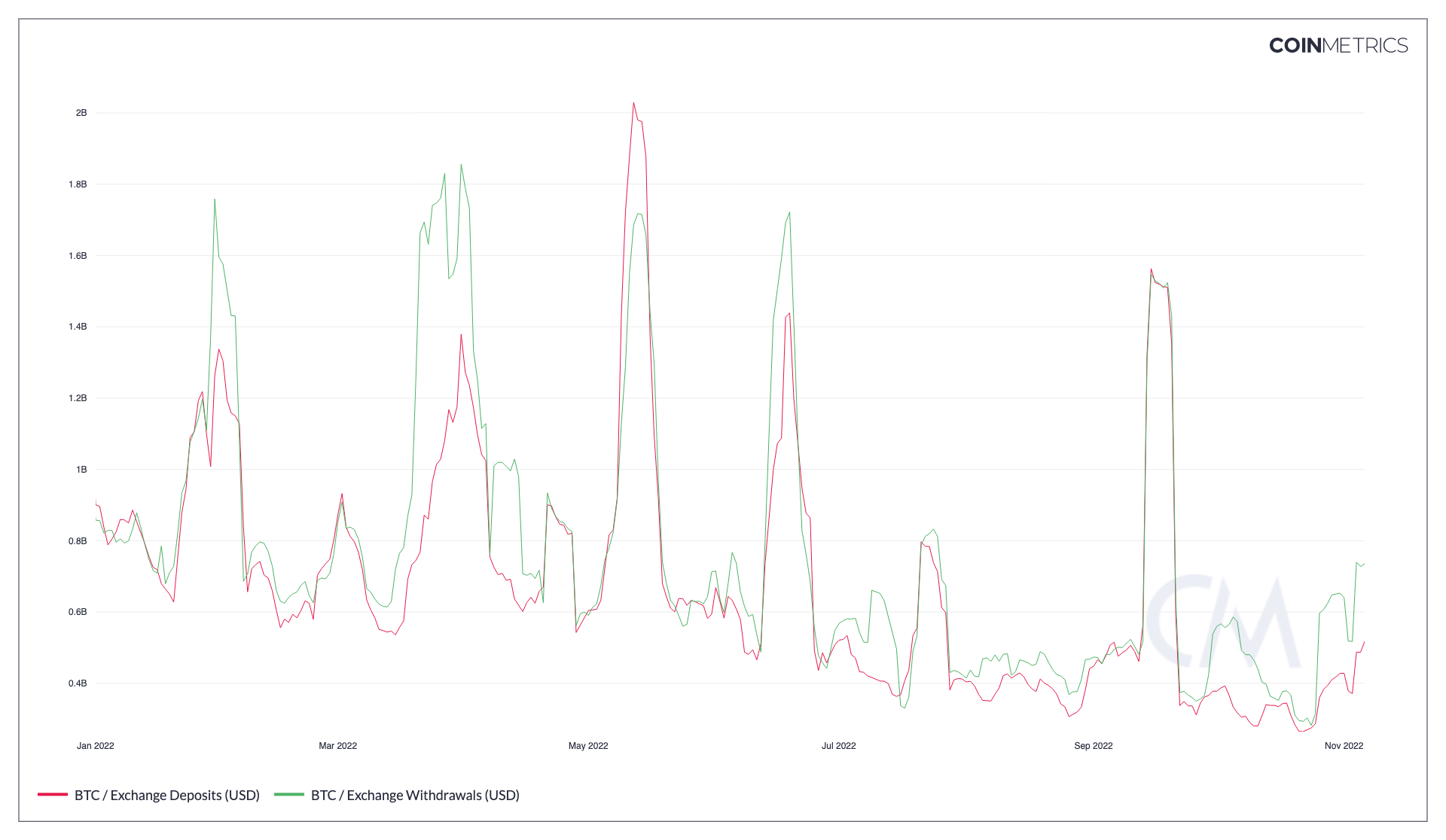

Before we get into this particular on-chain metric, let’s understand what it means. Exchange withdrawals, as the name suggests simply means the amount of BTC tokens measured in US dollars that are being withdrawn from exchange wallets to personal cold wallets. This typically indicates a HODLer behaviour since moving out tokens from exchange wallets to cold wallets involve costs and there’s higher intent to HODL. While on the other side, exchange deposits means the opposite – the amount of BTC tokens, measured in US dollars being deposited onto exchange wallets from external wallets, presumably with the intention to sell or transact.

Thus, from the chart above, we can see there has been a jump in the crypto exchange deposit and withdrawals in the past week and a half. This is a very mixed signal as crashes typically see a large number of exchange deposits and lower withdrawals. But this time around, we saw a much larger value of BTC tokens being pulled out of the exchanges (marked in green) than the BTC tokens being deposited into exchange wallets (marked in red). This could indicate a strong buy-the-dip action happening in Bitcoin’s particular case and could be a silver lining amid the current chaos in the crypto market.

Read more: BTC hash rate analysis

MVRV RATIO INDICATES UNDERLYING STRENGTH

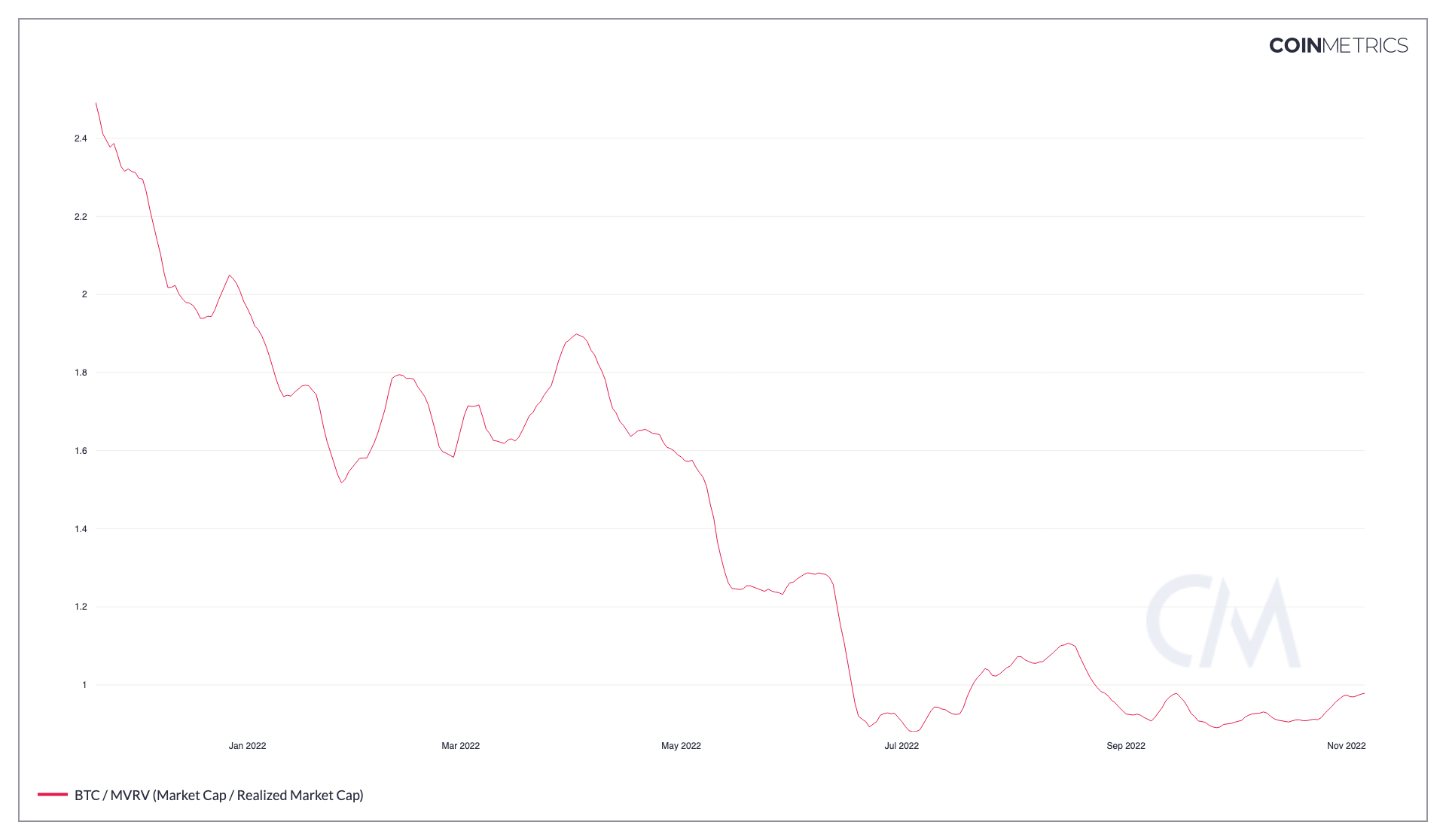

From the chart above, we can see that despite the near 23% drop BTC price has suffered in the past week, its market value to realized value (MVRV) ratio has managed to remain stable, and even gain slightly, currently just shy of the 1 mark. Simply put, MVRV is a ratio that measures when the price of a crypto is above, below or roundabout at its ‘fair value’ and assess market profitability. Hence, a value close to 1 indicates that a large section of those invested in the king coin are at breakeven or at a loss and the likelihood of further corrections is on the lower side and that an accumulation might be underway, which also corroborates with the metric mentioned above.

CONCLUSION

Thus, concluding from all the points above, we can clearly see that from a technical standpoint – things seem extremely bad for Bitcoin price right now. But on the on-chain metric front, we see some underlying strength still sustaining for the king coin. Hence, one can conclude that while immediate short term prospects look weak for Bitcoin, going forward a recovery is very much possible.

Prices as on 14 November, 2022.

Explained in Detail: What caused the FTX Collapse?

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more