Table of Contents

ToggleKey Takeaways:

- Bitcoin’s on-chain metrics suggest that BTC is heavily undervalued in current market circumstances.

- Two renowned valuation metrics – MVRV Ratio and the S2F model suggest that valuations are pretty low.

- Despite that, Bitcoin price continues to sit around the lowest point of 2022 bear run, threatening to breakdown anytime.

Bitcoin price action since the beginning of the year 2022 has been arguably lacklustre. Bitcoin’s market dominance is currently around 41-42%, but had touched 39% at one point in time about a month and a half ago. However, investors must note that Bitcoin price, like most other assets is cyclical in nature. In fact, data suggests that Bitcoin has been profitable in October 77% of the time while over the past nine years, Bitcoin has seen seven Septembers ending in losses, with an average return of -6%. This has held true so well that there are infamous terms like ‘Rektember’ and ‘Uptober’ which happen to be quite popular in the crypto community. But will it hold true this time around?

BITCOIN TECHNICAL OVERVIEW

As you can see from the chart above, Bitcoin price has been trading within a narrow range between $19,000 to about $22,000 for about five months now. It is now trading at the lowest point of the year and barely teetering on the edge, threatening to fall over any time now. It has also formed a descending triangle pattern on the charts (marked in black trendlines) – a well known bearish pattern and a breakdown below it is sure to hurt a lot of investors holding on to BTC.

BTC price is currently trading well below the 200 and just below the 50 day moving averages and is below all significant price levels. The Relative Strength Index is around 43 as of writing which wouldn’t be able to provide any major bullish support either. So overall things seem to be moderately bearish as of now which can quickly escalate if a sub-$19,000 breakdown sustains for long.

Related: Bitcoin Price Prediction

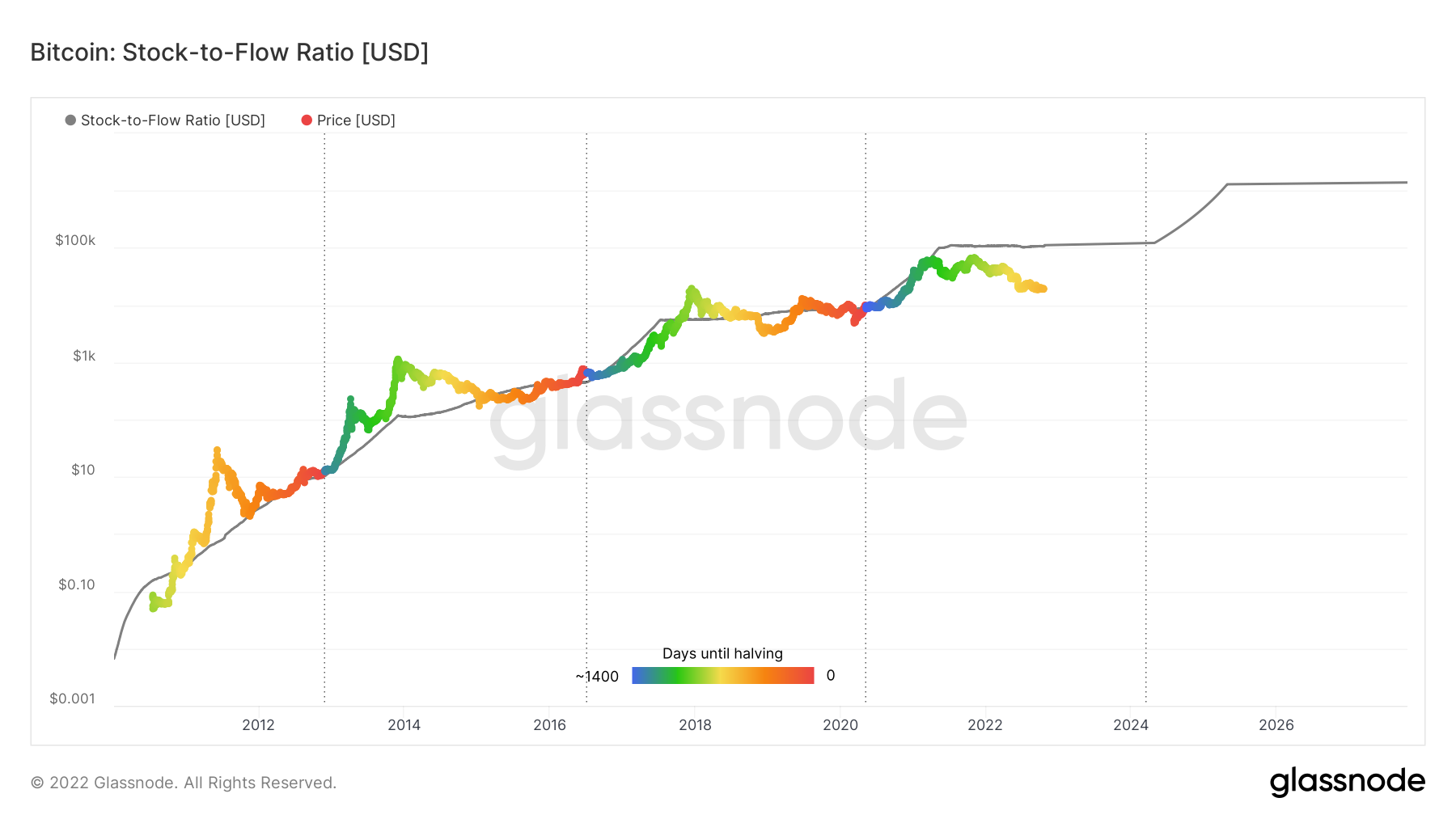

Bitcoin’s S2F model highly undervalued

According to the Stock-to-Flow model, created by a pseudonymous Twitter user – PlanB – Bitcoin is in a highly undervalued situation. The deviation of BTC price from the S2F ratio line (marked in black) is significantly large, and analysing historical numbers, it clearly indicates that BTC is highly undervalued as of now and a rebound should be on the way.

The stock-to-flow model for Bitcoin is basically a long term indicator that depicts when the asset is heavily oversold and when it is heavily overbought or it is at par with its value. S2F model is quite popular amongst veteran Bitcoin investors and even PlanB himself mentioned at the beginning of this month that he is buying into Bitcoin even more than ever.

Related: Bitcoin Technical Analysis

My first bitcoin investment was in 2015 at ~$400 (yellow circle). Most people said bitcoin was dead.

My 2nd investment was in 2018 at ~$4000 when I published the S2F model. Most people said bitcoin was dead.

My 3rd investment is now at ~$20,000. Most people say bitcoin is dead. pic.twitter.com/oUWppoJgxo

— PlanB (@100trillionUSD) October 2, 2022

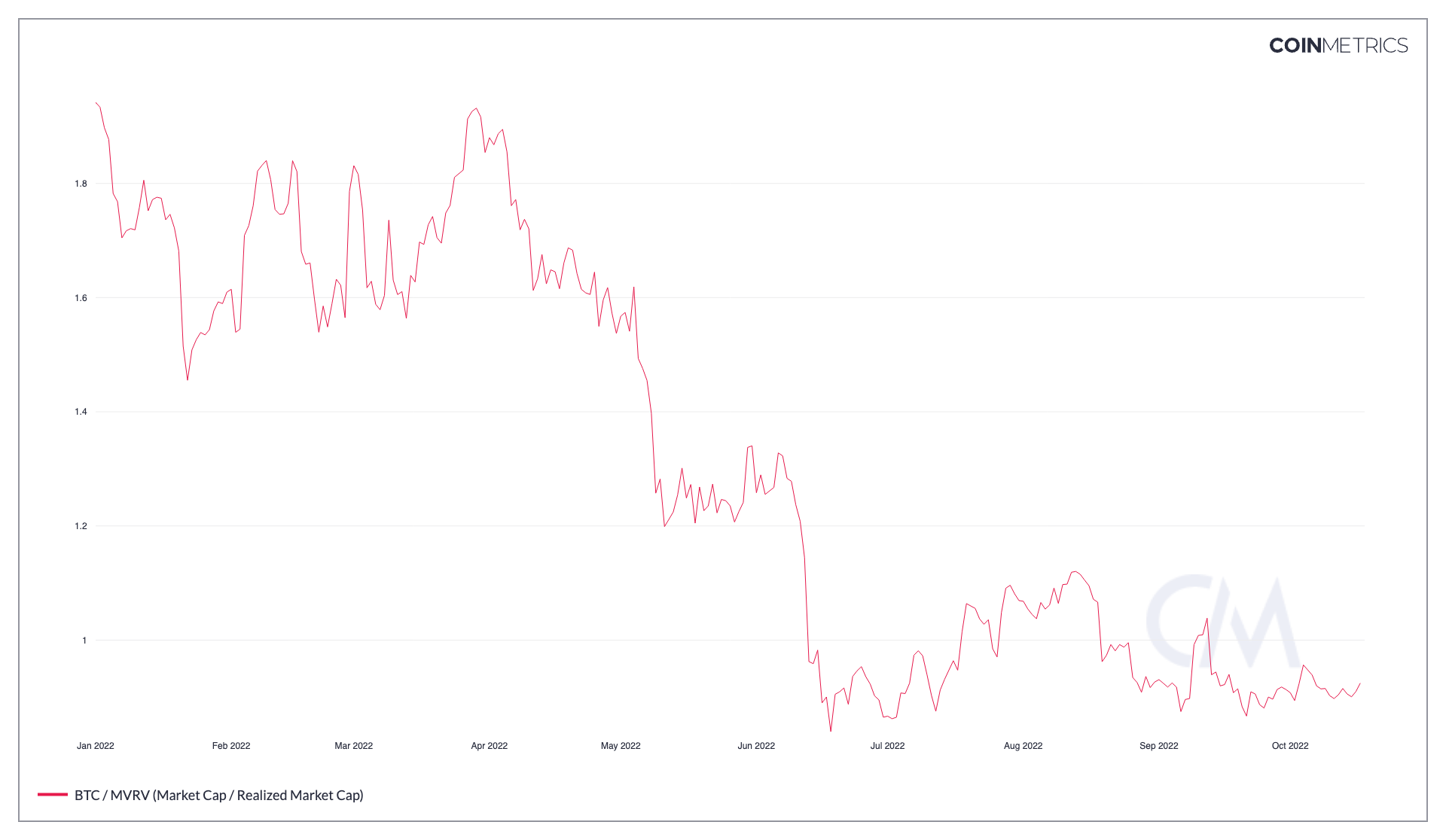

Bitcoin’s MVRV Ratio also hints at undervaluation

MVRV Ratio is essentially a ratio of an asset’s market capitalization versus its realized capitalization. As is evident from the chart above, Bitcoin’s MVRV Ratio is running below 1 ever since June 2022, except for a few momentary breakouts here and there. A lot MVRV Ratio indicates that the market value of Bitcoin supply is decreasing relative (which is but obvious in a bear market) to the realized value (cost basis). Lower values indicate a smaller degree of unrealized profit is in the system which may signal either undervaluation, or poor demand dynamics or both.

And hence, a MVRV Ratio under 1 typically indicates that a large cohort of Bitcoin investors have a supply that is at breakeven or even held at a loss. Hence, this indicates a strong signal of market capitulation and even a late stage bear market accumulation done by major holders in the market. So the logical conclusion is that a market bottom is forming out for Bitcoin at current levels.

Conclusion

So from the above inferences, we can conclude that Bitcoin price particularly, has reached a bottom in the market and a further fall could be unlikely unless there is some major bad news in the crypto market. But the one thing we do not know is how long this bottom will be sustained and when we may see a recovery happening. It could be the next month or the next year even – nobody knows. With high inflation rates across the world, Europe staggering amid the Russia-Ukraine war and other geopolitical events – the market may not show any recovery for a long time and investors need to be prepared for what is to come.

Read more: How much longer will BTC Price hover around $20000

Prices as on 21st October, 2022.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more