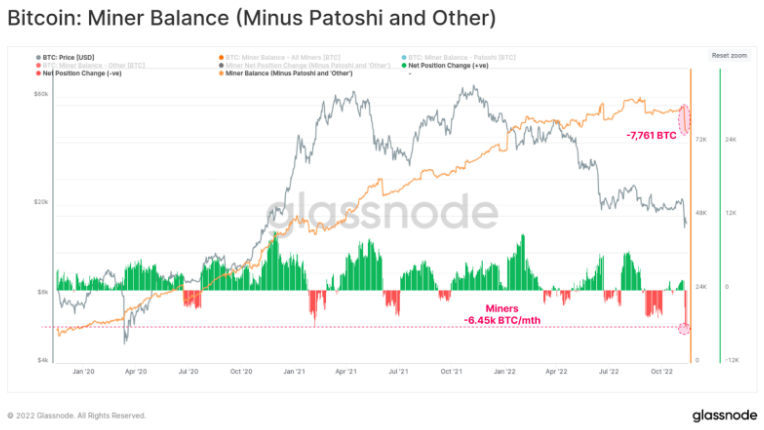

Bitcoin price has been hovering below the crucial resistance ever since the price dropped amid the FTX collapse. While the price seems to be under extreme bearish captivity, BTC miners are also facing huge turbulence to keep up their business running. As a result, the miner reserves are getting dried up, which is creating extreme selling pressure over the token in the open markets.

Moreover, the miners presently appear to be under huge stress as the miner balance has been slashed by nearly 8K BTC. According to the data from Glassnode, the miner balance dropped by 7,761 BTC along, dragging the levels to a 10-month low where the met position remains negative since the beginning of the monthly trade.

Read more on in detail on the: FTX Collapse

Source: Twitter

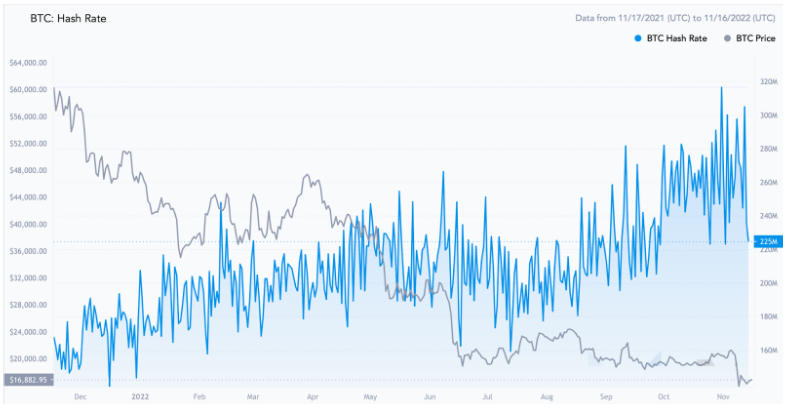

Bitcoin miners solve complex mathematical problems to verify the transactions and add the blocks to the blockchain. To do so, they require high computational power which is measured in terms of hash rate. With the fresh price slash, the miners appear to be in deep waters as they are unable to compensate for the mining requirements.

Hence, this could be the probable reason that the hash rate of BTC is also slumping hard. A drop in hash rate signifies the participation of fewer minors to mine Bitcoin which in turn reduces the competition and the difficulty. It may be hazardous as the risk of a 51% attack intensifies if the hash rate remains lower for some more days.

Read more: Bitcoin Price Prediction

The rate has risen high to mark new highs around 317 MH/s during H2 of October 2022 which has dropped to 225 MH/s at the moment. On the other hand, the average difficulty rose notably from 31.36T to mark a high of around 36.76T at the moment.

The Bitcoin mining companies have been struggling throughout the year as the value of the star crypto has been declining after it faced rejection from yearly highs. If the BTC price continues to drop towards the speculated targets below $15,000, the possibility of miners halting their operations may emerge.

The CEO of Asset manager Capirole, Charles Edwards tweeted that Bitcoin’s electrical costs have spiked for the 2nd time only in the past years. Hence, the average electricity bill for the miner has now raised beyond their income.

Source: Twitter

So now Whether the mining firms are heading towards bankruptcy?

The Terra LUNA collapse has led to a ripple of fallouts within the crypto space, meanwhile, many analysts believe many more bankruptcies are yet to come. The falling price of the large-cap and the small-cap cryptos is squeezing overleveraged miners and hedge funds that have lent money to the crypto space. Therefore, if the crypto space continues to shed more gains, the miner’s margins are expected to be compressed heavily which may be extremely difficult for them to survive through the crypto winter.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more