Key Takeaways:

- Growing Investment Landscape: The data showcases a robust presence of 150 crypto ETPs valued at $50.3 billion, heralding a burgeoning investment landscape within the crypto sphere.

- Spot Bitcoin ETF Anticipation: Anticipation is mounting around the potential approval of spot Bitcoin ETFs in the United States, a move that could potentially double the existing investment volume in the crypto ETP market.

- Global Institutional Interest: The interest in spot Bitcoin ETFs aligns with a global trend of institutional investment in crypto products, underscored by significant net inflows of $1.6 billion into global crypto ETFs.

- Top Performers: Among the 150 crypto funds, the top 20 ETFs garnered considerable investment attention, amassing $1.3 billion in inflows in 2023. Notably, ProShares Bitcoin Strategy ETF witnessed significant individual inflows.

- Potential Industry Transformation: The speculated approval of spot Bitcoin ETFs by the SEC could mark a pivotal moment, potentially transforming the crypto investment landscape and attracting substantial institutional investments.

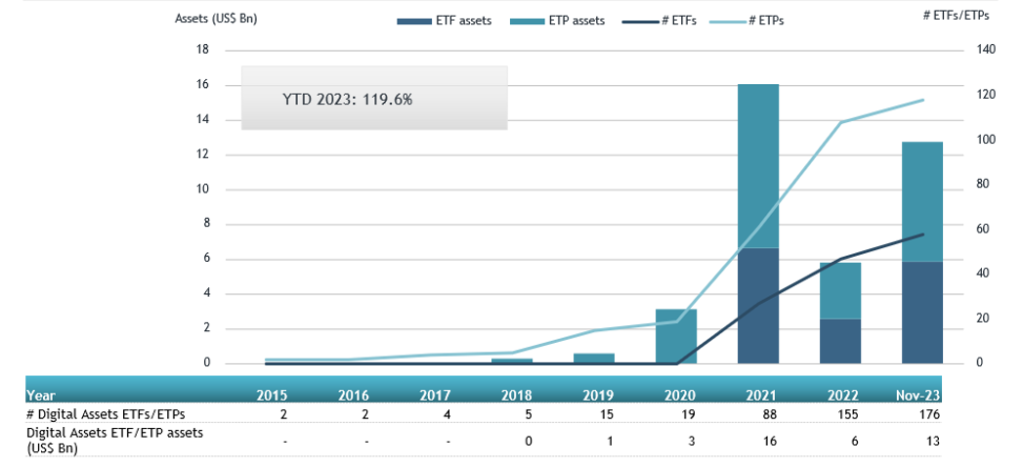

A new report from BitMEX Research has revealed a new trend and underscores the robust presence of crypto Exchange-Traded Products (ETPs) in the market, totaling 150 and boasting $50.3 billion in assets under management. These ETPs span spot and futures funds, predominantly tracking the performance of Bitcoin and Ethereum. Notably, Grayscale’s Bitcoin Trust leads the roster, aspiring to transition into a spot ETF.

Anticipation swells around the potential approval of U.S.-sanctioned spot Bitcoin ETFs, which could revolutionize the crypto ETF space by potentially doubling its investment volume. Bitwise’s forward-looking projection suggests these ETFs could amass a staggering $72 billion within five years. On a more conservative note, Van Eck estimates around $2.4 billion in inflows by Q1 2024.

Complete List of Cryptocurrency Related ETPs

In anticipation of the SEC approving the spot Bitcoin ETFs, we present what we believe to be a comprehensive list of all the existing crypto related exchange traded products

We have found 150 products with $50.3bn of assets, as at 22… pic.twitter.com/cFUxtuvXgd

— BitMEX Research (@BitMEXResearch) December 25, 2023

The prospect of a spot Bitcoin ETF is not novel globally, as several countries, including Canada, Australia, and Germany, have already greenlit such investment vehicles, leaving the US yet to follow suit.

This development aligns with the broader institutional interest in crypto investment products, as observed through a substantial uptick in inflows. ETFGI’s comprehensive report revealed a noteworthy year-to-date net inflow of $1.6 billion into global crypto ETFs. Notably, November alone witnessed a staggering $1.31 billion influx, nearly doubling the $750 million net inflow into crypto ETPs witnessed in 2022.

Among the 150 crypto funds, the top 20 have garnered significant attention, drawing in $1.3 billion in investments throughout 2023. The ProShares Bitcoin Strategy ETF (BITO), originating amidst the bullish crypto market in October 2021, notably recorded an upsurge of $278.7 million in additional inflows over the year. This pronounced momentum underscores a notable shift in investor sentiment favoring crypto ETFs.

The SEC’s speculated approval of spot Bitcoin ETFs is a pivotal juncture, expected to fundamentally transform the crypto investment landscape and attract substantial institutional investments.

Moreover, the surging influx into crypto ETFs reflects growing confidence among investors, affirming the strengthening interest in this burgeoning asset class. This increasing interest is a testament to the evolving perceptions about cryptos and their potential as significant investment opportunities.

As the market awaits the SEC’s verdict on spot Bitcoin ETFs, the potential approval could mark a turning point, unlocking immense opportunities and reshaping the crypto investment terrain. The impending decision carries significant implications, potentially setting off a new wave of investments and escalating the prominence of cryptos in the traditional financial sphere.

Read More: Bitcoin ETF & Ethereum ETF Timeline

Source: CoinTelegraph

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more