Table of Contents

ToggleKey Takeaways:

- SUSHI price has been trading within very narrow regions, not being impacted by the bullish market sentiments

- Despite the volume has maintained decent levels, the bulls are unable to uplift the price levels, which may compel the price to remain consolidated

- Technicals are not in favor of bulls and hence a consolidated trend may continue for a long.

Sushiswap gained massive attention during the DeFi boom in 2020, post to which the token remained largely unnoticed. Meanwhile, the price often underwent giant price actions which have reduced largely in recent times. Now that the crypto space is displaying some strength, will the SUSHI price trigger a recovery phase and reclaim the lost levels?

The platform recently underwent a massive exploit but presently most of the assets are said to be recovered. However, the price remains still without any variation on either side indicating the bulls continue to remain resilient despite the provision to leap longer. Therefore, the SUSHI price may witness a giant price action very soon.

Read more: 1inch Price Prediction

Sushiswap (SUSHI) Technical Overview

Source: Tradingview

- Sushiswap price is trading within a bearish descending triangle and displayed a bearish divergence, aiming to drop towards the lower support

- However, the strength of the rally, determined by the Average Directional Index or ADX is hovering along the middle ranges indicating the presence of the bulls

- Therefore, either the price may drop towards the lower support zone and trigger a rebound after a minor consolidation or the price may slice through the support to test the lower crucial support at $0.574

Sushiswap On-Chain Overview

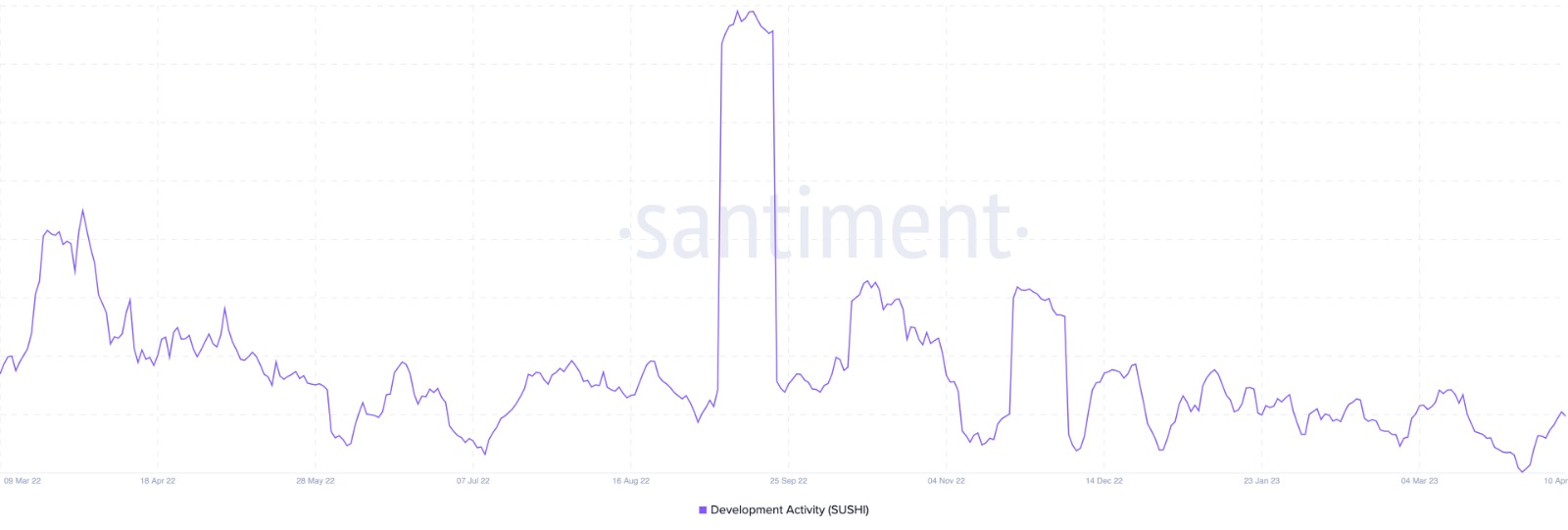

Sushiswap Development Activity

Source: Santiment

The network growth of a token is nothing but the efforts taken by the developing team to deliver new upgrades over the network from a business perspective. The network growth is recorded in the GitHub repositories which are largely public. The rise in the levels induces notable momentum within the token price as confidence in the token surges.

Woefully, the development activity of Sushiswap has dropped heavily in the past few weeks and failed to regain bullish momentum. It indicates less participation of the developers to develop new features.

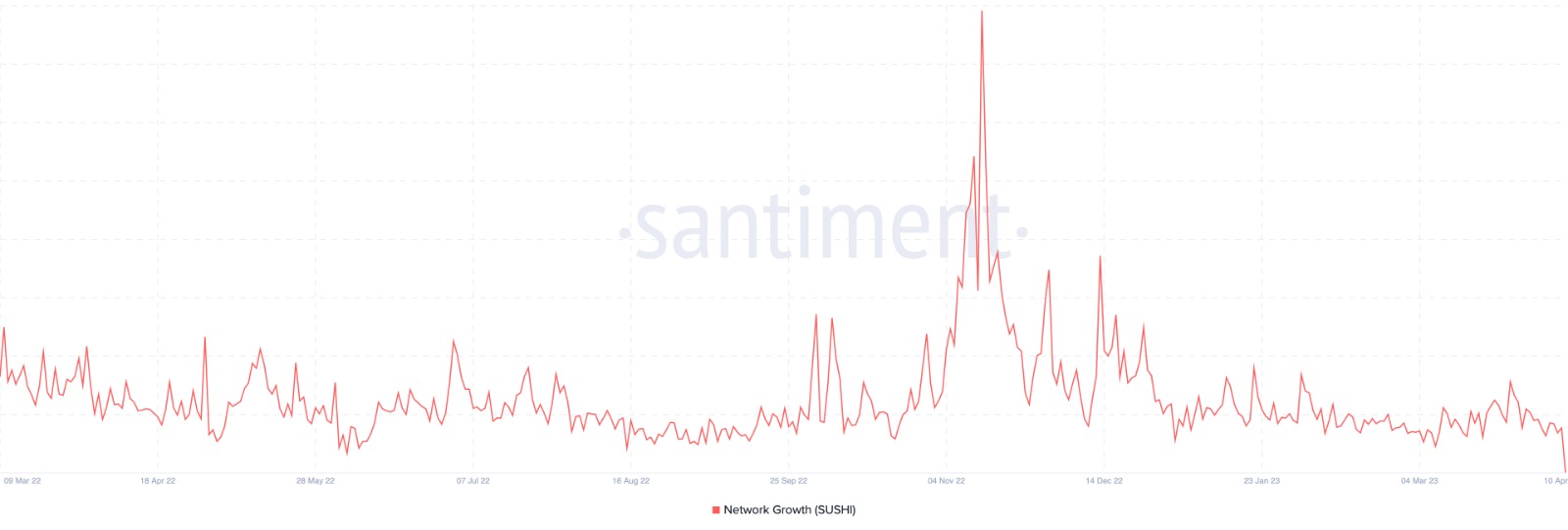

Sushiswap Network Growth

Source: Santiment

The network growth is much similar to that of the Daily active address where the number of active addresses is considered. Network Growth only considered those addresses which have carried out the transaction for the very first time. The metrics indicate the adoption levels of the platform and also enable us to determine whether the price is gaining traction among the other platforms in the crypto space.

Presently, the levels have heavily plunged and are unable to trigger a recovery phase. Therefore, no new addresses are willing to carry out any trades over the platform which may not be a good sign of a healthy rally.

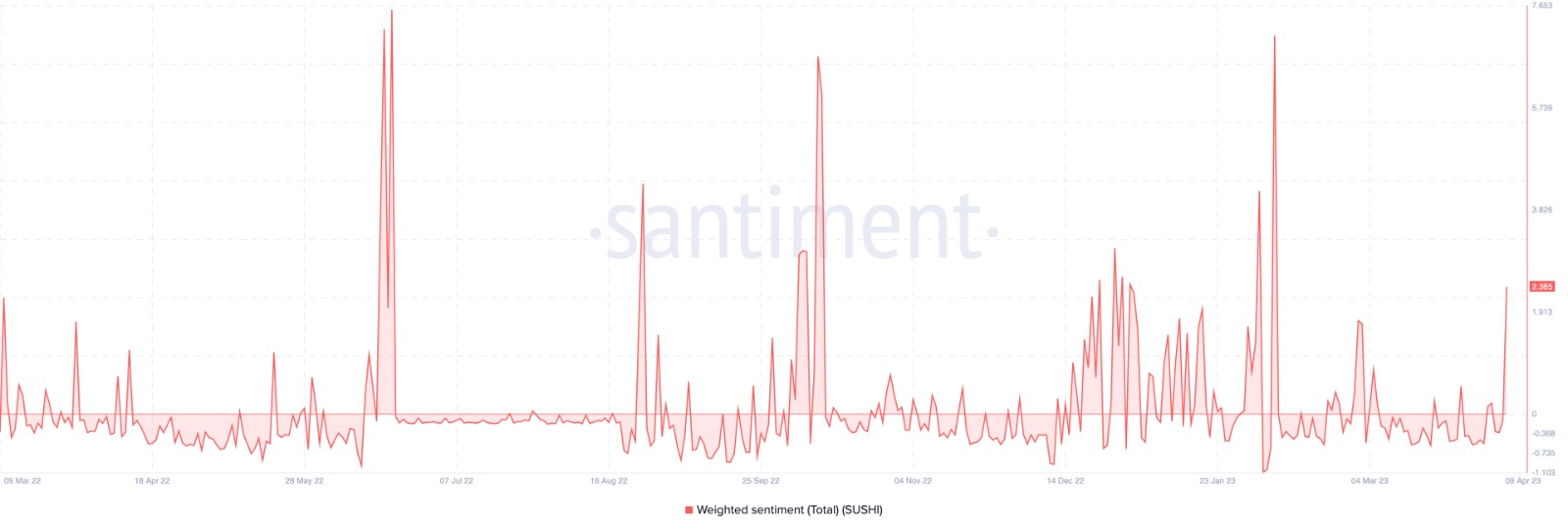

Sushiswap Weighted Sentiment

Source: Santiment

The market sentiments are filled with positives and negatives which are very important to keep up the volatility of the token. The weighted sentiments considered all the comments. posts, etc regardless of whether they are positive or negative, and compares it with the occurrence over time. Generally, prices surge high when the sentiment is high and bottom when low.

Presently, the sentiments have soared high within the positive ranges after hovering within the negative ranges for quite a long time. Therefore, a notable impact on the price may be expected that may lift it above the consolidation phase.

Know more: Volt Inu Price Prediction

Concluding Thought

Collectively, bearish clouds continue to hover over the Sushiswap price as the technicals suggest the bulls have no scope at the moment. Therefore, the present consolidation is expected to prevail for a long time which may enable the bulls to accumulate some strength and trigger a significant upswing in the coming days ahead.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more