Table of Contents

ToggleKey Takeaways:

- Launch Date Confirmed: Spot Ethereum ETFs are anticipated to launch on Tuesday, July 23, as confirmed by multiple sources and Bloomberg’s Senior ETF Analyst, Eric Balchunas.

- SEC Requirements: The SEC has requested issuers to include the Sponsor Fee in their final S-1 filings, which must be submitted by Wednesday, July 17, at 5:30 p.m. EST.

- Major Players Involved: Wall Street giants like BlackRock, Fidelity, VanEck, and Franklin Templeton are among the asset managers expected to debut their Ethereum ETFs simultaneously.

- Market Impact: Ether’s price surged by 7.1% in anticipation of the ETF launch, mirroring the significant market impact observed during the launch of spot Bitcoin ETFs earlier this year.

- Potential Inflows and Volatility: Analysts expect substantial but more modest inflows into Ethereum ETFs compared to Bitcoin ETFs, with projections of around $1 billion in monthly inflows, despite the smaller market size and trading volume of Ether.

The crypto community is abuzz with anticipation as Spot Ethereum ETFs are set to begin trading next Tuesday, July 23. This launch marks a significant milestone for the crypto market, opening up new investment opportunities for traders and investors. According to sources, this development has been confirmed by Bloomberg Senior ETF Analyst Eric Balchunas and insiders at two major issuers.

Confirmation and Final Steps

Eric Balchunas shared the news on social media platform X, stating, “Hearing SEC finally gotten back to issuers today, asking them to return final S-1s on Wed (incl fees). And then request effectiveness on Monday after close for a Tuesday 7/23 launch.” This statement was corroborated by two sources from the issuing firms, confirming the impending launch date.

Issuers are required to submit their final S-1 filings, including the Sponsor Fee, to the US Securities and Exchange Commission (SEC) by Wednesday at 5:30 p.m. EST. This step is crucial for gaining the final approval needed to begin trading on the proposed launch date.

SEC greenlights #Ethereum (#ETH) ETFs to commence trading on July 23. Bloomberg’s Eric Balchunas notes issuers must finalize S-1 forms by Wednesday and apply for effectiveness by next Monday’s close for a Tuesday launch.

Once Ether ETFs hit the market, they could see inflows of… pic.twitter.com/ozbrLS4xba

— Collin Brown (@CollinBrownXRP) July 16, 2024

Major Players and Regulatory Approval

Wall Street giants like BlackRock and Fidelity have been in discussions with the SEC for weeks, eager to launch their spot Ethereum ETFs. These firms have been working diligently to meet the regulatory requirements set by the SEC, which granted preliminary approval for key regulatory filings in late May. However, before these ETFs can hit the market, the SEC must approve the final S-1 filings.

This launch follows the successful introduction of spot Bitcoin ETFs in January, a move that took nearly a decade of negotiation with the SEC. The approval of these Bitcoin ETFs marked a significant victory for the crypto industry, which had been pushing for broader acceptance and integration into the financial mainstream.

Additional Read: Ethereum Price Prediction

Market Reaction and Expectations

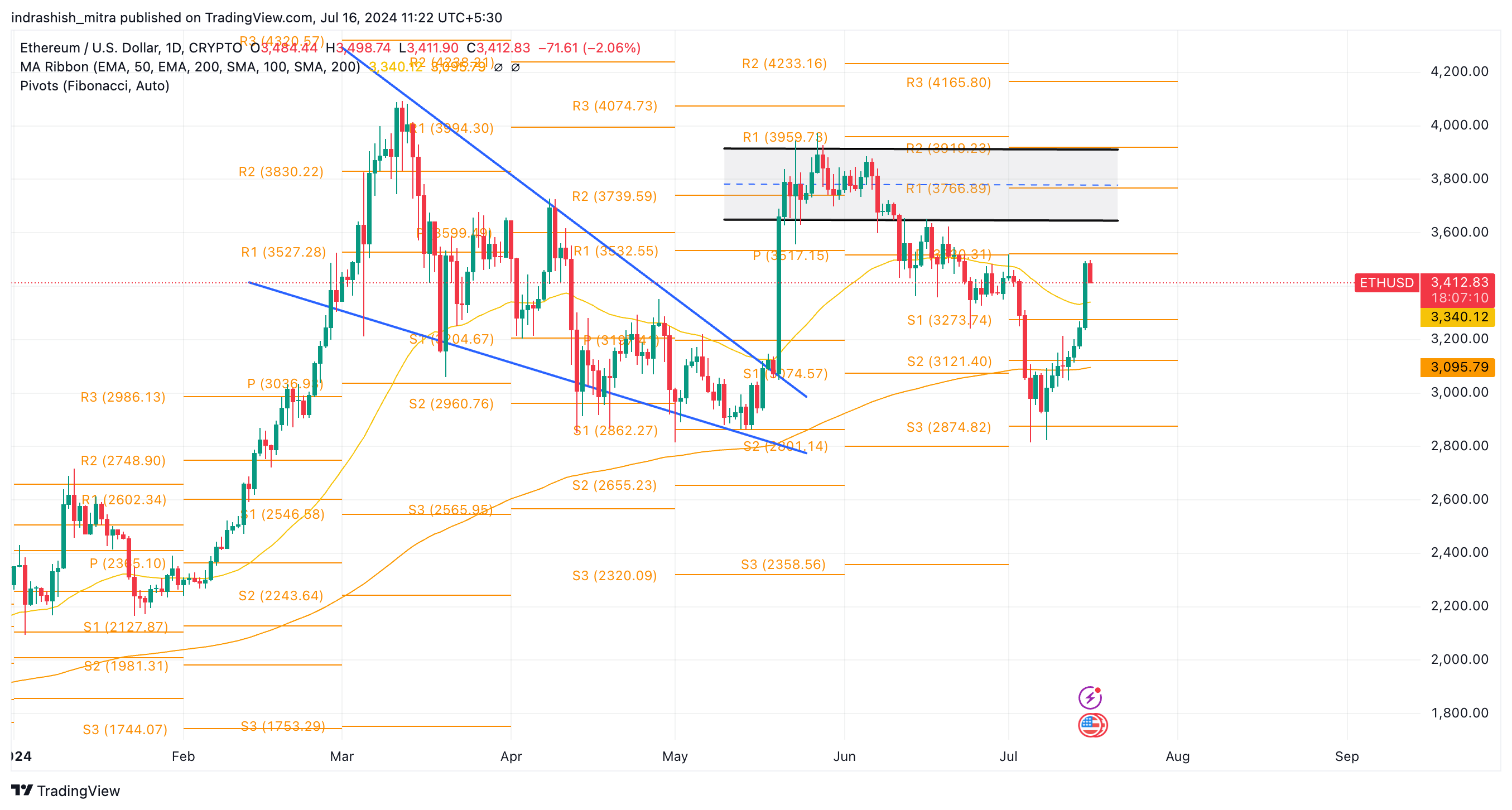

The anticipation of the Ethereum ETFs has already influenced the market, with Ethereum Price (ETH) rising significantly. On Monday afternoon, ETH was trading at $3,433.07, marking a 7.1% increase for the day and a 14.4% gain over the past week. This surge reflects the high expectations and optimism surrounding the upcoming launch.

Martin Leinweber, digital asset product strategist at MarketVector Indexes, advises tempering expectations regarding the inflows into the new ETFs. He notes that Ether’s smaller market size and trading volumes compared to Bitcoin could result in more volatility. Despite this, the introduction of Ethereum ETFs is expected to drive significant interest and investment.

Industry Impact and Future Prospects

The approval and launch of Ethereum ETFs represent another major step forward for the crypto industry. Following the success of Bitcoin ETFs, which attracted $6.6 billion in assets within the first three weeks and $33.1 billion in inflows by the end of June, the Ethereum ETFs are poised to further legitimize and mainstream crypto investments.

Thomas Perfumo, head of strategy at crypto exchange Kraken, emphasized that even if the inflows into Ethereum ETFs do not match those of Bitcoin ETFs, they will still be considered successful. Given Ether’s market value of $359 billion compared to Bitcoin’s over $1 trillion, more modest inflows are expected but still substantial.

Read On: Ethereum Price Post ETF Approval

A Look Ahead

The journey to this point has been long and filled with challenges. Issuers began filing for Ethereum ETFs in September, initially facing discouraging feedback from the SEC. However, the regulatory landscape shifted in May when the SEC approved rule changes necessary for listing these products.

SEC Chair Gary Gensler mentioned that the ruling on Grayscale’s Bitcoin ETF had influenced his thinking on Ethereum products, as the underlying market conditions were similar. This shift in regulatory approach paved the way for the current developments.

In conclusion, the launch of Spot Ethereum ETFs on July 23 signifies a pivotal moment for the crypto market. As investors and traders prepare for this new opportunity, the industry anticipates a broader acceptance and integration of digital assets into the traditional financial system. Stay tuned for further updates as we approach this historic launch date.

Source: Reuters

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more