Table of Contents

ToggleKey Takeaways:

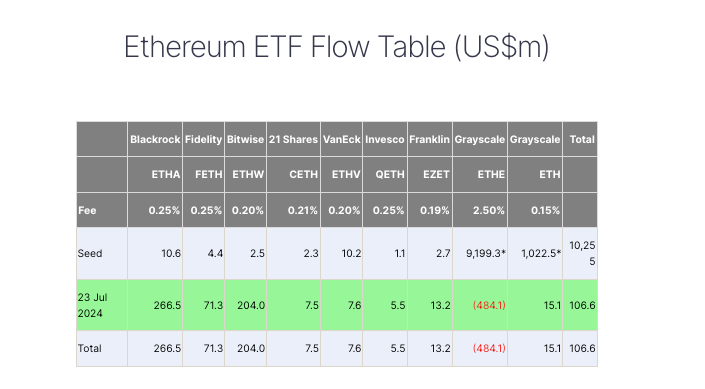

- Strong Debut for Spot Ethereum ETFs: The newly launched spot Ethereum ETFs posted net inflows of $106.6 million on their first day of trading, highlighting robust investor interest.

- Leadership by BlackRock and Bitwise: BlackRock’s iShares ETF (ETHA) and Bitwise’s Ethereum ETF (ETHW) led the pack with net inflows of $266.5 million and $204 million, respectively.

- Grayscale’s Outflows: Grayscale’s Ethereum Trust (ETHE) experienced significant outflows of $485 million on the same day, as investors took advantage of the new spot ETF options.

- Cumulative Trading Volume: The combined trading volume for these new spot ETH funds reached $1.08 billion on their debut, reflecting substantial market activity and interest.

- Price Impact: Despite the positive inflows, Ethereum (ETH) price saw a slight decline, trading at $3,451, down 1.4% over the last 24 hours and 1.5% over the past week.

United States Ether exchange-traded funds (ETFs) made a remarkable debut, posting net inflows of $106.6 million on their first day of trading. This positive start came despite substantial outflows from Grayscale’s Ethereum Trust, which saw $485 million in withdrawals.

BlackRock and Bitwise led the new entries, with BlackRock’s iShares ETF (ETHA) attracting $266.5 million and Bitwise’s Ethereum ETF (ETHW) drawing $204 million in net inflows. Fidelity’s Ethereum Fund (FETH) followed with $71.3 million in new investments.

The influx into these new spot Ethereum ETFs outweighed the significant outflows from Grayscale’s Ethereum Trust (ETHE), which experienced nearly $485 million in withdrawals. This figure represents approximately 5% of the fund, which once held assets worth $9 billion. The Grayscale Ethereum Trust, launched in 2017, had previously restricted investors with a six-month lock-up period on investments. Its recent conversion to a spot ETF allows investors to sell shares more freely, potentially explaining the high volume of outflows.

Know More: Bitcoin & Ethereum ETF Timeline

Dynamics of Inflows and Outflows

In January, the launch of spot Bitcoin ETFs also resulted in similar outflows from Grayscale’s Bitcoin Trust (GBTC), which saw over $17.5 billion in withdrawals following the introduction of 11 new spot BTC funds.

The Ethereum ETFs notched $106.6 million worth of inflows on day one | Source: FarSide / CoinTelegraph

Meanwhile, Grayscale’s Ethereum Mini Trust, a lower-fee spinoff product, managed to generate $15.2 million in new inflows. Franklin Templeton’s fund (EZET) netted $13.2 million, and 21Shares’ Core Ethereum ETF (CETH) saw $7.4 million in new investments.

Overall, the spot ETH funds recorded a cumulative trading volume of $1.08 billion on their first day. This volume is 23% of what the spot Bitcoin ETFs achieved on their debut, highlighting significant interest in Ethereum-based ETFs.

Market Reaction and Implications

Despite the positive net inflows, Ethereum price (ETH) saw a slight decline on the day. ETH was trading at $3,451 at the time of publication, down 1.4% over the last 24 hours and 1.5% over the past week, according to TradingView data.

The approval from the Securities and Exchange Commission (SEC) on July 22 paved the way for these ETFs to begin trading on July 23. Five ETFs commenced trading on the Chicago Board Options Exchange (CBOE), including the 21Shares Core Ethereum ETF, Fidelity Ethereum Fund, Invesco Galaxy Ethereum ETF, VanEck Ethereum ETF, and Franklin Ethereum ETF. Additionally, four more spot ETH ETFs are expected to list on Nasdaq or the New York Stock Exchange (NYSE) Arca soon, although official announcements from these exchanges are still pending.

Know More: Ethereum Price Prediction

Conclusion

The launch of spot Ethereum ETFs represents a significant milestone for the crypto market. Despite initial outflows from established trusts like Grayscale’s, the net positive inflows into these new funds underscore strong investor interest and confidence in Ethereum as an asset. The introduction of these ETFs not only provides a new investment avenue but also enhances market liquidity and accessibility, potentially driving broader adoption of Ethereum in the financial markets.

As the market continues to evolve, the performance and impact of these new ETFs will be closely watched, offering insights into the future trajectory of crypto investments and the role of digital assets in traditional finance.

Source: CoinTelegraph

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more