Table of Contents

ToggleKey Takeaways:

- SOL’s Technical Journey: SOL price embarked on a significant uptrend from sub-$10 to nearly $26 earlier in the year. Yet, in June, it faced a notable dip to $14.

- Impressive Recovery: After the dip, Solana’s price exhibited a remarkable recovery, surging from $14 to $30 and then settling around $18 before rallying 25% from late September 2023. Currently, it’s finding support near the R2 level of the Fibonacci pivot points.

- Chart Patterns: SOL price formed a symmetrical triangle pattern on the charts, breaking out convincingly. The notable levels to watch are $27 as resistance and $18.5 as support.

- Golden Crossover: SOL’s 50-day and 200-day exponential moving averages are on the verge of a bullish golden crossover, which could trigger a surge in buying activity.

Solana Technical Overview

- Analyzing SOL price from a technical perspective, it embarked on a substantial upward journey earlier in the year, soaring from below $10 to nearly reaching the $26 threshold.

- Between February and May 2023, the SOL price demonstrated remarkable stability, maintaining its value above the crucial $20 support mark on the price charts. However, the picture changed in June 2023 when a substantial market crash led to a descent to $14.

- Soon after this decline, Solana’s price executed an extraordinary recovery compared to other cryptos within the top 10 by market capitalization. It bounced back from the $14 level, briefly surging to $30 and then settling down around $18 for a while in the month of September before staging yet another rally that began on September 28, 2023.

- Solana price action has rallied a solid 25% since September 28, 2023 – and is currently taking support near the R2 level of the Fibonacci pivot points. If this holds well, a follow-on rally can ensue very soon!

- From a broader perspective, Solana’s price formed a symmetrical triangle pattern on the charts. Just a few days into this pattern, the altcoin successfully experienced a convincing breakout, currently trading at around $24 as of the time of writing this article.

- Notable price levels to monitor include $27 as a resistance region on the upside and $18.5 as a support zone on the downside.

- Conversely, SOL’s 50-day and 200-day exponential moving averages are showing signs of a possible bullish golden crossover. This significant development, coupled with a golden crossover, is anticipated by the experts to bring a fresh surge of buying activity in SOL price action.

Read More: Solana Price Prediction

Solana On-chain Overview

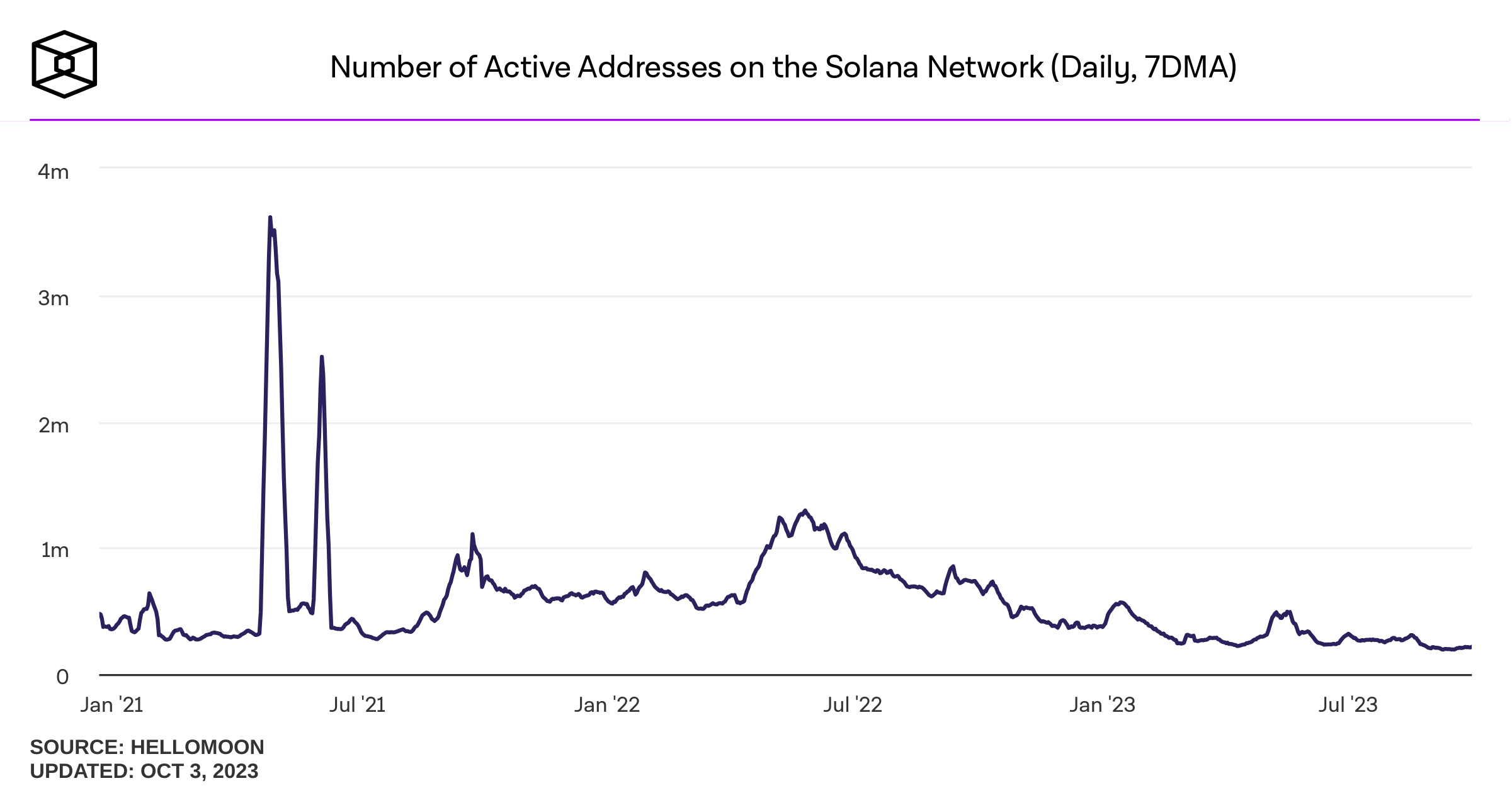

Solana Active Addresses Count

Observing the chart provided, one can discern a consistent decline in Solana’s Active Address Count throughout 2023. To be precise, from the outset of 2023, Solana’s active address count has plummeted from a peak of 566,000 to 200,000 at the time of composing this piece, marking a substantial 65% decrease. Cast your mind back to 2021, and Solana boasted significant active address counts on its blockchain, particularly in May 2021, when the initial phase of the 2021 bull run was witnessed. However, since the start of the current bear market cycle back in May 2022, Solana’s active address count has maintained a consistent downward trajectory.

While this dip in the active address count may raise concerns, it is crucial to recognize that such a decrease on a blockchain network is not unusual, particularly in an extended bear market like the one we are presently experiencing.

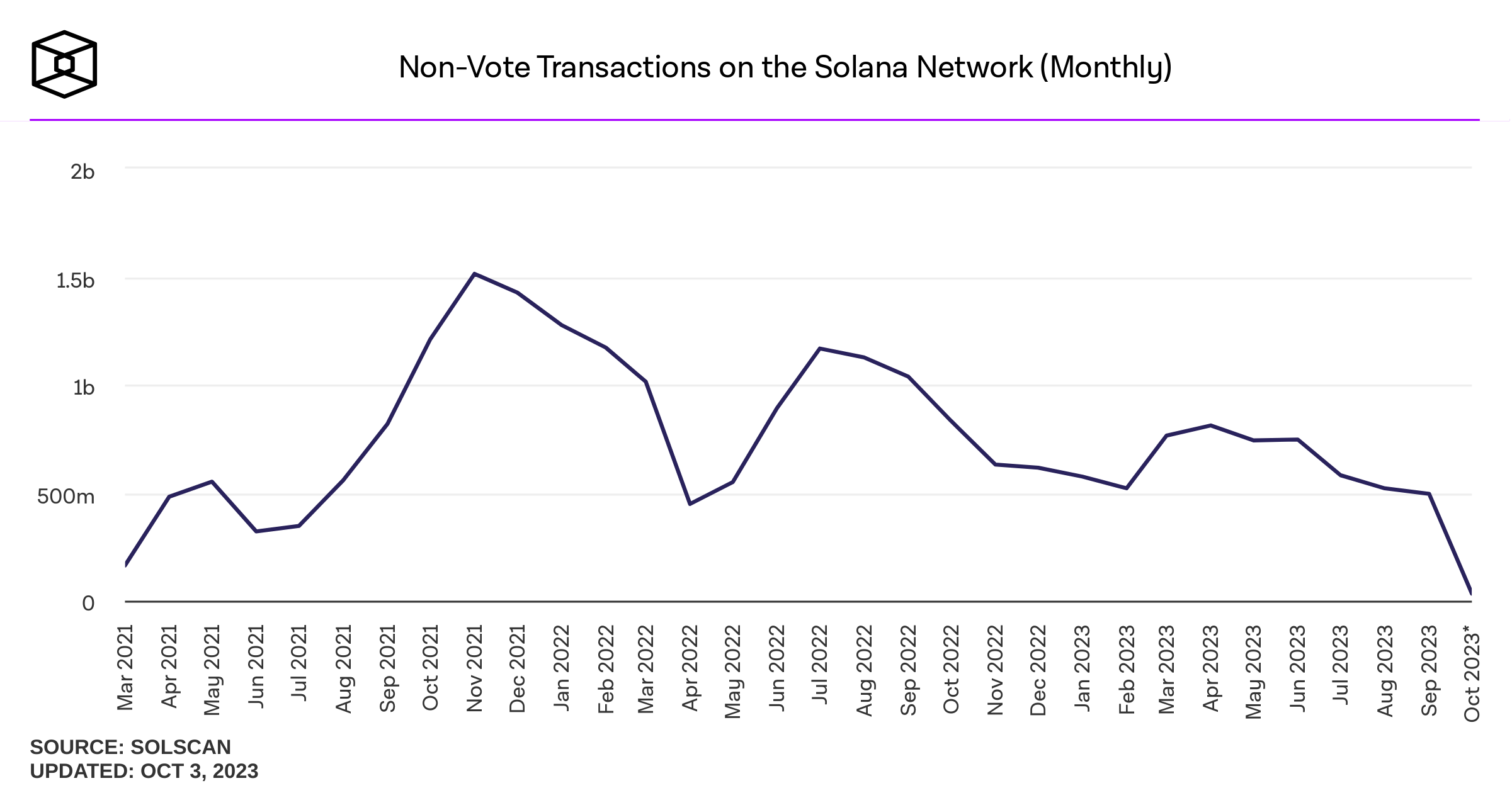

Non-Vote Transactions on the Solana Network (Monthly)

Solana’s network is more than just a platform for validating votes. It’s also a thriving ecosystem where various activities take place. Non-vote transactions play a significant role on the Solana network and are just as vital as the voting process. Non-vote transactions refer to actions on the Solana blockchain that don’t pertain to voting in the consensus mechanism. They encompass a multitude of activities, such as executing smart contracts, transferring SOL tokens, interacting with decentralized applications (dApps), and more.

The Solana network is designed to handle a vast number of these non-vote transactions rapidly and cost-effectively. This efficiency makes Solana attractive to developers and users alike. They can perform various tasks seamlessly, whether it is creating and deploying dApps, trading tokens on decentralized exchanges, or interacting with DeFi protocols.

A declining metric for “Non-Vote Transactions on the Solana Network” suggests a potential decrease in network activity beyond the core voting process. This could signify reduced usage of dApps, fewer token transfers, or diminished interaction with decentralized protocols. While a drop in non-vote transactions can be expected during bearish market conditions, it may also indicate a slowdown in the network’s utility or a shift in user behavior. Monitoring this metric is essential as it can offer insights into the overall health and adoption of Solana’s blockchain ecosystem, potentially affecting investor sentiment and development efforts.

Conclusion

Solana’s price journey in 2023 has been marked by significant swings. Despite the volatility, its recent rally and strong technical signals suggest potential for further gains. Key support and resistance levels play a crucial role in its price action. Additionally, the network’s decreasing “Active Address Count” raises some concerns, although this is common during extended bear markets.

Solana’s efficiency in handling “Non-Vote Transactions” showcases its utility, making it attractive to developers and users. However, a decline in this metric could indicate shifting user behavior or reduced activity in its ecosystem, affecting investor sentiment and development efforts. Monitoring these factors will be essential in assessing Solana’s future prospects.

Values as of October 4, 2023.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more