Table of Contents

Toggle- Sandbox price recorded spectacular gains in the past 24 hours with a rise beyond 25% to climb close to $0.9

- The bulls appear to have gained huge dominance due to which the price may remain inflated for the rest of the year, sustaining above $1

- With a giant price action during the previous day, the SAND price close the trade around $0.9113 with a market capitalization of $1.33 billion and a circulating supply of 1.49 billion

Read More: Decentraland Price Predictions 2023

The Sandbox price has gained a significant upswing in recent times as massive positive sentiments have coiled up following a collaboration with the Saudi Arabia Digital Government Authority(DGA). Many countries are moving ahead to become the Metaverse Hub and the United Arab Emirates (UAE) is one among them. The country recently showed interest in building its own metaverse and has been exploring policies and investments with regard to cryptos and Web3.

As per the latest update, the Metaverse pioneer The Sandbox platform has signed a Memorandum of understanding (MoU) with Saudi Arabia to build multiple metaverse projects. The COO and co-founder of Sandbox, Sebastian Borget, announced the collaboration and said,

“It was a true honor to sign our MOU partnership ceremony with Saudi Arabia Digital Government Authority(DGA) and we look forward to exploring, advising, and supporting mutually each other in activations of the Metaverse,”

The Sandbox Token Technical Overview

Source: Tradingview

- The SAND price has maintained a notable upswing since the beginning of the year 2023 and has been trading within an ascending trend forming constant higher highs and lows

- The recent upswing raised the price from the lower support to the higher resistance, wherein the price is experiencing a slight pullback which cannot be validated as a rejection

- The RSI is displaying a bearish trend but the MACD is extremely bullish, hence the price may be compelled to hover within narrow ranges

- However, if the bears enhance their grip over the rally, then a notable price drain may lead the token to test the support at $0.7, else may continue with a brief consolidation around $0.9.

- After reaching the edge of the consolidation, the price rises slightly above the resistance but the bears may quickly slash the price toward the lower support

Additional Read: Top Metaverse Projects 2023

The Sandbox Token On-Chain Analysis

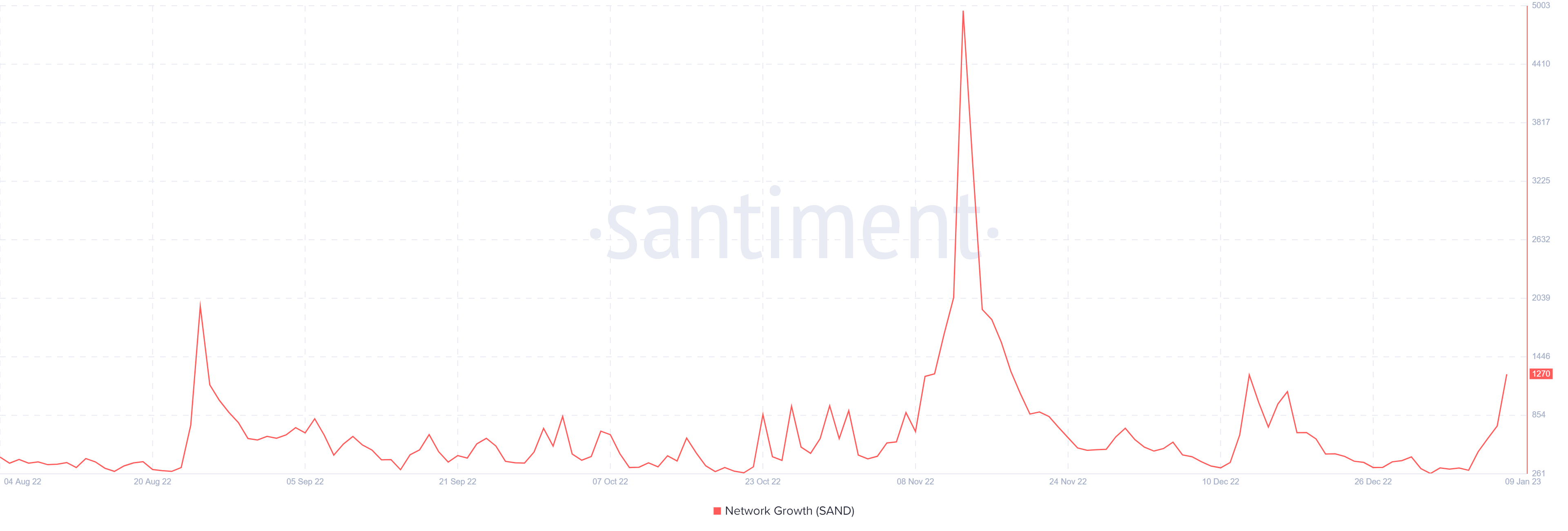

The Sandbox Network Growth

Source: Santiment

The network growth of the platform is calculated by the number of new addresses performing their first trade. It signals the user’s attention and adoption of the platform which may also be used to determine whether the project is gaining or losing traction. It basically indicates the number of new addresses created each day.

The network growth of the Sandbox has been negative lately as new addresses added to the platform were below 500. However, with the recent price action, the levels appear to be amplified to a large extent signifies massive user adoption.

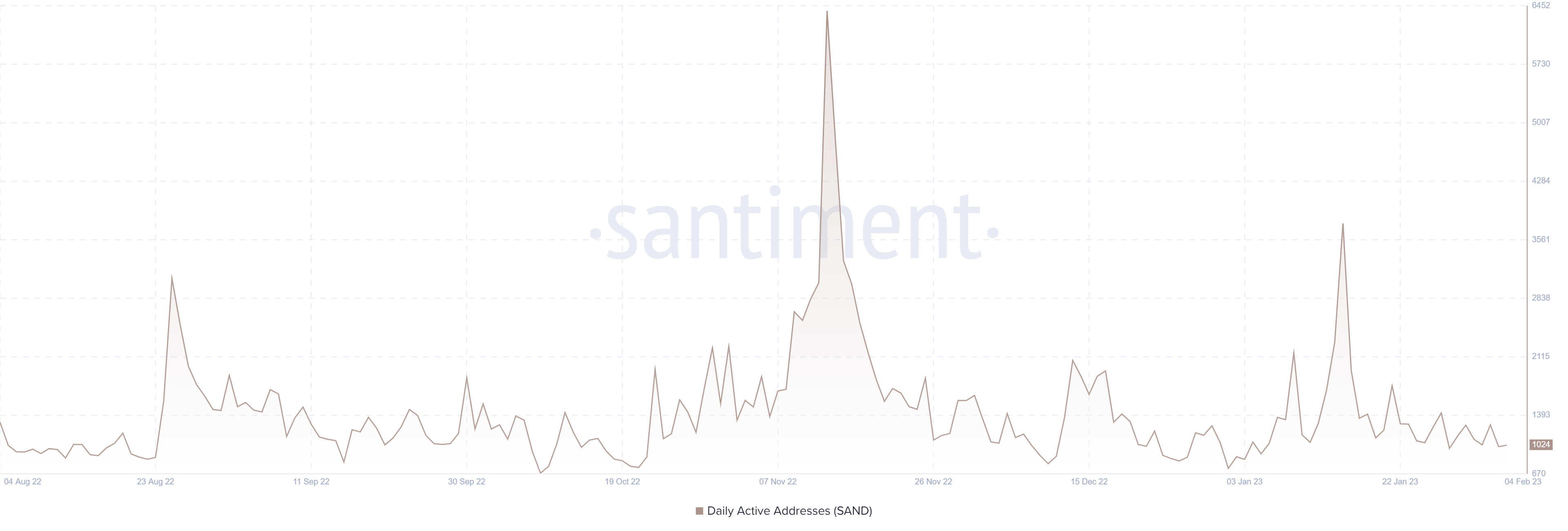

The Sandbox Daily Active Address

Source: Santiment

The daily active address is much similar to the network growth, but the DAA count considers all the addresses performing trade over the platform. Each address is considered only once per day, regardless of whether they are buying or selling or swapping, or performing multiple trades within the day. A rise denotes an increase in user action over the platform which further impacts the price as the volatility could have intensified notably.

In the case of the SAND price, the DAA has been testing the lower levels, maintaining a descending trend, although a couple of minor spikes were recorded in between. Therefore, it indicates the lowered interest of the market participants.

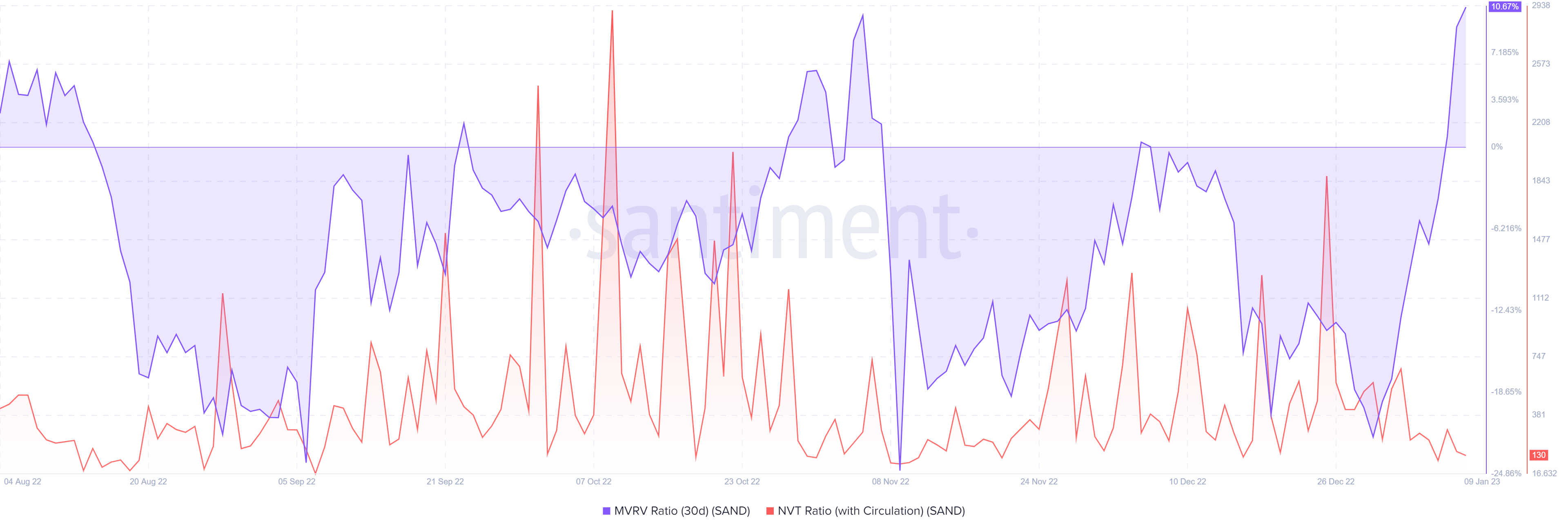

The Sandbox MVRV & NVT Ratio

Source: Santiment

The MVRV ratio is the comparative ratio between the market capitalization and the realized cap to get the fair value of the token. If the fair value is less than the current value, then the token is overvalued and may drop anytime. Besides, the levels being lower than the fair value, it indicates the price is undervalued and carrying the possibility of a rebound. The NVT ratio is the trend comparison between the transaction volume and the market cap.

Presently, the MVRV ratio has spiked high and hovering within the positive range indicating the token is overvalued. Therefore, the possibility of an interim pullback is possible as the traders are willing to sell the token to extract their profits. Meanwhile, the NVT ratio is dropping which indicates that the translation volume is growing faster than the market cap. This indicates that investor sentiment is bullish.

Concluding Thought!

The Sandbox token has risen significantly above the bearish captivity and the recent price action has fueled the hopes for the impending upswing. While the network growth and the DAA indicate the growth in the number of users, the MVRV & NVT ratio indicates the price action to remain bullish, discarding the bearish possibilities.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more