Table of Contents

ToggleKey Takeaways:

- XRP price is displaying immense bullish momentum over the past few days, printing consecutive green candles

- The bulls appear to have gained enough bullish momentum and hence could hold the price above the bearish influence

- The market participants appear to be bewildered on XRP’s next course of action as sentiments are bearish but the technicals flash towards a bullish breakout

Since the speculation around the Ripple vs SEC lawsuit has been positive, the XRP price has been displaying tremendous bullish momentum. The price has been bullish for the past couple of days, regardless of the fact that the top cryptos are trading sideways. Amidst all these speculations and assumptions, Ripple continues to strengthen its cross-border payments with the launch of a CDBC platform.

Ripple, in the latest update, launched a frictionless end-to-end solution called the Ripple CBDC platform for central banks, governments, and other financial institutions. The platform encourages issuing their own central bank digital currency, leveraging the power of blockchain technology over the XRPL.

The platform aims to address multiple use cases, and along with issuing a stablecoin, it offers its customers ledger technology powered by the XRPL ledger. It also enables issuers to manage the full life cycle of their fiat-based digital currency. Besides, it also offers operators and end-user wallets.

XRP Technical Overview

Source: Tradingview

- The XRP price in the short term appears to be extremely strong as it has been surging for nearly a week

- In the weekly chart, the price is approaching the crucial resistance again, despite being rejected multiple times in history

- The Bollinger bands after a minor squeeze, pulled a massive leg up but failed to cross the resistance levels at $0.56. However, the bands have begun to squeeze again which may now break above these levels, validating a fine upswing ahead

- Moreover, the RSI is rising, maintaining a fine upswing that may help the price to hold above the lower support in case of a steep bearish action

Read more: Ripple Price Prediction

XRP On-Chain Overview

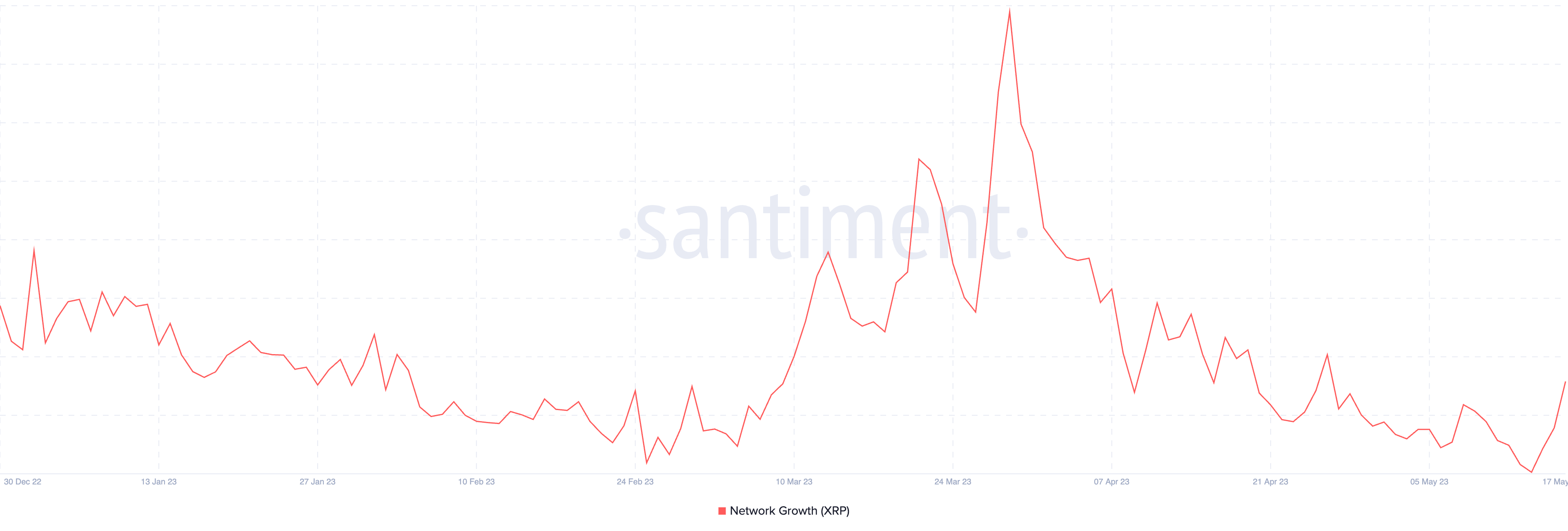

XRP Network Growth

Source: Santiment

The network growth is more or less similar to that of the daily active address, which considers all the addresses that interacted with the platform. Meanwhile, the network growth considers one of the new addresses or those addresses that have transacted for the first time. It illustrates user adoption over time and also determines whether the project is gaining or losing traction over time.

The network growth of XRP has been plunging heavily ever since it marked its high in mid of March 2023. The levels, after marking lows below 1000, slightly rebounded to reach close to 1300. However, the levels have dropped once more, indicating a drop in the creation of new addresses.

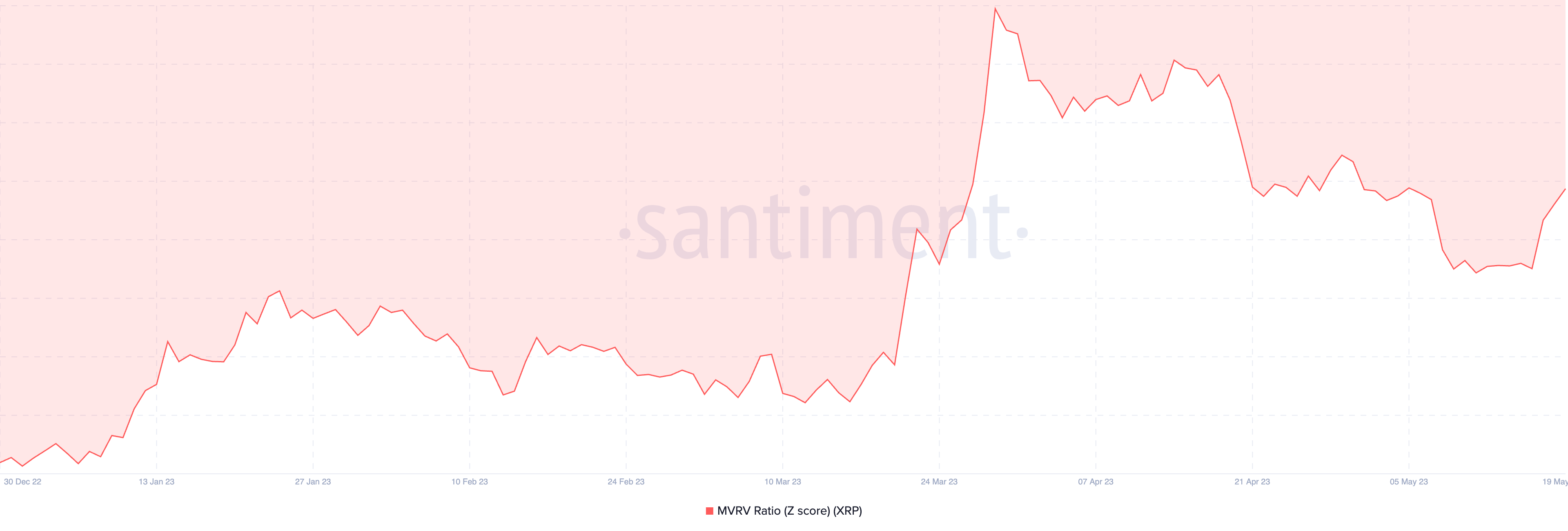

XRP MVRV Ratio

Source: Santiment

The MVRV ratio compared the current market value of the market capitalization of the crypto to its realized capitalization to get a fair value. This fair value determines whether the current price is overvalued or undervalued. If the fair value is above the current value, then the price is considered undervalued or overvalued.

The MVRV levels have been trading within the positive range for quite a long time but have soared magnificently, indicating the price has been gaining value. Now that the MVRV ratio has soared, it indicates that the bears may have become vigilant and are prone to a notable pullback as they extract the profits.

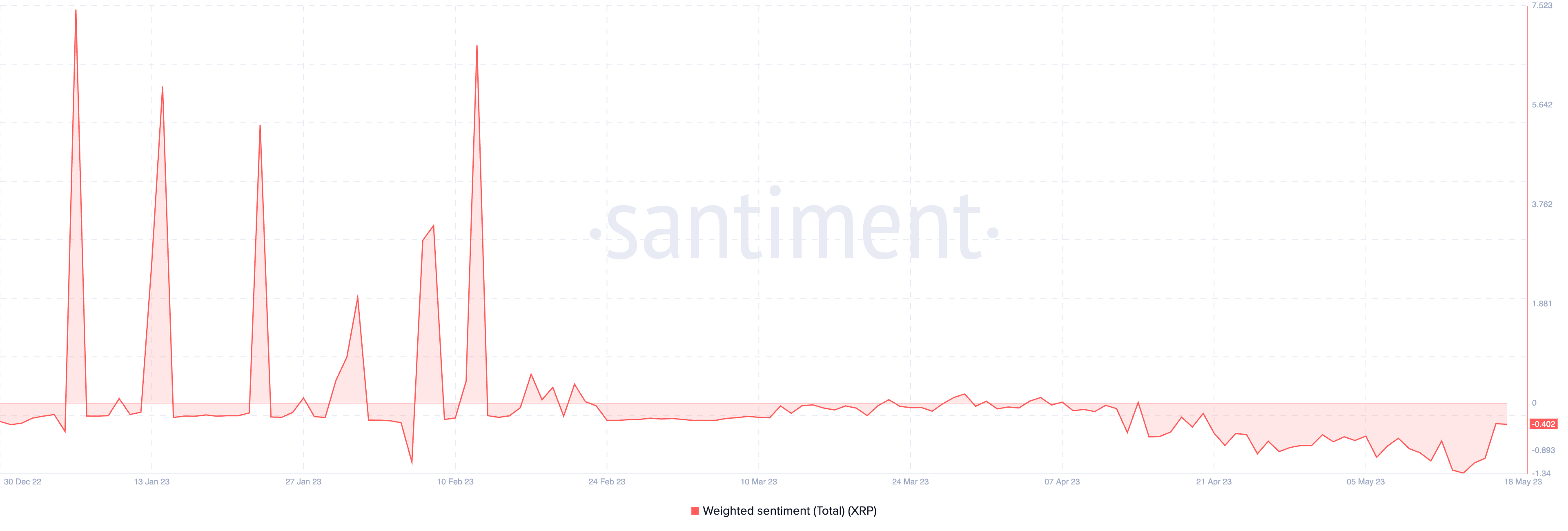

XRP Weighted Sentiments

Source: Santiment

Every project in the space receives positive as well as negative comments. The weighted sentiments consider all the sentiments prevailing within the market and compare them with their frequency over time. If the levels are in the positive range, then it is considered as the market participants are bullish on the crypto; otherwise, they are bearish.

The levels have been slightly below average and have been at these levels for quite some time. Hence, indicating the bearish sentiments prevailing within the crypto space. However, the price appears to be unimpacted by the negative sentiments, as it appears to be poised to maintain a fine upswing.

Know more: Bitcoin Price Prediction 2023

Concluding Thought

The XRP price has been showing tremendous strength in recent times with the rising positive speculation of the Ripple vs SEC case. Besides the positive MVRV ratio and a slight bounce in the network growth indicates the market participants to be bullish over the crypto in the short term.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more