Table of Contents

ToggleKey Takeaways:

- XRP price soared by more than 11% over the past weekend and approaching the crucial resistance zone which may further trigger a massive bull run

- The buying pressure has mounted enormously which may keep up the bullish momentum

- The rise in network activity suggests, an increase in the activity which may further rise the volatility of the platform

The XRP price is currently outperforming almost all the major cryptos, rising over 37% in the past 10 days. The steady rise is believed to occur when the final ruling of the Ripple vs SEC lawsuit is about to be rendered in the next couple of days. In the meantime, the whales have begun accumulating XRP, as the addresses holding above 10 million XRP have risen over 1% since February. This coincides with a notable drop witnessed by the addresses holding 1 million to 10 million XRP tokens.

The decision is believed to turn in favour of crypto, as many analysts, including John E. Deaton, see Ripple winning the case.

“I have no doubt Ripple will win and the current Supreme Court will shut down the SEC’s gross overreach,”

The positive advancement over the prolonged lawsuit could have induced significant bullish momentum, due to which the price is preparing to rise above the gigantic symmetrical pennant that it has been trading from for over 1000 days. Hence, a giant price action may begin, which may raise the price beyond $1 in the coming days.

Read More: Ethereum Price Prediction 2023

XRP Token Technical Overview

Source: Tradingview

- The XRP price was trading within a multiyear symmetrical pennant and approaching the apex of the consolidation

- The recent price action lifted the price, slicing through the upper resistance of the triangle but a bullish close above $0.52 may validate the bullish thesis

- Moreover, the average directional index (ADX) which determines the strength of the rally, has displayed a bullish divergence which may elevate the price above the major resistance

- Besides, the RSI is ranging high and may approach the overbought levels before the end of the week. This may trigger a minor pullback but the price may remain above the gained levels

XRP Token On-Chain Analysis

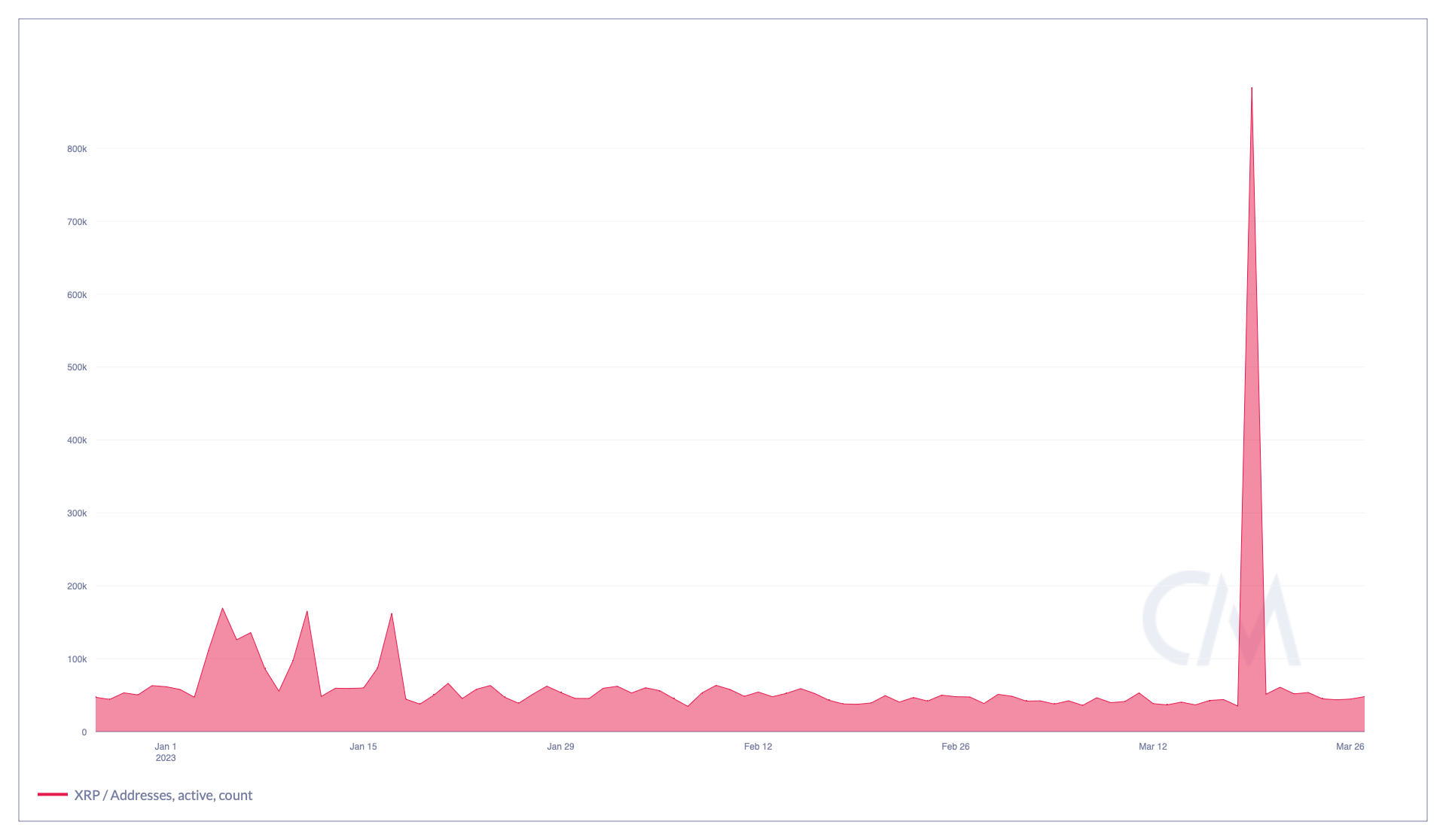

XRP Active Address Count

Source: Coinmetrics.io

The activity over the platform is very important to analyze as it determines the interest of the market participants over the platform. The market participants buy, sell, or swap their tokens, and the active address count displays the number of addresses that placed a trade in a day. The rise in the active address count indicates the high involvement of the market participants, which may keep the token volatile and prone to giant price actions.

The active address count has remained stagnant but has remained around 50K for most of the time since the beginning of 2023. However, the recent upswing raised the price from $0.38 to as high as $0.49 attracting more liquidity and also addresses due to which a major spike was encountered.

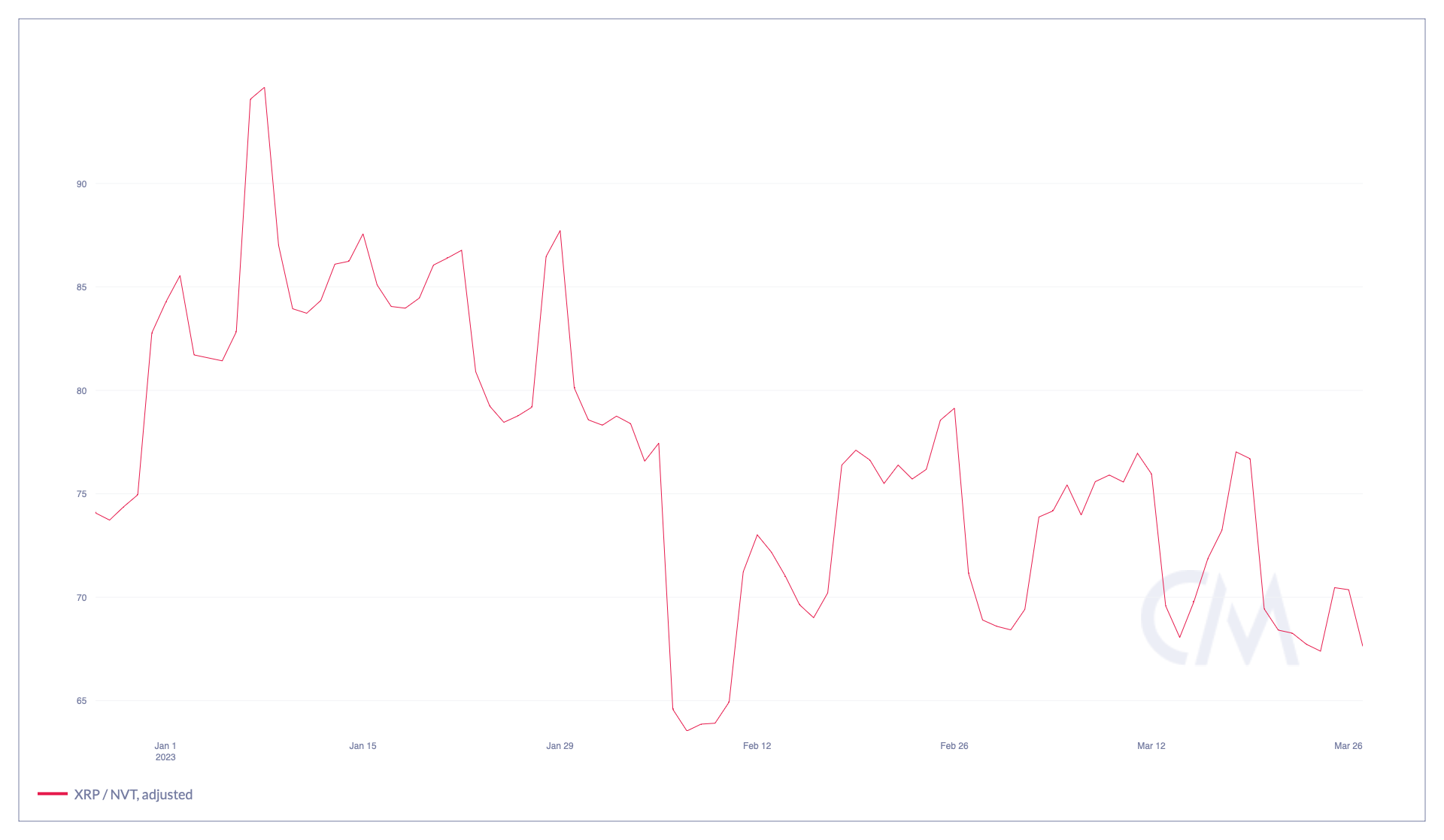

XRP 30-Day NVT Ratio

Source: Coinmetrics.io

The NVT ratio is nothing but the Network value to transactions which compares the number of transactions against the token’s market capitalization. In short, it describes the relationship between the market cap and the transaction volume. A high NVT ratio indicates that the network is having a relatively high netwrok value but low network activity, indicating the sentiments among the market participants are bearish.

However, the 30-day average of the NVT ratio is plunging down which indicates the network’s having less value but higher network activity. Therefore, the market sentiments appear to remain bullish, and the impact on the price may also be positive.

Additional Read: Bitcoin Price Prediction

XRP Address Count With More than 1% Supply

Source: Coinmetrics.io

The address count with more than 1% active supply may also be considered as the whale addresses which largely hold nearly 1% of the circulating supply. The rise in the metric usually creates FOMO within the market as the investors usually follow the trend set by the whales expecting significant growth in the coming days.

The active address count has risen finely a coupleof days ago, indicating massive whale accumulation. However, the levels dropped further despite the price continuing to remain within the bullish range. Hence, indicating the bullish momentum to prevail for the long ahead.

Concluding Thought

The XRP price has been bullish for quite a long time as the trend flipped expecting a positive closure of the Ripple vs SEC lawsuit which is expected to be produced any time from now. The rise in the active address count indicates the rise in interest among the other market participants. The other metrics like the NVT ratio and the supply in the top 1% address also point towards a notable upswing ahead.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more