Table of Contents

ToggleKey Takeaways

- Total crypto market capitalization exceeds $1.55 trillion, reaching a 19-month high.

- Bitcoin has become the world’s ninth-largest tradable asset, surpassing Meta’s capitalization.

- Despite bullish momentum, retail demand remains relatively stagnant.

- Various indicators, including the USDT premium, Google Trends, and perpetual futures funding rates, suggest a lack of significant retail participation.

The crypto market has witnessed a remarkable surge, with the total market capitalization surpassing $1.55 trillion on December 5. Bitcoin Price (BTC) and Ethereum Price (ETH) experienced notable weekly gains of 14.5% and 11%, respectively, propelling Bitcoin to become the world’s ninth-largest tradable asset. Despite this bullish momentum, retail traders seem hesitant to join the fray. This article explores the factors contributing to the cautious approach of retail participants in the current crypto market.

Rajat Soni, a personal finance analyst, posted on X, his thoughts on the matter.

Retail investors aren’t paying attention to #bitcoin.

They are more worried about whether or not they will be able to pay rent or put food on the table.

They will likely start paying attention near the next top (IMO sometime in 2025) and they will FOMO into a position before…

— Rajat Soni, CFA (@rajatsonifnance) December 2, 2023

Read On: Bitcoin Price Prediction

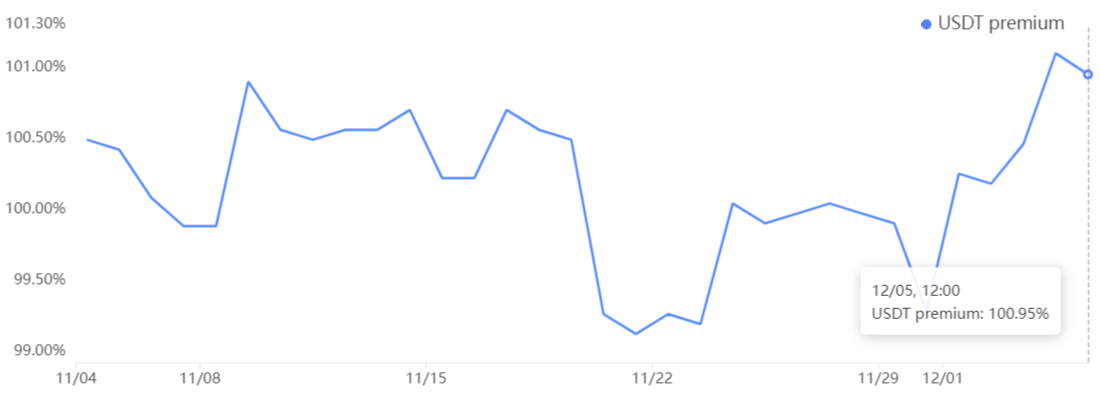

USDT Premium as a Gauge of Retail Demand:

The Tether (USDT) premium in China is a valuable gauge of retail demand in the crypto market. This premium measures the difference between peer-to-peer USDT trades based on the Yuan and the value of the U.S. dollar. On December 5, the USDT premium relative to the yuan saw a modest improvement but remained within the neutral range, suggesting cautious retail sentiment. This metric has not breached the 2% threshold for over half a year.

Source: OKX I Cointelegraph

Additional Read: Ethereum Price Prediction

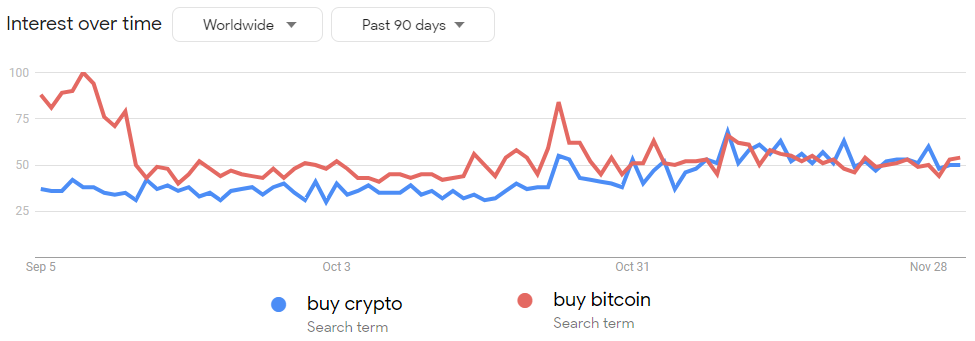

Google Trends Indicate Stable Retail Interest:

Analysis of Google Trends data reveals stable search patterns for terms like “buy Bitcoin” and “buy crypto” over the past three weeks. The 90-day index stands at approximately 50%, showing no significant improvement in recent interest levels. Despite Bitcoin’s surge of 53% in the past 50 days, search levels remain 90% below their all-time high in 2021, indicating a subdued retail interest compared to previous market conditions.

Source: Google Trends I Cointelegraph

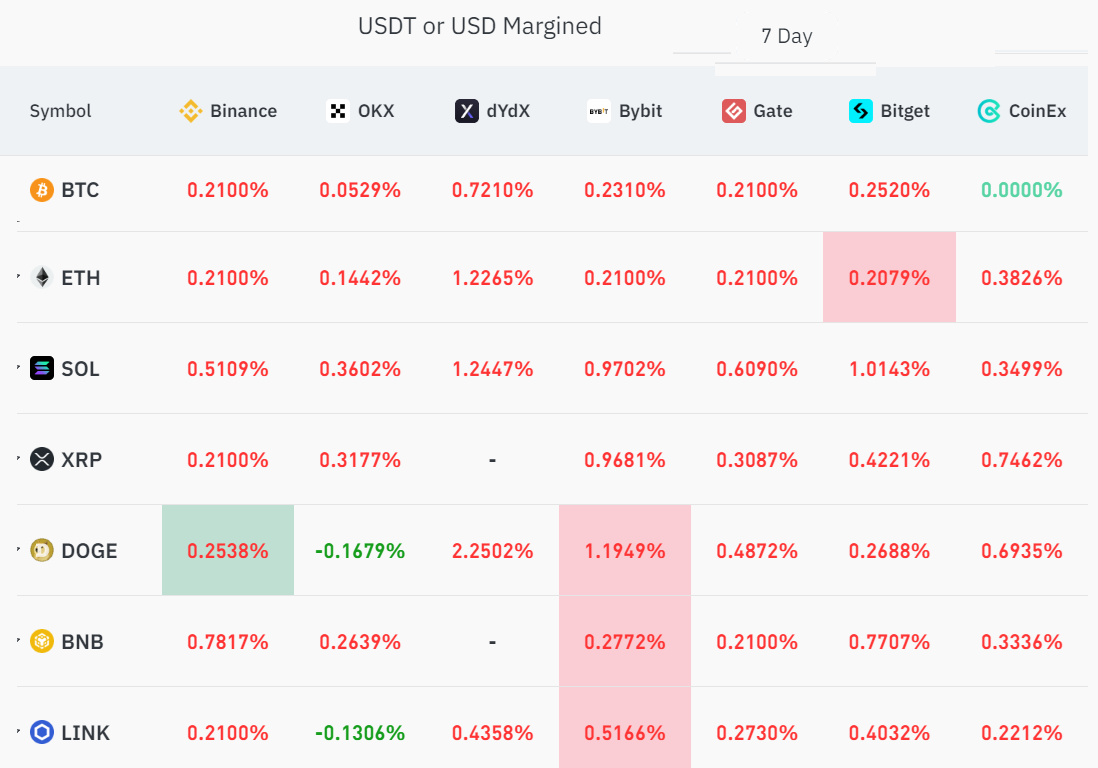

Perpetual Futures Funding Rates:

Examining the derivatives markets, particularly perpetual futures, provides insights into retail trader behavior. The weekly funding rate for most coins fluctuates between 0.2% and 0.4% per week, indicating a slight demand for leverage among longs. However, during bullish periods, this metric can surpass 4.3%, which is not currently true for the top seven coins in terms of futures open interest. The absence of a significant increase in funding rates suggests a lack of new retail participants displaying excessive optimism.

Source: Coinglass I Cointelegraph

Conclusion:

Retail traders remain on the sidelines while the crypto market has grown substantially. Various indicators, including the USDT premium, Google Trends, and perpetual futures funding rates, point to cautious retail sentiment. The reasons for this cautious approach range from the impact of an inflationary environment to decreased interest in credit. Investors, holding approximately $6 trillion in “dry powder” in money market funds, appear hesitant to actively participate in the current market conditions.

Source: CoinTelegraph

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more