On April 12, 10:27 pm, the Ethereum Shanghai Upgrade went live and a couple of minutes later, the block was validated successfully on the Ethereum mainnet. This was one of the most momentous occasions in the history of the Ethereum network, especially after the Ethereum Merge last year on September 2022.

Additional read: Ethereum Shanghai Upgrade

Hi Shapella 👋

Withdrawals have appeared! pic.twitter.com/POqeZwkZJ4

— Etherscan (@etherscan) April 12, 2023

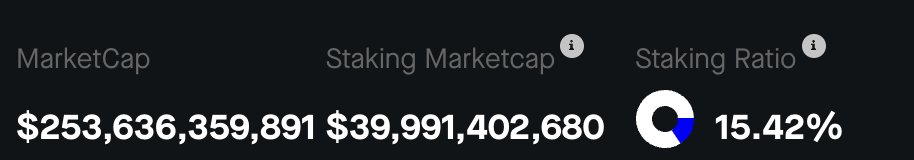

With the successful implementation of the Shanghai-Capella upgrade, the unlocking of staked Ether from the Beacon Chain was suddenly possible! All the rewards and the ETH tokens that had been locked up in the deposit contract, since the launch of the Beacon chain back in 2020 were now possible to be unlocked and the rewards gained by validators on the new Ethereum PoS network could be redeemed. According to data from stakingrewards.com, nearly $40 billion worth of staked ETH has now been unlocked from the deposit contract!

However, there’s a pinch. To ensure that there isn’t a sudden deluge of ETH tokens in the market, that could negatively affect prices in a vicious cycle of panic selling – there were mechanisms put in place to ensure that ETH tokens could only be unlocked and sold off in a staggered, phased manner.

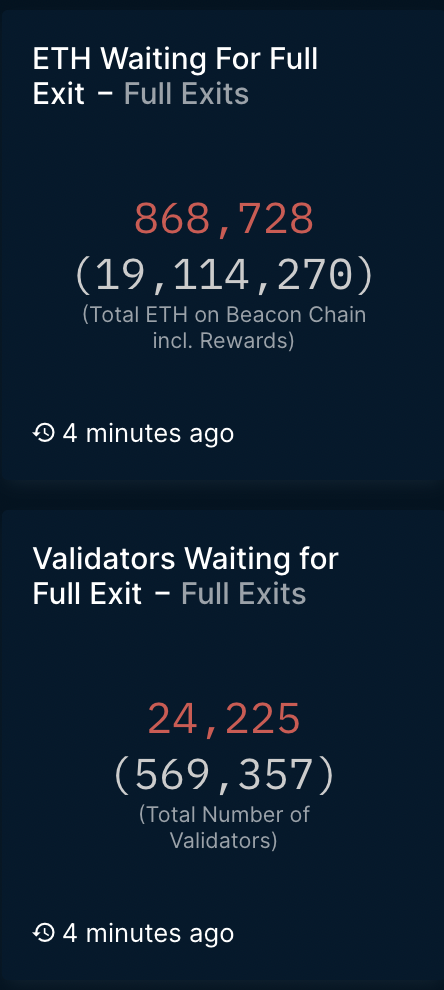

Now, according to a report – so many Ethereum validators have put in requests to unstake their Ether (ETH) from the blockchain, following the successful Shapella Hard Fork that now there is a nearly two-week-long queue to get your withdrawals processed on the chain! While there are differences in opinion about the exact number of pending withdrawal requests from validators, according to the network explorer Rated, the number of validators waiting for redemptions has grown to about 17,000 for full withdrawals and 285,000 for partial withdrawals. Also, another blockchain analysis firm, Nansen estimates about 24,000 pending requests for full withdrawals. This represents just 4% of the total number of validators on Ethereum (about 567,000, according to Nansen) – who want a full redemption. A full withdrawal is when validators want the entirety of their original deposit of 32 ETH tokens back.

So far, only about 1000 validators have successfully exited the Beacon chain, having fully redeemed their original deposit of 32 ETH.

Read more: Ethereum Price Prediction 2023

Not everyone is leaving!

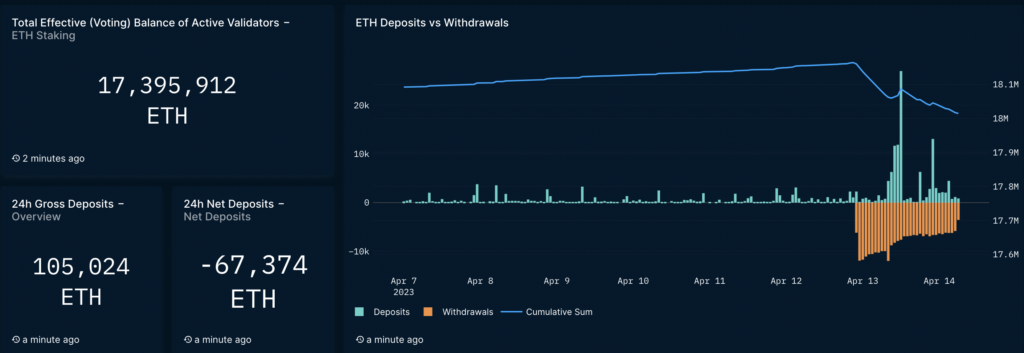

While some validators are looking to exit with their investments and redeem their gains – Nansen has observed that the number of Ether tokens are being deposited onto the Beacon Chain is seeing some growth! This indicates there are stakers out there who still want to participate in the maintenance of the Ethereum blockchain and contribute in securing it, while at the same time earn rewards too.

But on a net basis, withdrawals still outweigh the deposits. The 24-hour net deposit change into the Beacon Chain currently stands at minus 67,374 ETH at the time of writing this article.

It is still too soon to extrapolate too much out of this data as more data is yet to come in, especially from liquidity staking providers and also other major exchanges like Coinbase (which holds more than 12.6% fo all staked ETH). Unstaking hasn’t opened up there yet and those numbers are yet to factor in. So stay tuned!

Values as on April 14, 2023.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more