Table of Contents

ToggleThe leading Ethereum staking service, Lido platform’s governance token holders have proposed to call for a vote to look over the ETH funds allocation. The DAO submitted the proposal on Tuesday reiterating on whether the ETH holdings worth $30 million should be staked or sold.

Lido’s financial arm ‘Steakhouse Finance’ drafted four proposals to optimize the use of ETH in its treasury. These proposals included an option to sell or stake ETH or use the funds for operations on the platform and also diversify its stablecoin holdings. Currently the platform holds 20,304 ETH which is approximately worth $30 million.

The value of Lido (LDO) jumped to 18% after the proposal submission. Later it retracted to 10% on Wednesday. Lido has witnessed a 1 month high by 30% post Kraken’s staking service shutdown by the SEC.

Read More: Ethereum Price Prediction

Source: Trading View

The community responses on the Lido Research Forum have been quite balanced so far. In addition, Steakhouse Finance has drafted a suggestive allocation of Lido’s ETH treasury.

- [45%] Stake as soon as possible

- [30%] Stake after withdrawals

- [12.5%] Curve pool

- [10%] Do not stake

- [2.5%] Buy NFTs

The proposal from Lido’s advisory was expected given the fact that the time to unstake ETH from the Beacon chain is around the corner. With Ethereum’s much awaited Shanghai upgrade, users will be able to withdraw their funds in a phased manner.

The discussions within the DAO are also pondering on what to do with Lido’s ETH holdings in the Aragon contract.

The proposal also outlines the nearest possible options on the treasury funds

- Withdraw the funds whenever possible

- Unstake the funds once the protocol enables withdrawals

- Don’t sell or distribute the funds.

Additional Read: Top Crypto Dao Projects In 2023

The bull run for Lido and other DeFi tokens

Ethereum staking requires users to lock their ETH funds for a stipulated period of time. Lido DAO offers a more flexible hallway for investors to stake their ETH holdings via Lido’s non custodial staking mechanism.

Lido DAO has been witnessing intermittent spikes in its price. The token had started to see a surge well before the Ethereum Beacon chain merge. The TVL of Ethereum on Lido stood at $5.57 billion in the middle of 2022. Lido comes across as a lucrative ETH staking platform as users receive stETH – staked Ether as rewards for adding liquidity to the staking pool. Since, staking on the Beacon chain requires an individual to have 32 ETH which would account to USD 1,694.50 (according to ETH’s trading value today)

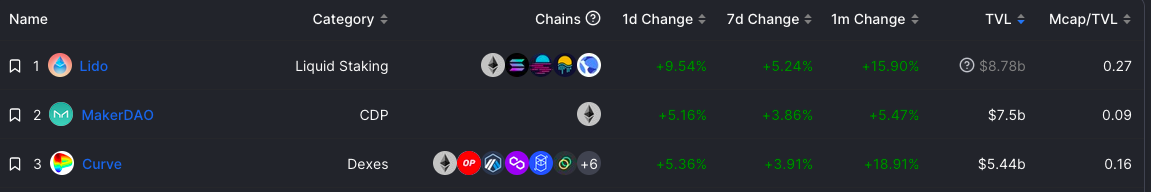

According to DeFi Lama – a crypto TVL data aggregator, Lido Dao holds the highest TVL of ETH, much ahead of MakerDAO and Curve Finance.

Source: Defi Lama

Token Reward Plan for Lido DAO contributors

The DAO also submitted a proposal to get an authorization for donating up to a maximum ceiling of 22 million LDO to a grants association for using it in a Token Reward Plan (TRP) Through the plan the contributors will receive tokens that will allow them to participate in the governance for the next 4 years.

A Snapshot vote to authorise a 22M LDO ceiling for a four year Lido DAO contributor Token Reward Plan (TRP) is live: https://t.co/JucmwSoqh6 pic.twitter.com/WafykK9M7G

— Lido (@LidoFinance) February 15, 2023

Source: CoinDesk

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more