Table of Contents

ToggleKey Takeaways

- Polygon price kickstarted 2023 trade with a blast and soared more than 100% at the moment to mark a 9-month high above $1.4

- The value may not face a bearish reversal in the near time as the bulls are poised to elevate the price by another 100% soon

- The traders have been pretty active over the platform as active address count spikes but a drop in network growth suggests less involvement of the bears

Polygon’s price has been soaring for more than a month and has now recovered 100% of its loss incurred after the giant market collapse fueled by the fall of Terra’s ecosystem. The price is now half the way towards its ATH and is hence believed to carry huge bullish momentum in the coming days. Several factors contributed to the recent price increase, the most significant of which are listed below.

After being undervalued for the whole of 2022, the price quickly rose, marking the resurgence of the bull run. Polygon is all set to launch its much-awaited zk-EVMs before the end of Q1 2023, which enables cheaper transactions in a secured environment. Alongside, the platform also recorded a massive surge in NFT transactions reaching 1.5 million.

Besides, the platform’s recent collaboration with Simens, a German industrial powerhouse and the 3rd-largest publicly traded company by market cap, issued its first digital bond worth 60 M euros, or nearly $64 million on the Polygon chain. These bonds are expected to reduce the paperwork and directly reach potential customers.

Read more: What is Polygon Zk-EVM?

Polygon Technical Overview

- The MATIC price with the recent upswing has sliced through the crucial resistance at $1.35 heading close to the next higher target ar $1.45

- The Bollinger bands have expended heavily as the prices are constantly hovering along the upper resistance of the bands

- After experiencing an extensive expansion, the bands may tend to compress, compelling the price to undergo a minor pullback.

- The price is believed to retest the crucial resistance turned into support levels, as a part of the correction phase post to which a gigantic upswing may rise the price beyond $1.5

Polygon On-Chain Analysis

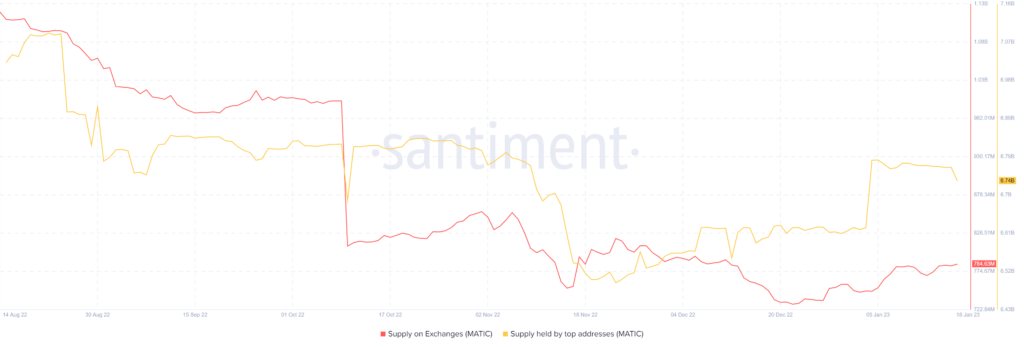

Polygon Supply on Exchanges/ Supply on Top Addresses

Source: Santiment

The supply on exchanges refers to the number of tokens present in the wallet managed by them. This determines the popularity of the token in the market as it displays the activeness of the platform. The supply has dropped presently, which indicates bullish sentiments of the market participants who wish to hold the token and hence moved away from the exchanges.

Besides, the supply on the top addresses indicates the balance held by the whales. Whenever the levels rise, it creates excitement among the traders who usually follow and accumulate some. Woefully, the levels have dropped heavily in the present case which indicates that the whales are liquidating. On the contrary, more coins in circulation may also lead to increased volatility that may positively impact the price.

Read more: Polygon Price Prediction

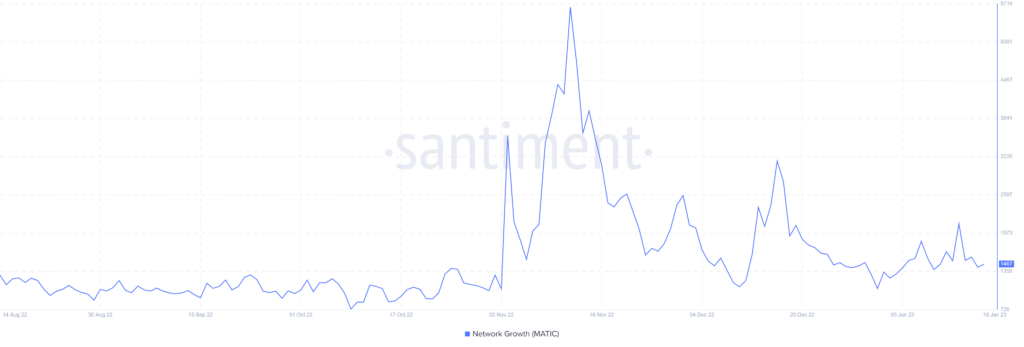

Polygon Network Growth

Source: Santiment

The Network growth of the platform indicates the number of new addresses performing their first trade. It is basically used to know whether the token is gaining traction or losing its popularity. The rising levels indicate that the network is receiving more new addresses each day which indicates a rise in the adoption of the token.

Presently, the Network Growth of MATIC is on the decremental side as the levels have dropped heavily. It indicates a decreased involvement of the new traders over the platform which could slash the adoption rate harder. However, a minor spike in the levels can be witnessed, but they remain around the average levels.

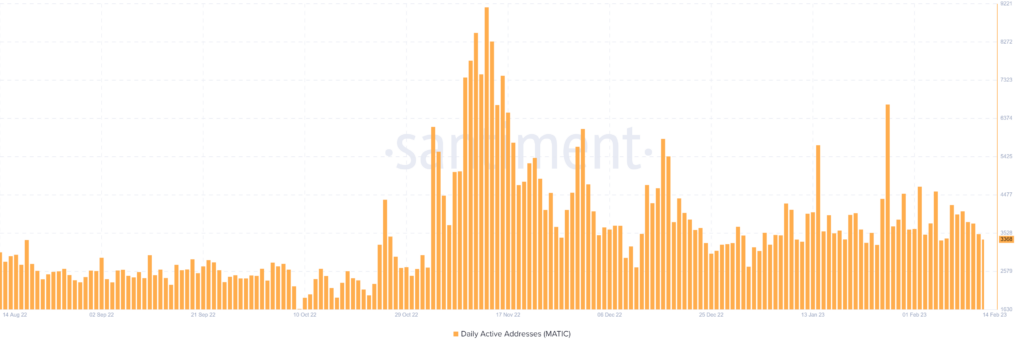

Polygon Daily Active Address

Source:Santiment

The daily active address is the number of addresses interacting with the platform on daily basis. It is the address count that places buy/sell or swap orders that in turn determines the activeness of the platform. The more the address interacts, the more active could be the platform as the DAA rises notably.

Presently, the DAA levels are increasing which may indicate that more traders are placing orders which may keep up the volatility of the token. However, every address is considered only once per day, regardless of whether the address has performed trade multiple times in a day.

Concluding Thought

Polygon MATIC price has been displaying acute strength for quite a long time and hence is believed to remain elevated. The drop in the network growth but a decent spike in the daily active address indicates the lower involvement of new users but the experienced traders continue their activity over the platform. Moreover, the dried exchange reserve also substantiates the claim of a major bullish wave that is fast approaching.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more