In a recent surge of transactional activity on the Polygon network, gas fees witnessed an astounding rise, reaching as high as $0.10. The catalyst for this spike was the fervent rush to mint a newly introduced token called POLS, inspired by the Ordinals protocol.

What is going on on @0xPolygon POS chain? 6m transactions in last 24 hrs. 170 TPS on average. 1mn+ MATIC burnt by the protocol. The chain worked smoothly, gas fees went crazy though but no reorgs or 0 blocks etc.

I hear there is some game Baby Shark Launching, could that be the…

— Sandeep Nailwal | sandeep. polygon 💜 (@sandeepnailwal) November 16, 2023

What is going on, on Polygon?

Gas fees on the Ethereum layer-2 Polygon skyrocketed over 1,000%, peaking at $0.10 due to the overwhelming demand for minting POLS tokens. Polygon founder Sandeep Nailwal expressed surprise at the heightened activity, speculating that it might be linked to the launch of a new Polygon-based NFT collection.

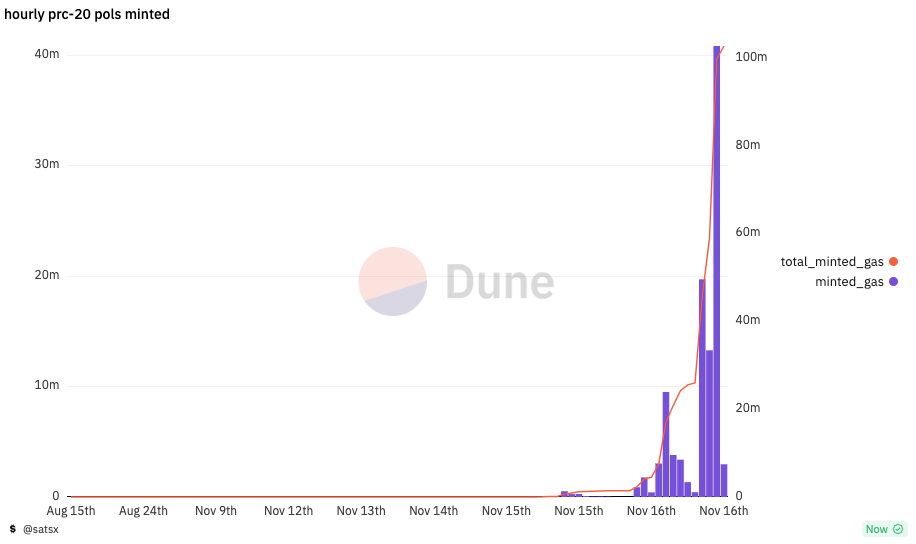

The surge in gas fees and network activity can be attributed to the enthusiastic minting of the POLS token, with Dune Analytics data revealing the use of over 102 million MATIC tokens, equivalent to $86 million, as gas.

Source: Dune I CoinTelegraph

The POLS token, operating on the PRC-20 protocol, shares similarities with the Bitcoin Ordinals-derived BRC-20 token standard. Currently, only 8.7% of the total POLS supply has been minted, with over 18,100 owners claiming the token.

Read More: Polygon Price Prediction

Conclusion

Despite the momentary frenzy, Polygon gas fees have returned to their usual levels, settling around 882 gwei. Gas fees measure the computational effort required for a transaction, with 1 gwei approximately equal to 0.000000001 MATIC. This surge echoes a trend observed earlier in the Bitcoin network after the release of the Ordinals protocol, which allowed direct minting of NFTs onto the Bitcoin blockchain.

Source: CoinTelegraph

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more