Table of Contents

ToggleKEY TAKEAWAYS:

- Polygon’s native crypto token MATIC price has rallied significantly in the last couple of days, spiking nearly 40%.

- In fact, approximately in the last two months, MATIC price has rallied over 70% from the lows!

- This has made MATIC one of the top recovery candidates out of all the top major cryptos by market capitalization.

Polygon has been in the news for quite some time now as it has had one of the best recovery from its lows in the current year, despite the raging bear market. Polygon’s native crypto token, MATIC has rallied over 260% from its 2022 lows back in June 2022 and it seems that rally is slated to continue further.

In fact, recently Polygon has been attempting to expand its brand into the masses by organizing roadshows in India, in multiple cities, all the way from Mumbai to Delhi, Ahmedabad, Lucknow and several others.

Read more: MATIC price prediction

Polygon is excited to meet the next generation of entrepreneurs during the #Web3MadeinIndia Roadshow

Find your tribe

https://t.co/4RydrRpWTu

Join us as we travel throughout India. Our first two stops were Kochi and Jaipur.

JOIN US ON THE ROAD

— Polygon (@0xPolygon) November 7, 2022

It has also been busy with a string of partnerships with major names in the tech space, expanding its level of reach and providing blockchain based solutions to real world problems, all the way from issuing caste certificates on the blockchain in Maharashtra to filing police complaints or FIRs on the blockchain, taken up by the police department in UP’s Firozabad. It was also the only blockchain firm to be selected for Disney’s Accelerator Program, 2022.

Thus with all the good things happening on that front, how does the technical aspects look?

POLYGON (MATIC) TECHNICAL OVERVIEW

We can clearly see from the chart above how MATIC price has managed to rally over 260% from its lows back in June 2022 and is trading well above $1 as of writing this. In fact in the last four days alone, MATIC price has managed to rally a staggering 37%, going all the way from $0.85 to around $1.18, even touching highs above $1.2. This indicates how strongly Polygon price has broken through the psychological resistance level at $1 which it had been trying to breach since the beginning of July but hadn’t been able to until now.

To add to that, MATIC price rally has also resulted in the formation of a golden crossover of the 50 and the 200 day moving averages, which indicates strong bullish behaviour in the near future. The rally in the past couple of days was followed by strong volumes as indicated by the volume underlay on the chart and hence, very evidently – market participants are participating in the rally. The Relative Strength Index for this coin happens to be very close to the overbought territory so we could see stabilization of the price at current level or even slight corrections but nothing that would be a cause for concern.

Read more: MATIC technical analysis

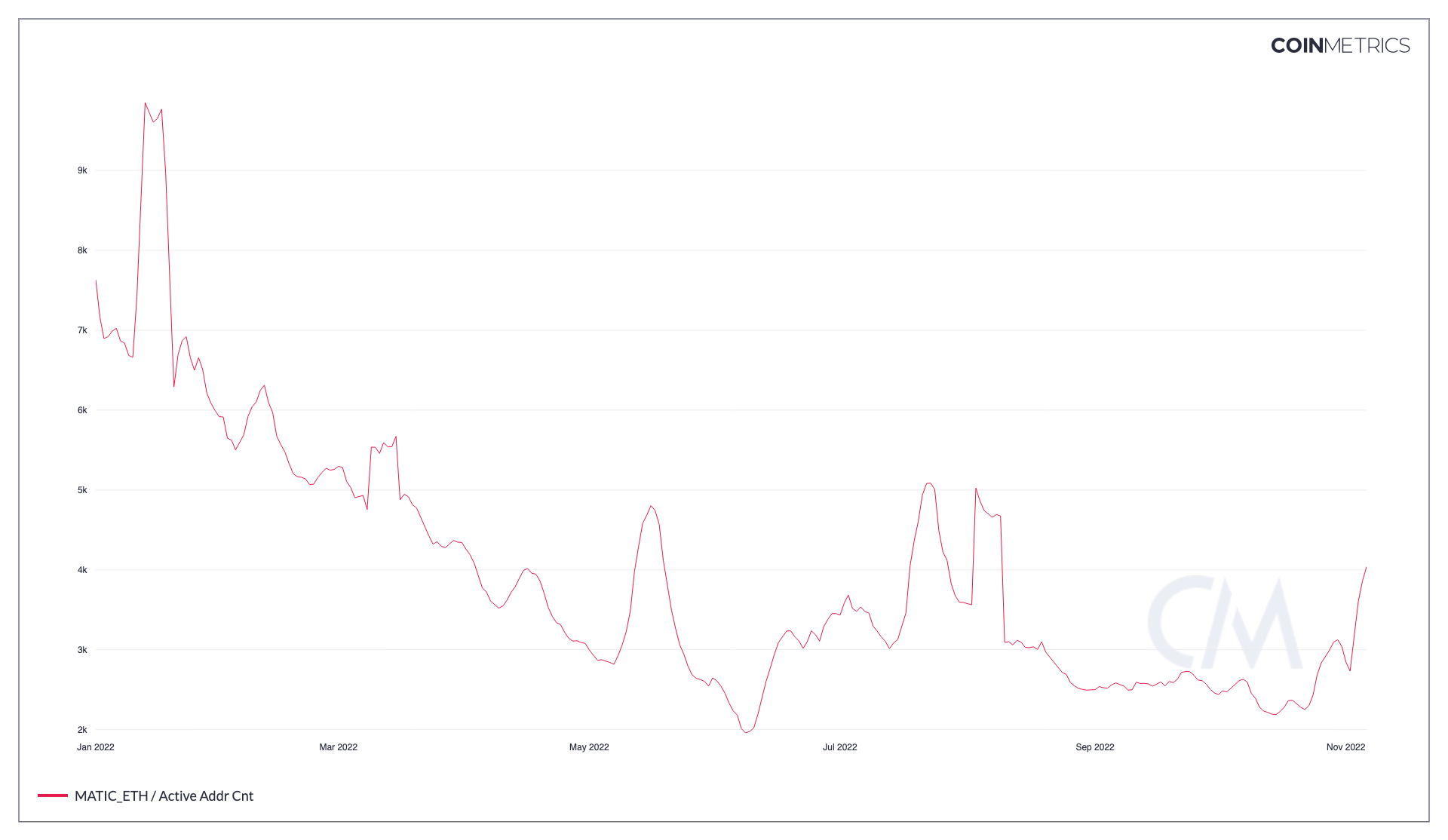

MATIC’S ACTIVE ADDRESSES COUNT SEES A SPIKE!

MATIC’s active addresses count had been on the decline ever since the beginning of the year but since May 2022, post the crash led by the Terra LUNA implosion – the active addresses count has stabilized largely and seemingly bottomed out. Now with the recent rally in price since the beginning of November, 2022 – we are seeing a jump in the active addresses count for the token too.

This is a very good sign as a recovery in the active addresses count alongside the recovery in price suggests that users on the platform are returning and thus a further price appreciation in the near future becomes more and more likely in the token.

MATIC’S MARKET CAP DOMINANCE SHOOTS UP!

In another positive set of developments – MATIC’s market cap dominance has been rising too. In fact, it has gone from sub 0.3% levels back between June and July 2022 – to nearly 1% as of writing, is a huge deal. A greater share of a crypto’s market cap in the overall market cap of the crypto market indicates that an altcoin season could be coming and probably be led by some of these popular altcoins.

This is particularly evident from the rally exactly a year ago, when the market bull run was largely led by the king coin, Bitcoin itself – hence despite MATIC’s price being nearly $3, its market cap dominance was under 0.8%. But now even with its price being under $1.2, its market cap dominance is nearly 1% indicating that it would have larger role to play.

CONCLUSION

After looking at all the points mentioned above, we can clearly identify MATIC as one of the top recovery candidates by the end of the year or even spilling over into 2023. An improved market cap dominance of a coin is a very good sign, followed by an improvement in the active addresses count bodes well for the future of Polygon price.

Price as on 7 November, 2022.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more