Table of Contents

ToggleKey Takeaways:

- PEPE, a very hyped memecoin, started enthusiastically but quickly succumbed to the bearish sentiment prevailing in the overall crypto market.

- Since its listing in May, Pepecoin price has consistently declined, losing over 60% of its value in just a month.

- To revive market enthusiasm, Pepecoin price needs to break through critical resistance levels, starting with the region between the S1 and pivot point (P), coinciding with its previous all-time low.

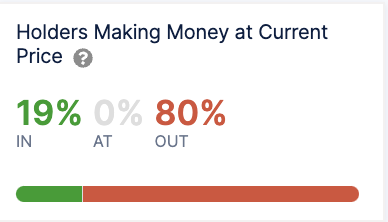

- The profitability metric for Pepecoin holders is bearish, with only 19% of investors in a profitable position, potentially leading to increased selling pressure and hindering price recovery.

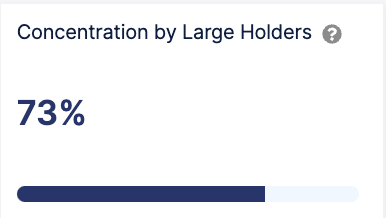

- The concentration of 73% of the PEPE supply among large holders poses a risk of market manipulation and erratic price movements, further contributing to the overall bearish sentiment.

Pepecoin Price Technical Overview

-

PEPE price began its journey with a lot of hype, followed by some listing gains, but soon came down with the bearish fever. As is evident from the chart above it has lost over 60% of its value within a month. In mid-June, it attempted to make some recovery, but that was quickly sold into, and PEPE price resumed its downward journey once again, quickly breaking its all-time lows by the end of August 2023.

- PEPE price is currently taking the support of the S2 level, according to the Fibonacci pivot points on the chart, and is also trading below its 50-day exponential moving average.

- To bring back any sort of enthusiasm into the market, PEPE would need to break out of several crucial resistance zones on the chart, beginning with the region between the S1 and the pivot point (P). This region also holds the previous all-time low region, which could possibly act as a resistance level now, and thus a breakout beyond that is extremely crucial.

- If, in the coming months, it can breach that, then we might see a continuation rally up to R1 at $0.00000128 – that would be a 100% jump from current levels. This is the maximum it might be able to touch if there is a broad recovery in the crypto market and Pepecoin price decides to rally along with it.

- PEPE price is currently facing severe bearish pressures, especially due to the fact that it is down over 40% in the past 30 day and nearly 60% in the past 60 days. Thus, PEPE price needs to sustain above the S2 or $0.0000006 support level according to the Fibonacci pivot points.

Read more: Pepecoin Price Prediction

Pepe On-chain Overview

Profitability of Pepe Holders

The profitability of PEPE token holders currently paints a bearish picture for the token’s ecosystem. Data from IntoTheBlock reveal that only a mere 19% of investors find themselves profitable, enjoying gains on their holdings. In stark contrast, over 80% of PEPE holders are currently in the red, seeing red on their books.

With most investors at a loss, this significant imbalance can have detrimental effects on market sentiment. It often leads to increased selling pressure as many holders might offload their tokens to cut their losses or minimize risk. Such a bearish sentiment can hinder price recovery and potentially create a downward spiral, making it challenging for Pepe to regain bullish momentum.

Investor psychology plays a critical role in crypto markets, and when the majority faces losses, it can contribute to prolonged downtrends and reduced confidence in the Pepe price’s future prospects.

Read more: All New Bitcoin On Chain Analysis Framework

Concentration by Large Holders

Moreover, compounding the bearish outlook for the PEPE token is the concerning metric of “concentration by large holders.” Data reveals that a significant 73% of the circulating PEPE supply is concentrated among these large holders. This concentration not only poses a risk of major market manipulation but also makes the token vulnerable to substantial price swings driven by the actions of a few significant players. The potential for price manipulation and erratic market movements by these large holders can further erode investor confidence and contribute to the overall bearish sentiment surrounding Pepe, creating a challenging environment for a sustained recovery.

Conclusion

PEPE faces a challenging path to recovery as it grapples with bearish price trends, a lack of profitability for the majority of holders, and significant supply concentration among large holders. Breaking through key resistance levels is essential for any potential bullish momentum, but the current market sentiment remains largely pessimistic. Investor psychology, influenced by widespread losses and the risk of manipulation, plays a crucial role in the token’s future trajectory, making sustained recovery a formidable task for PEPE price.

Read More: Shiba Inu Price Prediction

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more