Table of Contents

ToggleKey Takeaways:

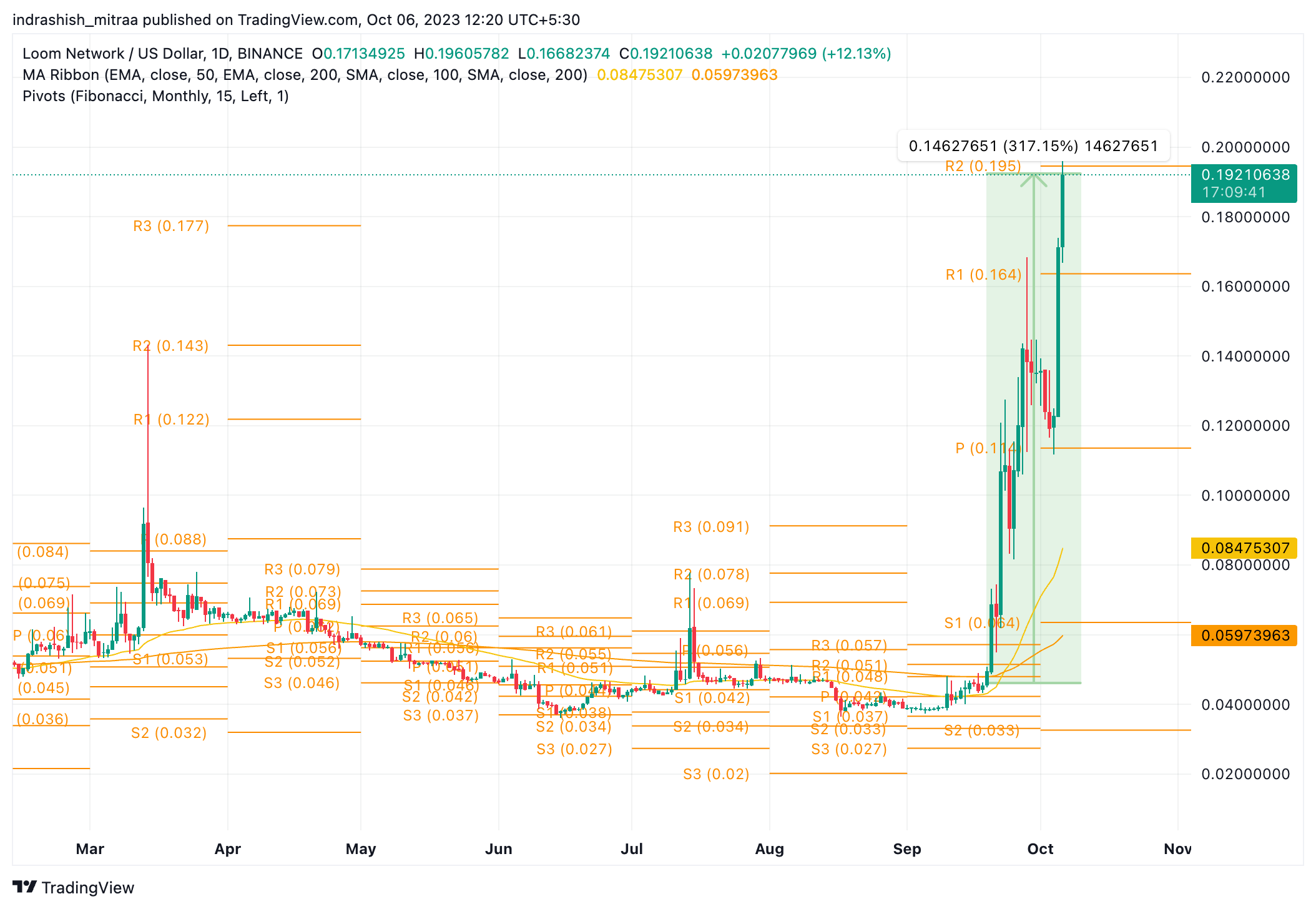

- LOOM’s Remarkable Rally: Loom Network (LOOM) experienced a massive price rally, surging by a staggering 317% between September 19 and the time of this article, currently trading around $0.19.

- Golden Crossover and EMA Breakout: The rally was accompanied by a convincing golden crossover of the 50-day and 200-day exponential moving averages (EMAs), and prices successfully broke out of both EMAs in September, which provides robust support for the ongoing rally.

- Fibonacci Pivot Levels: Loom price is currently trading just shy of the Fibonacci pivot R2 level at $0.195, with the next target set at $0.245 (R3), which also corresponds to the all-time high of the token.

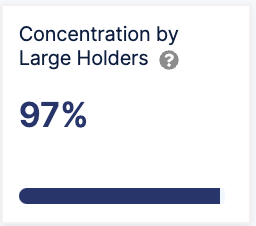

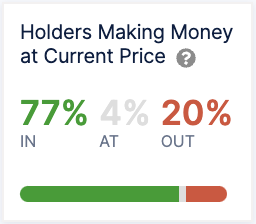

- Concentration by Large Holders and Profitability: Concentration by large holders, holding over 97% of the circulating supply, and about 77% of LOOM holders are in profit, 4% are at breakeven, and 20% are facing losses.

Loom Network Technical Overview

- Loom Network is an altcoin that has had subdued price action all through the year in 2023, but has been seeing a massive rally in the last couple of weeks. LOOM price has rallied a massive 317% between September 19 and, as of writing this article, currently trading around $0.19.

- According to CoinMarketCap, LOOM price has rallied a solid 45% in the past 24 hours alone and about 11% in the past 1 hour – and is up about 380% YTD.

- This rally also triggered a convincing golden crossover of the 50-day and the 200-day exponential moving averages, and prices have also broken out of both the EMAs in September itself. This would provide strong support as this rally continues.

- Early in October, LOOM price corrected slightly to take support at the pivot level of the Fibonacci pivots – and then quickly continued to breach the R1 level too.

- Currently, the LOOM price is trading just shy of the Fibonacci pivot R2 level of $0.195, and the next immediate target for the LOOM price is placed at $0.245, which is the R3 of the Fibonacci pivot level. This $0.245 also happens to be a level that closely coincides with the all-time high of the token; thus will be a difficult resistance level to breach.

- Overall, things seem pretty bullish for the token, and the rally can be expected to continue going forward – with minor corrections along the way.

Learn More: Top Crypto Price Predictions, BTC, ETH & Other Altcoins

Loom Network On-chain Overview

Concentration by Large Holders

Concentration by Large Holders is essentially a metric that measures the total holding of whales (addresses that own more than 1% of the circulating supply of a token) and investors (addresses that own between 0.1% to 1% of the circulating supply). Currently, according to data from IntoTheBlock, over 97% of the circulating supply is held by these large whales and investors.

While this is a sign that whales are pretty interested in this token – it also means that the prices of this token are prone to wild price swings and volatility when these whales decide to buy or sell in the open market. This makes this altcoin unattractive for investors with lower risk and downside tolerance.

Profitability of LOOM Holders

The profitability of LOOM holders is a crucial on-chain metric that provides insights into the financial well-being of investors in the LOOM crypto. As of the latest data, a significant 77% of LOOM holders find themselves in a favorable position, enjoying profits on their investments. This statistic demonstrates the potential for wealth creation in the LOOM market. However, it’s worth noting that a smaller percentage, approximately 4%, are hovering at the breakeven point, indicating they have yet to realize substantial gains or losses. On the flip side, 20% of LOOM holders are still facing losses, emphasizing the volatility and risk associated with the crypto market. This on-chain metric showcases the diverse financial outcomes experienced by LOOM investors, reflecting the dynamic nature of crypto investments.

Read More: Ethereum Price Prediction

Conclusion

Loom Network’s recent price surge is undeniably impressive, and it has achieved significant gains in a short span. The golden crossover and EMA breakout provide a solid foundation for this rally, and with Fibonacci pivot levels as targets, there’s potential for further upward movement. However, it’s important to note that the high concentration of holdings by large investors could lead to price swings. Additionally, the profitability of LOOM holders reflects the volatile nature of the crypto market, with a mix of profitable and loss-bearing investors. Overall, while bullish sentiment prevails, the market may see minor corrections along the way.

Values as of October 6, 2023.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more