Table of Contents

ToggleKey takeaways:

- Litecoin has been one of the biggest gainers in the past 24 hours, gaining over 10% to touch $64 levels before falling slightly and is currently around $62.

- In fact, Litecoin was also one of the few coins that managed to lose the least amid the devastating crash that followed the FTX collapse.

- It has recovered almost all of what it has lost in the interim and is very close to providing a breakout over a critical resistance zone.

⚡⚡LITECOIN⚡⚡

Top gainer in the last 24hrs!!! pic.twitter.com/sgG3NGQpTS

— Litecoin (@litecoin) November 17, 2022

Litecoin has been a very popular coin for many crypto enthusiasts ever since its inception back in 2011. It combined the best security and reliability features of Bitcoin – its predecessor – but with lower transaction costs and higher transaction speeds. Thus it is very aptly named as Litecoin – it is a lighter version of Bitcoin as it delivers transaction speeds upwards of about 2.5 minutes as opposed to Bitcoin’s 10 minutes to an hour!

The average #Litecoin transaction fee is less than a penny! ⚡️

— Litecoin (@litecoin) November 17, 2022

And according to recent data, Litecoin’s mining difficulty is continuing to rise, hitting new highs. Litecoin Foundation took to twitter to share the news too.

Litecoin mining difficulty is continuing to rise hitting new highs!🚀🚀

Difficulty is a variable measure of how difficult it is to find a hash below a given target. An important metric for mining & how the truly decentralized #Litecoin network controls new coin issuance. pic.twitter.com/9EcYEsHY0a

— Litecoin Foundation ⚡️ (@LTCFoundation) November 9, 2022

LITECOIN TECHNICAL OVERVIEW

Litecoin price, as mentioned earlier, has managed to recover very strongly from the recent lows. In fact, despite the crash amid the collapse of the FTX crypto exchange – LTC price was able to hold on to its support level (marked in yellow) of around $45. Even historically, it has been a strong support level and can be expected, ever since the month of June 2022, post the Terra LUNA crash. It has only been tested once and never again. This is a good signal going forward as the $45 level has held out through two of the biggest crashes in the bear run of 2022 and can be expected to do so again too.

Along with that, it is very close to providing a golden crossover of the 50 and 200 day moving averages on the chart – which would add further momentum to the bullish action. And if you were to add the decently healthy Relative Strength Index level of 55 – any market recovery going forward from current levels would be wholeheartedly supported by the bulls. And if LTC price is able to break out of the $64 resistance level, we can see a strong recovery in this coin.

Read more: LTC Price Prediction

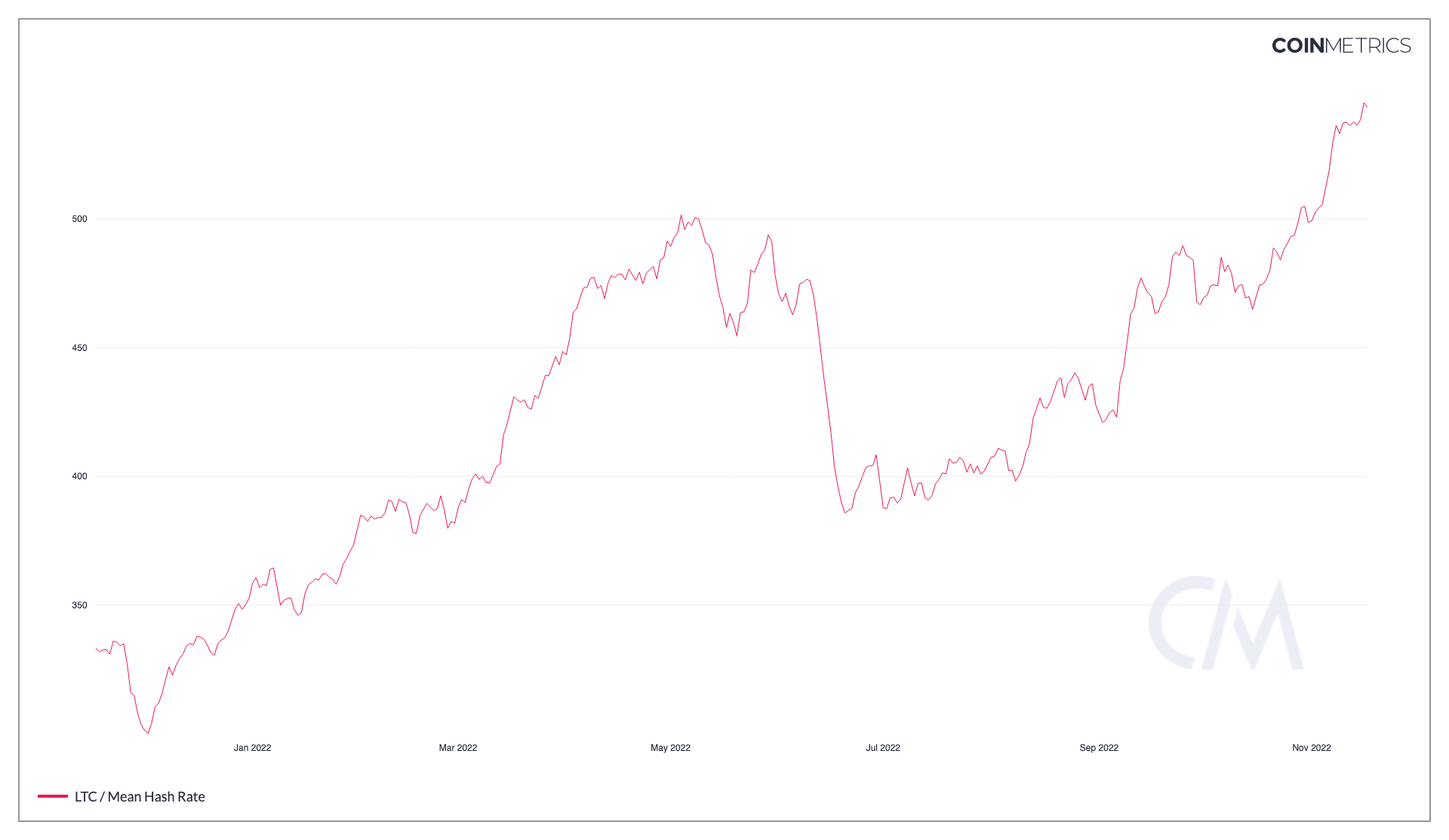

Litecoin Mean Hashrate touching new ATH!

As mentioned earlier – Litecoin’s mean hasrate has been on a constant rise all through the year, despite the raging bear market in the year. This indicates strong mining activity in the crypto token along with strong confidence in the token itself because of which this token, despite suffering in the bear run has managed to show underlying strength. A rising hashrate also indicates the improved overall security of the network too.

The global Litecoin network hashrate is a calculated value and is measured in hashes per second (H/s). The calculation uses the current mining difficulty and the average Litecoin block time between mined blocks versus the defined block time as variables to determine the global Litecoin network hashrate.

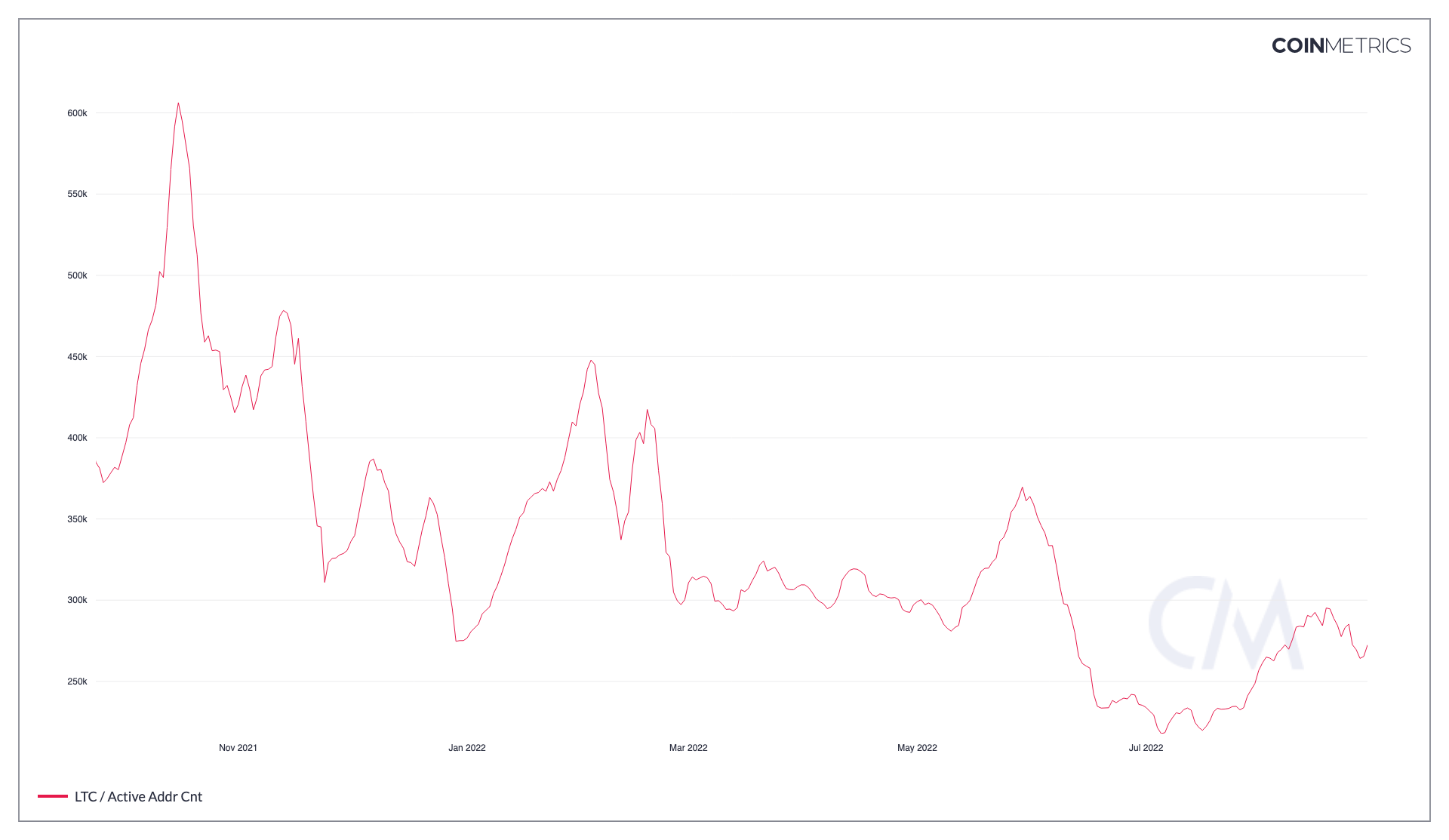

LTC’s Active Address Count on the decline

However, all the positive indications from the other factors, active addresses on the Litecoin blockchain have been declining. While that not a great sign for any blockchain – it could be attributed to the raging crypto winter that the market is undergoing right now. Active addresses typically tend to always go down during bear markets because of poorer sentiments and this could be simply that. The beginning of the next bull run could revive this metric very quickly.

Conclusion

Thus, while not all things are not going well for the Litecoin ecosystem – what can’t be denied is the fact that there is strong underlying strength in the coin and the community backing it – from holders to miners. Thus, Litecoin is definitely a coin that one can keep and eye out for and track closely. Whenever we see a resumption or a pullback rally in the market, Litecoin is slated to be one of the best recovery candidates going forward.

Read more: FTX Price Prediction

Prices as on 18 November, 2022.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more