Following the highly anticipated Ethereum Shanghai Capella Upgrade going live on the Ethereum mainnet earlier last week that enabled staking withdrawals, the liquid staking sector of the crypto market has been seeing increased attention. While Lido has dominated the liquid staking space by a huge margin, there are smaller players in the sector that are beginning to capture some market share.

One of these smaller players happens to be Agility, and it has experienced tremendous growth in the past couple of days. According to Agility themselves, it calls itself a liquid staking derivatives (LSD) distribution platform that incentivizes deposits of Ether and other liquid staking tokens.

This is a project that was launched very recently when its contracts were launched as recently as in the past two weeks. Agility’s ETH staking pool contract, which holds over $170 million worth of wrapped Ether (wETH) had its first transaction about 9 days ago.

Know more about Ethereum Shanghai Upgrade

Agility saw huge traction on the chain too as, five of the top ten most active decentralized finance (DeFi) smart contracts by total inflow in the past two weeks belong to Agility and saw over $400 million worth of TVL in Agility’s staking pools in a matter of days, according to data from blockchain analytics firm, Nansen.

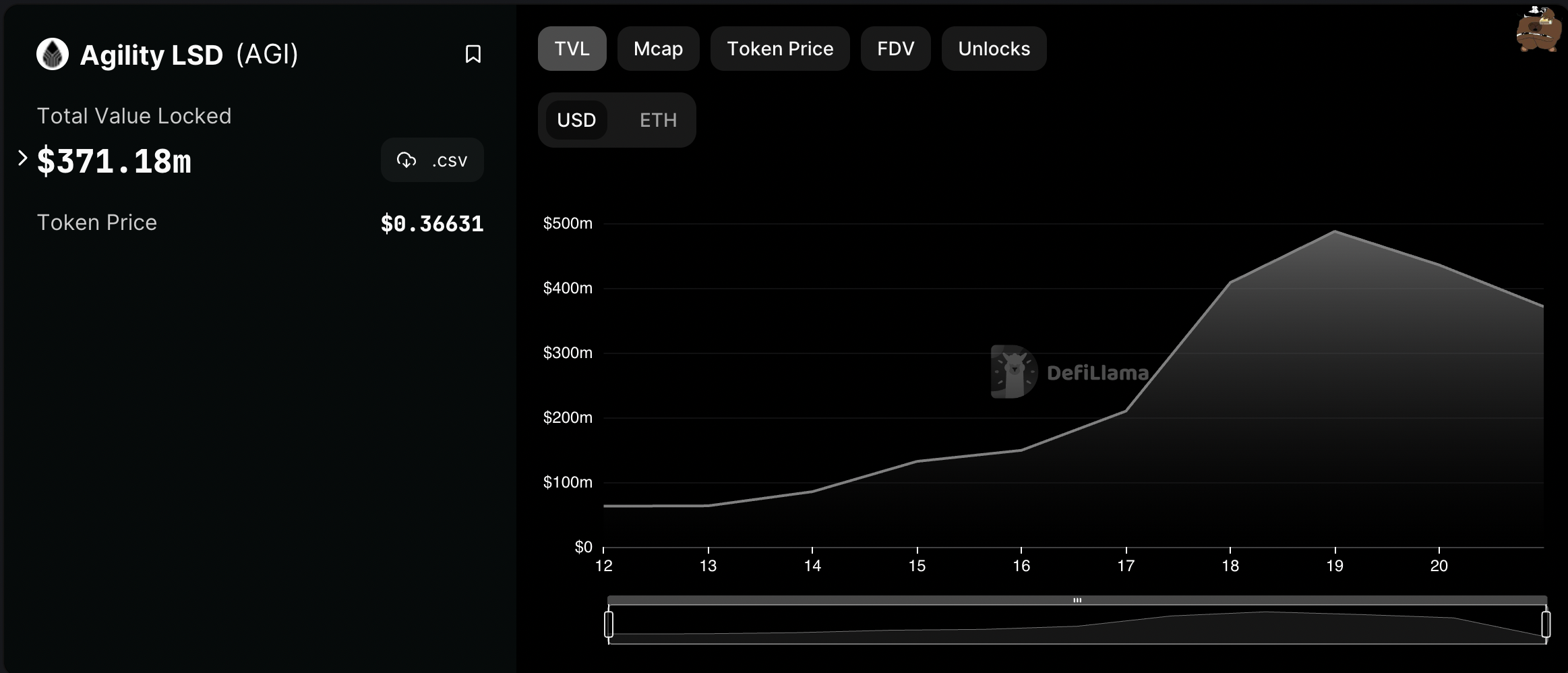

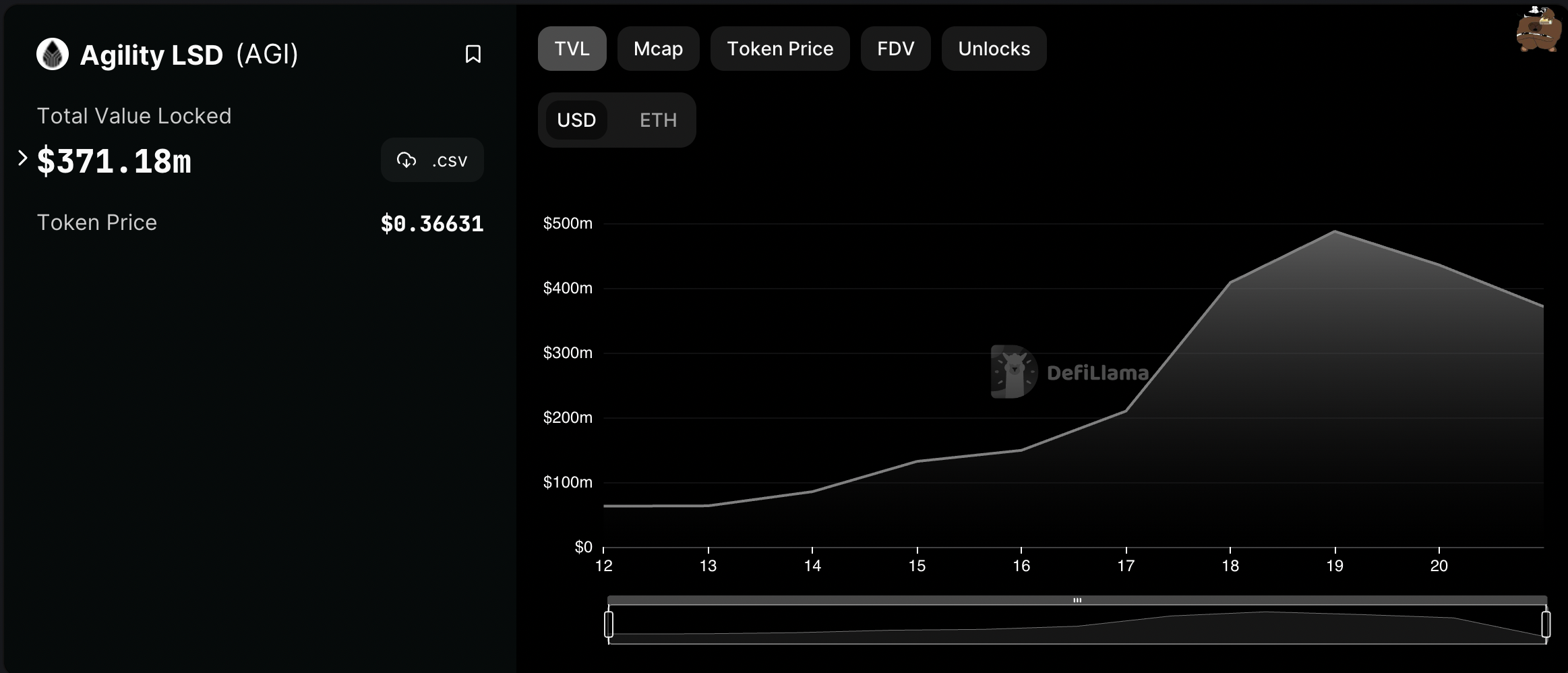

According to data from DefiLlama, Since April 12, the day when the Shanghai hard fork went live, Agility’s total value locked increased by more than 650% to touch $480 million in total-value-locked (TVL) on April 19, before receding to $370 million as of writing. In the past 4 days alone, AGI’s TVL spiked from around $200 million on April 17 to over $480 million on April 19 and is now at $371 million.

Agility LSD Total-Value-Locked (TVL) in DeFi | Source: DefiLlama

On April 12, data from CoinGecko indicated that AGI’s total daily trading volume stood at less than $9,000. Within 2 days, this changed dramatically and spiked to roughly $1.5 million. Currently, as of writing this article, Agility’s trading volumes are at about $3.2 million.

Agility LSD has been seeing improvements across the board too. According to data from Snapshot, Agility LSD’s decentralized autonomous organization (DAO) has 135 members while a CoinDesk report from Nansen data shows that the number of unique addresses holding AGI tokens has increased to a hefty 926 from 1 back on April 5.

However, despite all its successes in the past couple of days, Agility LSD has been facing some flak due to its network architecture and protocols.

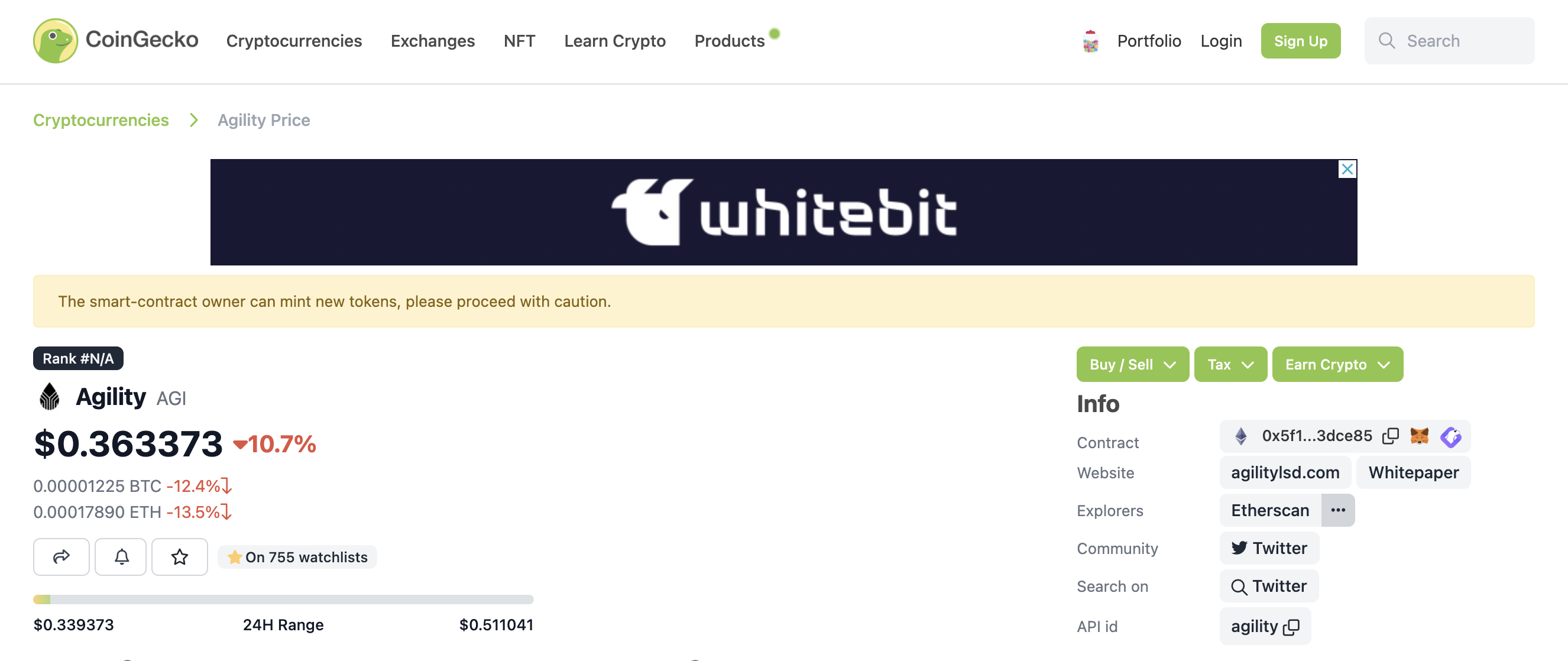

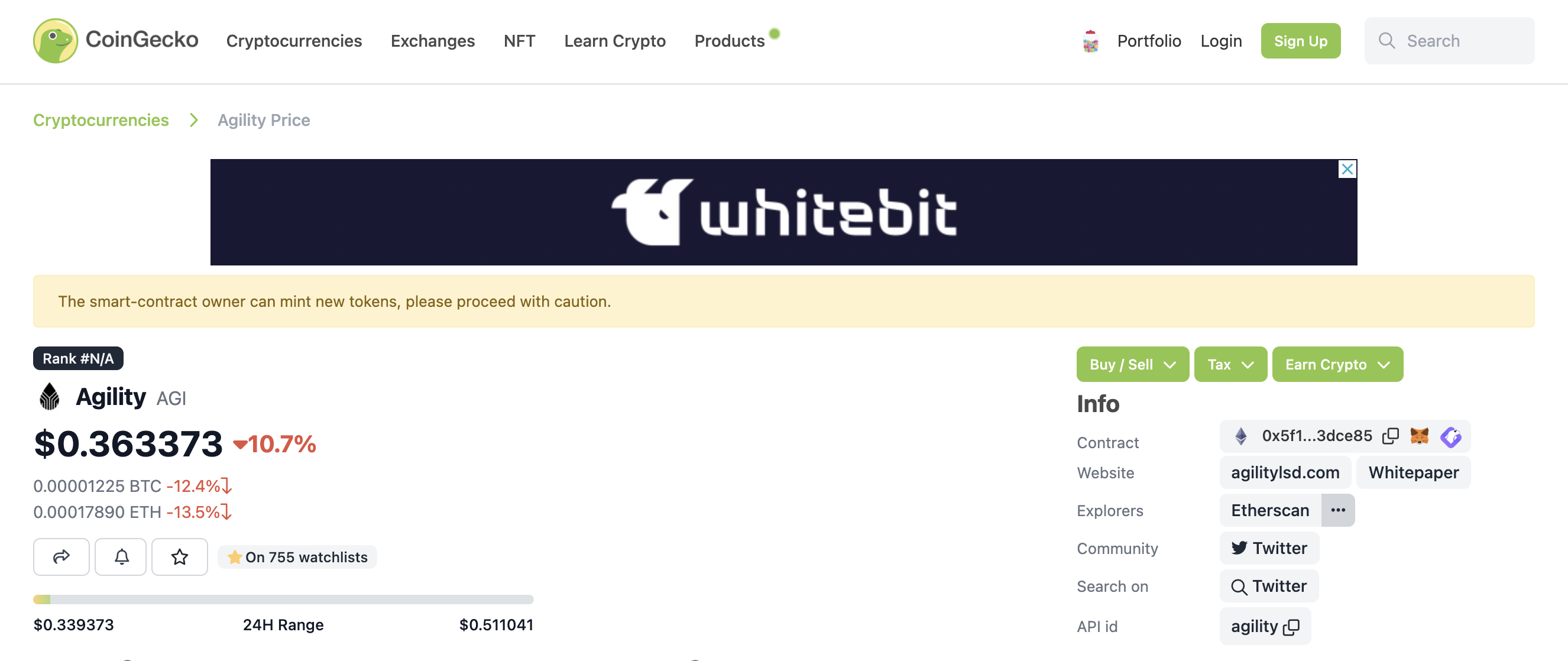

Agility LSD Snapshot | Source: Coingecko

According to Open Zeppelin, there are three functions in the AGI’s smart contract that allows selective privileged accounts to mint more AGI tokens to increase supply and also the feature to pause trading activities in the smart contract. Due to this, as depicted in the image above, the AGI token page on CoinGecko says, “The smart-contract owner can mint new tokens, please proceed with caution.” Thus, investors should be careful and undertake thorough research before looking to invest their funds in this project.

Additional read: Top Liquid Stakign Crypto Tokens in 2023