Lido DAO: Why is LDO price up 20% this week?

Lido DAO is a Decentralized Autonomous Organization that allows users to pool their funds together to earn yield on Ethereum-based assets. This 20 % surge in price could be a sign of more to come and a great opportunity for investors to get in on the ground floor.

Table of Contents

ToggleKey Takeaways:

- Lido DAO price has been on the rise ever since the beginning of the year 2023 intensified this week with a 20% jump, reclaiming the positions above $3 for a while

- The bulls appear to have accumulated enough strength and hence the ascending consolidation may prevail for a long to mark a new ATH beyond $5 soon

- The LDO price underwent an iconic rally and close the previous day’s trade at $2.63 with a market capitalization of $2.06 billion and a circulating supply of 842.13 million

Lido DAO, the liquid staking solution for the Proof-of-stake blockchains like Ethereum, Solana, Terra, etc has been on the rise in times when the entire crypto space is undergoing a notable price depression. The popular staking platform gained huge attention in 2022 ahead of the Ethereum Merge and soon became the leader of the space, being one of the top depositors on the ETH 2.0 smart contract.

The platform has recently proposed an upgrade which is believed to be the most transformative change, taking a step ahead towards greater decentralization. One of the key features of the upgrade is the introduction of the staking router. Here the developers can create new node operators using a modular architecture. Secondly, the proposal also enables the stETH holders to withdraw their funds at a 1:1 ratio.

The other key factor that led to a massive spike in the LDO price was when the Coinbase CEO hinted at the probable ban on crypto staking by the SEC. The price soared by more than 11% immediately after the announcement. Lido DAO is a decentralized staking platform and a crackdown on the centralized platforms could be like icing on the cake. However, SEC has denied commenting on the ongoing rumors.

Read More: Top 5 Crypto DAO Projects In 2023

Lido DAO (LDO) Token Technical Overview

Source: Tradingview

- The Lido DAO token has been ranging within an ascending triangle since the beginning of 2023 and has reached one of the crucial price zones

- Although the prices are facing bearish interference which may intensify in the next couple of hours, the bulls are well-positioned to trigger a rebound and uplift the price

- The Bollinger bands have begun to squeeze which indicated the compression of the price and an extended squeeze may result in a massive explosion of the price

- The RSI has displayed a bearish divergence and the ADX is also sliding down indicating the weakness of the rally at the moment

- Therefore, the price could slide back within the ascending triangle to reach the edge of the pattern and undergo a breakout to reclaim the levels above $3

Lido DAO (LDO) Token On-Chain Analysis

Lido DAO (LDO) Development Activity

Source: Santiment

The development activity of a project signifies the effort of the development team to upgrade the network with new features. It also signifies the ongoing work on these features, signaling a roll-out in later times. The market participants tend to be bullish on the token-seeking robust fundamentals. The development activity is recorded on the GitHub repository which is public and accessed by all.

The development activity maintained decent levels throughout 2022 regardless of the bearish market sentiments. Soon after the market flipped in 2023, the activity also surged which is currently at the peak of around 38.95. This indicates the team is extremely serious about the future prospects of the network and may work accordingly.

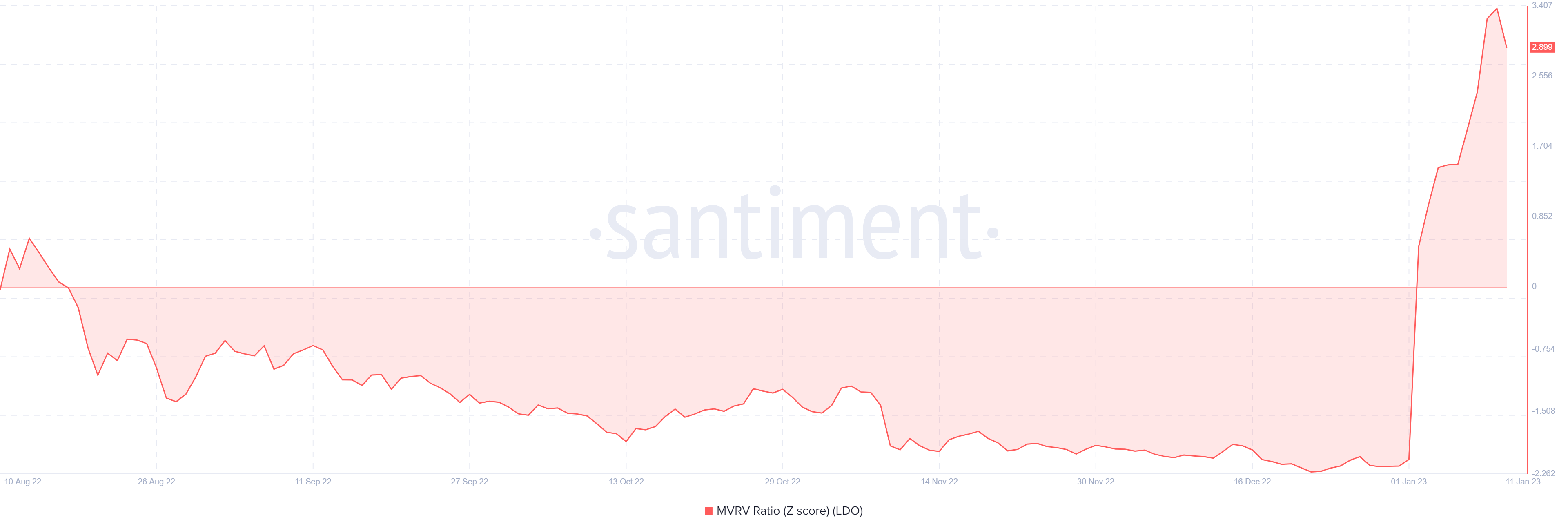

Lido DAO (LDO) MVRV-Z Score

Source: Santiment

The MVRV-Z score is the difference between the total market cap and the realized market cap which is further divided by the standard deviation of the market cap. It usually determines if the token is undervalued or overvalued depending on the fair value of the token. When the Z-score drops below ‘0’ it suggests the token is trading far below the fair value and vice versa.

Presently, the MVRV-Z score of the Lido DAO token has risen fairly within the positive regions indicating that the price is extremely overvalued. Therefore, the possibility of a minor plunge could be imminent but the bullish momentum may be carried further.

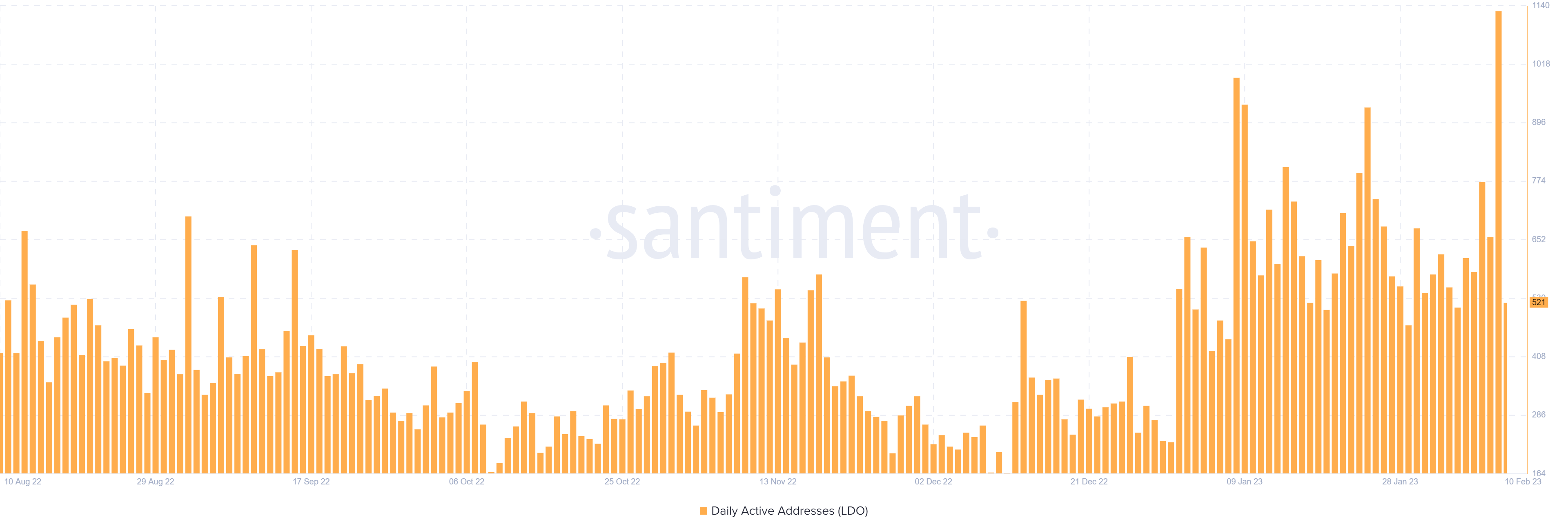

Lido DAO (LDO) Daily Active Addresses

Source: Santiment

To perform a trade, the addresses have to interact with the platform and place the order. Growth in these addresses indicates the rising popularity and traffic over the platform. The daily active address is a metric that calculates such addresses regardless of whether it is a buy address, sell address, or a swap address but only once per day.

The daily active address in the case of LDO is on the rise. The jump has been recorded ever since the beginning of the year which signifies the growing interest of the market participants in the token that makes the token more volatile and in turn impacts the price positively.

Read More: Boba Network’s Community Votes To Launch Uniswap V3

Concluding Thought!

Lido DAO token is surging high and may continue to do so as the bullish sentiments have mounted. The rise in the development activity & active address count indicates the growing attention and adoption of the token while the jumped MVRV-Z score indicates that the traders are under profit. Although the price is believed to undergo a slight pullback, the bulls are believed to resume their activity soon, uplifting the LDO price beyond pivotal levels.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more